- myFICO® Forums

- Types of Credit

- Credit Cards

- # of CCs with a balance...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

# of CCs with a balance...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: # of CCs with a balance...

@ sarge12. I try before to print the reports once and i run otta ink so i never try to print them again , i save the pdf,spend every single day about 3 or more hrs going thru them, make sure i sent pmts on time, getting cli , reduce apr and so on....i spend just in cc pmts some one monthly income.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: # of CCs with a balance...

@CreditDunce wrote:

@bk510 wrote:

@CreditDunce wrote:For my profile, I haven't seen much difference in my FICO 08 scores when I let most of my cards report a balance. EQ-04 does seem to be hurt. I don't have enough DPs for the other FICO models. Personally, I wouldn't worry about the number of cards reporting a balance unless you are house hunting.

I have been carrying balances on 8 of my cards all under 10% each for about 6 months and my FICO 08 seems to stay around 670ish hardly any changes at all.

i just joined NFCU and apped for Platinum Visa and now I'm worried that I'll take a big hit on TU-04 which is who they pulled. I undersatnd TU-04 is generally lower than FICO-08

My app status is pending.....

Your FICO 04 scores can be higher or lower than your FICO 08 scores. There isn't a general rule about one being higher. They weigh different things differently.

Last spring I had 15 revolvers. I let between 2-10 cards report small balances. My TU-08 score was remarkably stable at 800 over the time. It did bump up for one pull, but it was during the times TU was having problems with INQ showing up. My EX-08 score didn't seem to be affected by the number of TL's reporting a balance either. However, I didn't have enough DP's to make any findings. The score inched up 3 points every month or two from 803->806->806->809.

I only have one monthly EQ-04 score. The score averaged aroud 750's when I had over 50% of my accounts reporting a balance. Near the end when I was getting ready for an app spree. With only 4 accounts reporting a balance the score hit 778. Then with 2 accounts reporting a balance it jumped to 816. However, I passed some other milestones when that last score was reported. I have read other threads saying TU-04 is not as sensitive to number of accounts reporting a balance, but I don't have any personal experience. None the less, cutting down the number of cards with a balance (while not letting the util of the remaining card increase) would probably give you some points on TU-04. The new account will probably not hurt your score much unless your AAoA drops under an integer boundary.

Good luck with your app. NFCU doesn't seem to be that particular about high credit scores. I am sure you will be approved.

Thanks, Dunce

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: # of CCs with a balance...

@peghede wrote:@ sarge12. I try before to print the reports once and i run otta ink so i never try to print them again , i save the pdf,spend every single day about 3 or more hrs going thru them, make sure i sent pmts on time, getting cli , reduce apr and so on....i spend just in cc pmts some one monthly income.

Which is exactly what I would not have time to or want to do..... 3 hours a day, oh lort.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: # of CCs with a balance...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: # of CCs with a balance...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: # of CCs with a balance...

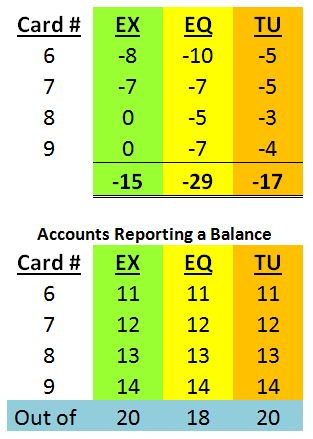

I did an experiment a couple years ago on here where I let all my cards report a balance, one by one, each month so that I could see what the effects would be.

Nothing else changed on my reports except another card reporting. I allowed just enough so that 1% reported on the card.

When I went over 50% of total accounts reporting I took an 8 pt hit on EX, 10 point hit on EQ and 5 pt hit on TU. Each time another card reported I took a 3 to 7 point hit on my reports. By the time all cards were reporting my EX had dropped 15 points, EQ had dropped 29 points and TU had dropped 17 points.

Going over 50% of all accounts (CCs, installments, etc) reporting a balance is when I went over the threshold. Once I hit 70% of all accounts reporting a balance is when I saw the 15 to 29 point drop.

Here was my chart that I posted back in 2014:

ETA: I only had 9 cards at that time. I clearly have more now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content