- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: >1% cash back cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

>1% cash back cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

>1% cash back cards

I've been looking through old threads for good cash back cards. I know there are lots of threads about this already but I just wanted to make sure I wasn't missing any really good ones. I didn't include ones that have great sign up bonuses because I'm looking for cards that will be useful for a long time to come.

Quicksilver ~ 1.5%

Dividend/Discover/Freedom ~ 5% rotating categories, 1% everything else

Sallei Mai MC ~ 5% gas/groceries/books (amazon), 1% everything else

US Bank Cash+ ~ two chosen 5% categories, one chosen 2% category, 1% everything else

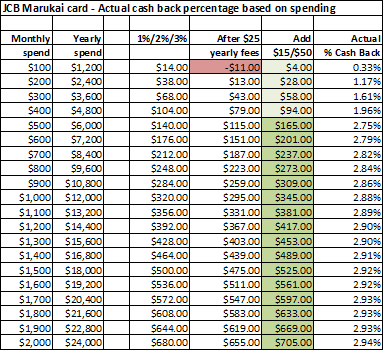

JCB Marukai ~ 1% first $1000, 2% next $2000, 3% everything over $3000 (residency requirements apply, 25$ annual fee)

Fidelity Amex ~ 2% deposited in Fidelity account

BCE ~ 3% groceries, 2% gas, 2% department stores

BCP ~ 6% groceries, 3% gas, 3% department stores ($75 annual fee)

Does anyone have any (or know of any) other cash back (not rewards) cards that they think are worth considering?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >1% cash back cards

If you're in CA or HI, the JCB Murakai using the Discover network is 3% cashback.

*Edited* - Sorry, didn't notice you alrady listed JCB.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >1% cash back cards

@NikoD wrote:I've been looking through old threads for good cash back cards. I know there are lots of threads about this already but I just wanted to make sure I wasn't missing any really good ones. I didn't include ones that have great sign up bonuses because I'm looking for cards that will be useful for a long time to come.

Quicksilver ~ 1.5%

Dividend/Discover/Freedom ~ 5% rotating categories, 1% everything else

Sallei Mai MC ~ 5% gas/groceries/books (amazon), 1% everything else

US Bank Cash+ ~ two chosen 5% categories, one chosen 2% category, 1% everything else

JCB Marukai ~ 1% first $1000, 2% next $2000, 3% everything over $3000 (residency requirements apply, 25$ annual fee)

Fidelity Amex ~ 2% deposited in Fidelity account

BCE ~ 3% groceries, 2% gas, 2% department stores

BCP ~ 6% groceries, 3% gas, 3% department stores ($75 annual fee)

Does anyone have any (or know of any) other cash back (not rewards) cards that they think are worth considering?

PenFed Cash Rewards 5% on gas

****** Last HP & New TL was March 6th 2014 *** GOAL: No HP's or New TL's for 2 + years and 840's Scores ******

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >1% cash back cards

@NikoD wrote:I've been looking through old threads for good cash back cards. I know there are lots of threads about this already but I just wanted to make sure I wasn't missing any really good ones. I didn't include ones that have great sign up bonuses because I'm looking for cards that will be useful for a long time to come.

Quicksilver ~ 1.5%

Dividend/Discover/Freedom ~ 5% rotating categories, 1% everything else

Sallei Mai MC ~ 5% gas/groceries/books (amazon), 1% everything else

US Bank Cash+ ~ two chosen 5% categories, one chosen 2% category, 1% everything else

JCB Marukai ~ 1% first $1000, 2% next $2000, 3% everything over $3000 (residency requirements apply, 25$ annual fee)

Fidelity Amex ~ 2% deposited in Fidelity account

BCE ~ 3% groceries, 2% gas, 2% department stores

BCP ~ 6% groceries, 3% gas, 3% department stores ($75 annual fee)

Does anyone have any (or know of any) other cash back (not rewards) cards that they think are worth considering?

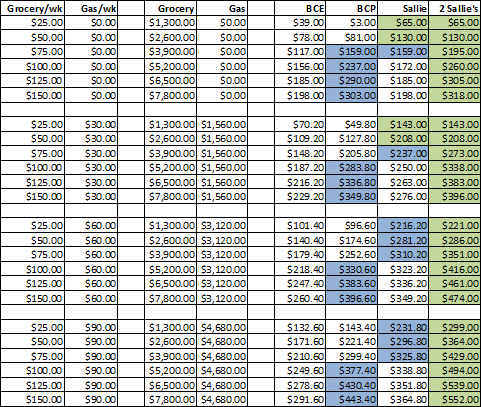

BCE is not worth considering as a cash back card. Its good for getting a large credit limit quickly, and it is an American Express. But, frankly, Sallie Mae is better for low grocery spend, and BCP is better for high grocery spend. Since high grocery spend usually equates to a family, if both parents obtained a Sallie mae, that would be ideal. And even if you Choose the BCP, the Sallie Mae is a better card for Gas Station purchases:

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >1% cash back cards

@Open123 wrote:If you're in CA or HI, the JCB Murakai using the Discover network is 3% cashback.

*Edited* - Sorry, didn't notice you alrady listed JCB.

JCB is a strange card, due to the various rules. This is how that breaks down:

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >1% cash back cards

@NikoD wrote:I've been looking through old threads for good cash back cards. I know there are lots of threads about this already but I just wanted to make sure I wasn't missing any really good ones. I didn't include ones that have great sign up bonuses because I'm looking for cards that will be useful for a long time to come.

Quicksilver ~ 1.5%

Dividend/Discover/Freedom ~ 5% rotating categories, 1% everything else

Sallei Mai MC ~ 5% gas/groceries/books (amazon), 1% everything else

US Bank Cash+ ~ two chosen 5% categories, one chosen 2% category, 1% everything else

JCB Marukai ~ 1% first $1000, 2% next $2000, 3% everything over $3000 (residency requirements apply, 25$ annual fee)

Fidelity Amex ~ 2% deposited in Fidelity account

BCE ~ 3% groceries, 2% gas, 2% department stores

BCP ~ 6% groceries, 3% gas, 3% department stores ($75 annual fee)

Does anyone have any (or know of any) other cash back (not rewards) cards that they think are worth considering?

Huntington Voice card, for 3% cash back on a user selectable category. IF you are in their banking area.

Citizen Bank Green$ense card. IF you are in their banking area.

Bank of America Better Balance Rewards. great for a moderate, monthly bill. My $46 DSL bill would end up getting 18.1% cash back... More if you have other BOA accounts.

US Bank Cash+. On the list twice, because its possible to get two of those cards (see my signature).

Sallie Mae Upromise card. 5% + 5% online shopping (sometimes even more) through their portal using the Upromise.com card.

Wild cards: Santander Bravo, AARP, AAA Member Rewards

Business cards: Chase Ink cash, etc. American Express Simply Cash. Lowes Business Rewards card. American Express TrueEarnings Business card.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >1% cash back cards

@Open123 wrote:If you're in CA or HI, the JCB Murakai using the Discover network is 3% cashback.

*Edited* - Sorry, didn't notice you alrady listed JCB.

Though it says for CA residents, I did some digging and looked at the application. It says residents of Nevada, Oregon and Washington can apply for that one as well. The HI one is just for residents of HI though.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >1% cash back cards

@Themanwhocan wrote:

@NikoD wrote:I've been looking through old threads for good cash back cards. I know there are lots of threads about this already but I just wanted to make sure I wasn't missing any really good ones. I didn't include ones that have great sign up bonuses because I'm looking for cards that will be useful for a long time to come.

Quicksilver ~ 1.5%

Dividend/Discover/Freedom ~ 5% rotating categories, 1% everything else

Sallei Mai MC ~ 5% gas/groceries/books (amazon), 1% everything else

US Bank Cash+ ~ two chosen 5% categories, one chosen 2% category, 1% everything else

JCB Marukai ~ 1% first $1000, 2% next $2000, 3% everything over $3000 (residency requirements apply, 25$ annual fee)

Fidelity Amex ~ 2% deposited in Fidelity account

BCE ~ 3% groceries, 2% gas, 2% department stores

BCP ~ 6% groceries, 3% gas, 3% department stores ($75 annual fee)

Does anyone have any (or know of any) other cash back (not rewards) cards that they think are worth considering?

Huntington Voice card, for 3% cash back on a user selectable category. IF you are in their banking area.

Citizen Bank Green$ense card. IF you are in their banking area.

Bank of America Better Balance Rewards. great for a moderate, monthly bill. My $46 DSL bill would end up getting 18.1% cash back... More if you have other BOA accounts.

US Bank Cash+. On the list twice, because its possible to get two of those cards (see my signature).

Sallie Mae Upromise card. 5% + 5% online shopping (sometimes even more) through their portal using the Upromise.com card.

Wild cards: Santander Bravo, AARP, AAA Member Rewards

Business cards: Chase Ink cash, etc. American Express Simply Cash. Lowes Business Rewards card. American Express TrueEarnings Business card.

So it's possible to get 2 in your name alone not just being added as AU?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >1% cash back cards

@NikoD wrote:

@Themanwhocan wrote:

@NikoD wrote:I've been looking through old threads for good cash back cards. I know there are lots of threads about this already but I just wanted to make sure I wasn't missing any really good ones. I didn't include ones that have great sign up bonuses because I'm looking for cards that will be useful for a long time to come.

Quicksilver ~ 1.5%

Dividend/Discover/Freedom ~ 5% rotating categories, 1% everything else

Sallei Mai MC ~ 5% gas/groceries/books (amazon), 1% everything else

US Bank Cash+ ~ two chosen 5% categories, one chosen 2% category, 1% everything else

JCB Marukai ~ 1% first $1000, 2% next $2000, 3% everything over $3000 (residency requirements apply, 25$ annual fee)

Fidelity Amex ~ 2% deposited in Fidelity account

BCE ~ 3% groceries, 2% gas, 2% department stores

BCP ~ 6% groceries, 3% gas, 3% department stores ($75 annual fee)

Does anyone have any (or know of any) other cash back (not rewards) cards that they think are worth considering?

Huntington Voice card, for 3% cash back on a user selectable category. IF you are in their banking area.

Citizen Bank Green$ense card. IF you are in their banking area.

Bank of America Better Balance Rewards. great for a moderate, monthly bill. My $46 DSL bill would end up getting 18.1% cash back... More if you have other BOA accounts.

US Bank Cash+. On the list twice, because its possible to get two of those cards (see my signature).

Sallie Mae Upromise card. 5% + 5% online shopping (sometimes even more) through their portal using the Upromise.com card.

Wild cards: Santander Bravo, AARP, AAA Member Rewards

Business cards: Chase Ink cash, etc. American Express Simply Cash. Lowes Business Rewards card. American Express TrueEarnings Business card.

So it's possible to get 2 in your name alone not just being added as AU?

That is correct. I PC'd both my cards (Platinum, Cash Rewards) to Cash+.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >1% cash back cards

@Themanwhocan wrote:

@NikoD wrote:

@Themanwhocan wrote:

@NikoD wrote:I've been looking through old threads for good cash back cards. I know there are lots of threads about this already but I just wanted to make sure I wasn't missing any really good ones. I didn't include ones that have great sign up bonuses because I'm looking for cards that will be useful for a long time to come.

Quicksilver ~ 1.5%

Dividend/Discover/Freedom ~ 5% rotating categories, 1% everything else

Sallei Mai MC ~ 5% gas/groceries/books (amazon), 1% everything else

US Bank Cash+ ~ two chosen 5% categories, one chosen 2% category, 1% everything else

JCB Marukai ~ 1% first $1000, 2% next $2000, 3% everything over $3000 (residency requirements apply, 25$ annual fee)

Fidelity Amex ~ 2% deposited in Fidelity account

BCE ~ 3% groceries, 2% gas, 2% department stores

BCP ~ 6% groceries, 3% gas, 3% department stores ($75 annual fee)

Does anyone have any (or know of any) other cash back (not rewards) cards that they think are worth considering?

Huntington Voice card, for 3% cash back on a user selectable category. IF you are in their banking area.

Citizen Bank Green$ense card. IF you are in their banking area.

Bank of America Better Balance Rewards. great for a moderate, monthly bill. My $46 DSL bill would end up getting 18.1% cash back... More if you have other BOA accounts.

US Bank Cash+. On the list twice, because its possible to get two of those cards (see my signature).

Sallie Mae Upromise card. 5% + 5% online shopping (sometimes even more) through their portal using the Upromise.com card.

Wild cards: Santander Bravo, AARP, AAA Member Rewards

Business cards: Chase Ink cash, etc. American Express Simply Cash. Lowes Business Rewards card. American Express TrueEarnings Business card.

So it's possible to get 2 in your name alone not just being added as AU?

That is correct. I PC'd both my cards (Platinum, Cash Rewards) to Cash+.

I've never known anyone to have two of the same cards. Do you know if that's rare for a bank to allow two of the same cards? I was just wondering if this is something that other banks do also (though I have no interest in 2 of any other cards. I'm just curious since I've never seen it before.)