- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: does the "will my charges be approved" thing w...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

does the "will my charges be approved" thing with amex dictate how much to ask for in a CLI

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

does the "will my charges be approved" thing with amex dictate how much to ask for in a CLI

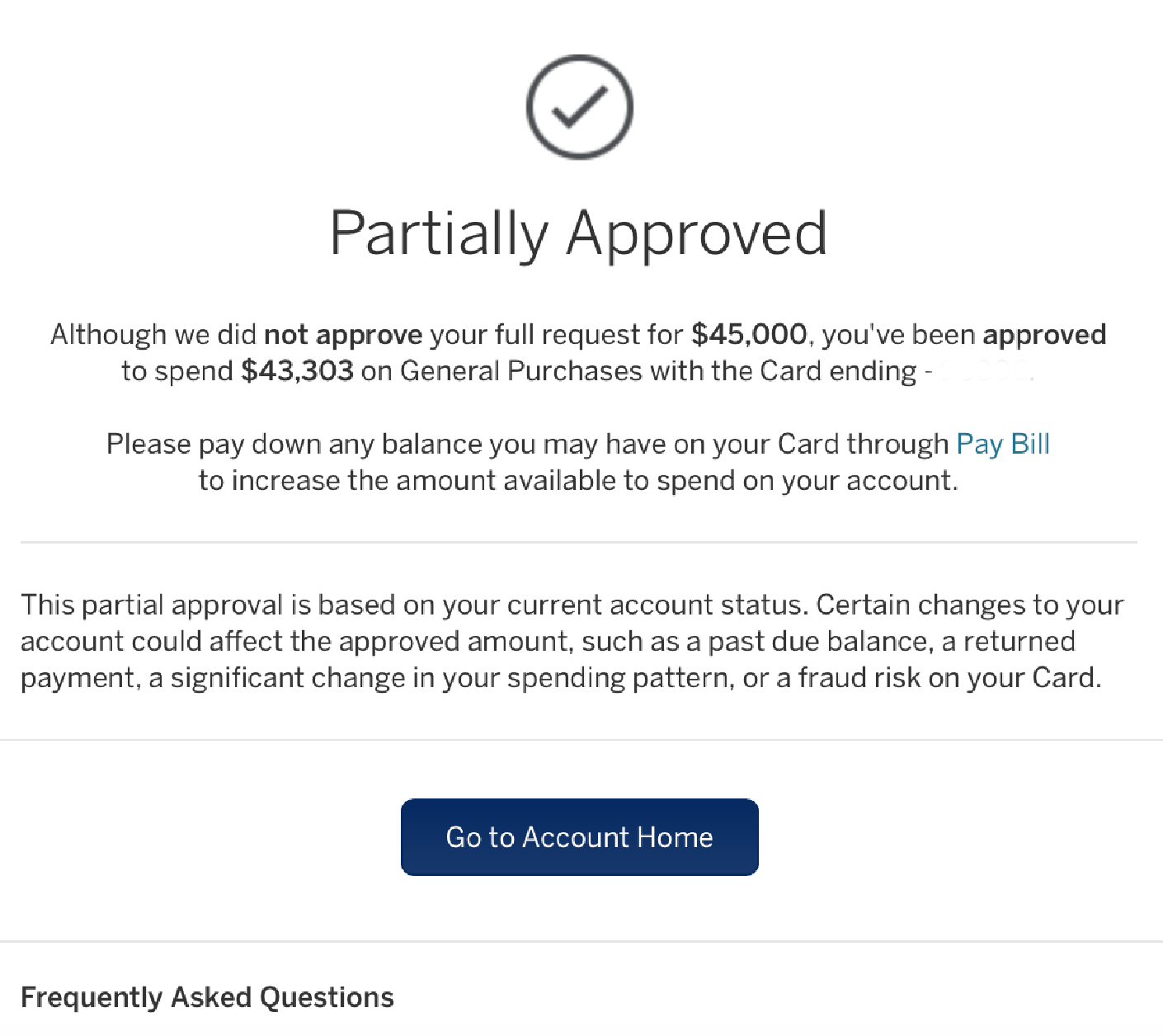

So I was messing around with amex since honestly im a little miffed at them for denying me a blue cash preffered, I was hoping to be redeamed a little bit. I figured I would try for a limit increase on my other amex revolver, (was hoping to get a BC preffered, then close the optima and move the limit to it) I have a revolver optima platinum and regular platinum as well as a business platinum with them. The revolver has a 24,900 limit (last increase was from 10k to 24,900 back in June 2013). So I tried the will it approve thing first and it let 35k go through so I tried 45k and it said partially approved for 43,303 (wierd number I know), But I have 1596.90 on the card currently so thats $44,899 total. (so I guess they are happy with me being about 20k over the current limit) So Im curious shoud I ask for a 20k increase in the CLI thing or still try for something higher? I went through a 4056-t thing last spring. Happy to do it again, the only thing is not all of my income from 2015 is taxable and I had deductions last year I wont have this year or that I had in 14 so IDK if they will be happy with me reporting over whats on my tax return. (tax return shows about 70k less than actual income but I can document everything). If they want to use my 2014 return then were all good. Any tips? Thanks!

Amex Biz Platinum NPSL I Lowes Business 42k I Amex Simply Cash + $22,500 I Chase Ink 21K I B of A World Points $20,500 I B of A Bus MasterCard 16k I Amex SPG 3K.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: does the "will my charges be approved" thing with amex dictate how much to ask for in

Ummm Lol

No it does not mean you will be granted a CLI of that amount

In fact it's a snapshot of what they will allow at that moment

Tomorrow that same feature may only allow 10k or maybe even less

Your best bet is to request the amount you want via CLI and hope for the best

They'll either counter of flat out deny

Good luck

Have you done your research of the CC?

Does it fit your spending?

Do you have a plan for the bonus w/o going into debt?

Can you afford the AF?

Do you know the cards benefits? Is it worth the HP?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: does the "will my charges be approved" thing with amex dictate how much to ask for in

I can provide a data point... my BCP limit is only $1k, and when I use that same link it tells me I'm good to spend over my limit (the last time I tried was $500 over - 50% of my total credit line).

Keeping that in mind, they have denied every CLI request I've ever made.

I realize the numbers you're talking about are exponentially higher than mine, but I would expect the same concept to apply, just at a different scale.

It's just like when I had my Green charge card they were fine with approving me to spend $2500 in a single purchase to be paid back in 30 days, but the limit on my revolving card stayed relatively tiny. They clearly differentiate between revolving credit lines and net-30 charging (which is what charging over the credit limit on a revolver basically is).