- myFICO® Forums

- Types of Credit

- Credit Cards

- current member app for amex!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

current member app for amex!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

current member app for amex!

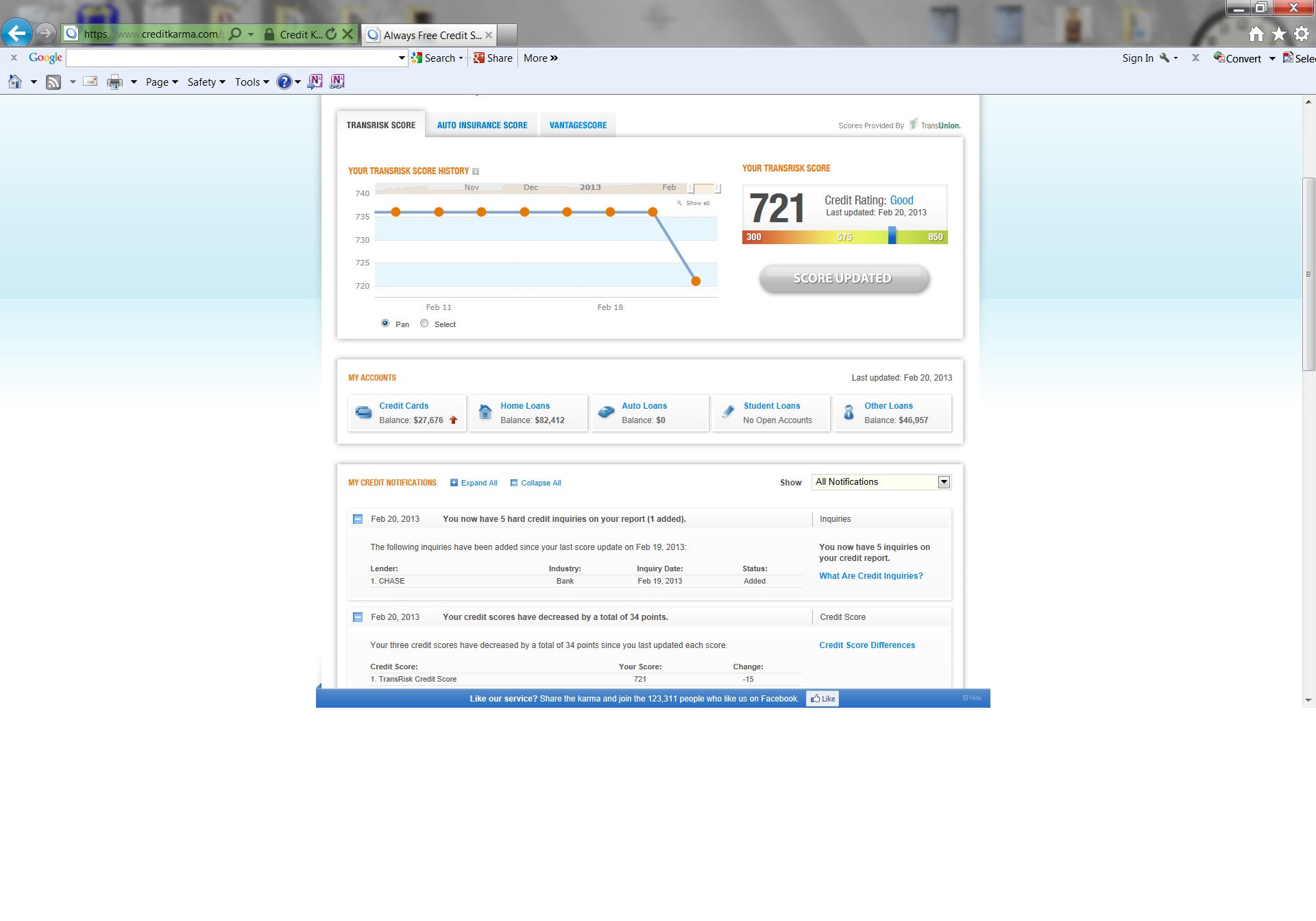

I called and asked for an increase on one of our chase cards and then. applied for the bcp. Got a credit karma alert, I know its a FAKO but I still watch it. Look at the drop from 1 inquiry

"Money isn't the most important thing in life, but it's reasonably close to oxygen on the "gotta have it" scale". ~Zig Ziglar

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: current member app for amex!

oh btw the app is still pending

"Money isn't the most important thing in life, but it's reasonably close to oxygen on the "gotta have it" scale". ~Zig Ziglar

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: current member app for amex!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: current member app for amex!

Thats the first time I've seen Chase pull TU.

||| Chase Sapphire Preferred 2013 -- $10,000

SCORES: EQ FICO: 787, EX FAKO: 801, TU FICO: 790 (Lender Pull)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: current member app for amex!

@Bobert22 wrote:Thats the first time I've seen Chase pull TU.

They'll pull whatever bureau you ask them to look at.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: current member app for amex!

thats not completly true. Chase Has a cra chosen for each card that they have, they always pulled eq but the manager of UW said that most jp cards go eq, the csp-cs will go tu now and that the priority club goes tu. and then... they can pull an alternate for you at your request. But as of 2/15/13 she said alot changed. Something about moving credit betweeen joint cards and then the report they pull as a primary was assigned. She said not a big deal but they did it to get some deverisfied information on card holders. I said good luck because we have a few cards with you and others that dont report at all ha ha!!! she laughed and said they werent worried about us, kinda made me feel good

"Money isn't the most important thing in life, but it's reasonably close to oxygen on the "gotta have it" scale". ~Zig Ziglar

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: current member app for amex!

@swpopham wrote:thats not completly true. Chase Has a cra chosen for each card that they have, they always pulled eq but the manager of UW said that most jp cards go eq, the csp-cs will go tu now and that the priority club goes tu. and then... they can pull an alternate for you at your request. But as of 2/15/13 she said alot changed. Something about moving credit betweeen joint cards and then the report they pull as a primary was assigned. She said not a big deal but they did it to get some deverisfied information on card holders. I said good luck because we have a few cards with you and others that dont report at all ha ha!!! she laughed and said they werent worried about us, kinda made me feel good

Interesting.

||| Chase Sapphire Preferred 2013 -- $10,000

SCORES: EQ FICO: 787, EX FAKO: 801, TU FICO: 790 (Lender Pull)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: current member app for amex!

@swpopham wrote:thats not completly true. Chase Has a cra chosen for each card that they have, they always pulled eq but the manager of UW said that most jp cards go eq, the csp-cs will go tu now and that the priority club goes tu. and then... they can pull an alternate for you at your request. But as of 2/15/13 she said alot changed. Something about moving credit betweeen joint cards and then the report they pull as a primary was assigned. She said not a big deal but they did it to get some deverisfied information on card holders. I said good luck because we have a few cards with you and others that dont report at all ha ha!!! she laughed and said they werent worried about us, kinda made me feel good

I don't know why they stated that; however, that's not accurate from anecdotal reports, or even close to it. A cursory check of the credit pulls databases demonstrates that's not the case.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content