- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: thoughts on my monthly lineup

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

thoughts on my monthly lineup

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

thoughts on my monthly lineup

I have a card lineup that I've been using for a while. I'm in the garden now, but looking for any suggestions. This is how I break down my months:

Any gas and grocery purchase goes on the Amex BCP.

3x bills like utility go on my Barclays rewards

All other purchases go on my arrival plus or quicksilver in order to build 1.5% cash back and 2X points for cash back and points for travel on all purchases.

Should I look into chase freedom or discover it for the revolving categories? I like using the arrival plus as much as I can since its 2X points for everything. Is there anything I should be doing differently? Thanks in advance! Looking forward to card recommendations and advice!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: thoughts on my monthly lineup

@Anonymous wrote:

Hi all-

I have a card lineup that I've been using for a while. I'm in the garden now, but looking for any suggestions. This is how I break down my months:

Any gas and grocery purchase goes on the Amex BCP.

3x bills like utility go on my Barclays rewards

All other purchases go on my arrival plus or quicksilver in order to build 1.5% cash back and 2X points for cash back and points for travel on all purchases.

Should I look into chase freedom or discover it for the revolving categories? I like using the arrival plus as much as I can since its 2X points for everything. Is there anything I should be doing differently? Thanks in advance! Looking forward to card recommendations and advice!

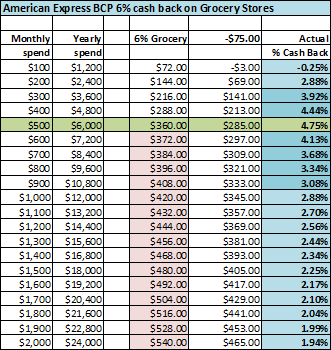

BCP is sub-optimal since you have a spending cap on grocery stores plus an annual fee. So you're probably not earning as much as you think you are. there are much better cards to use for Gas station purchases. if you used the BCP for groceries only:

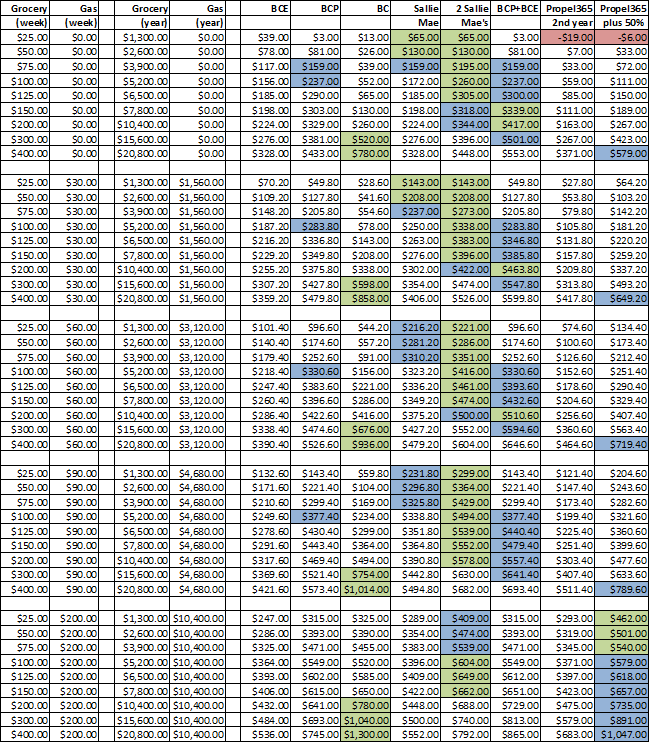

The Sallie Mae Rewards card (monthly cash back caps: 5% on $250 at Grocery stores; 5% on $250 at Gas Stations; 5% on $750 at Book stores like amazon.com) is a good choice, and you can eventually apply for a second Sallie Mae to solve problems with spending cap limits. Sallie Mae has no annual fee.

https://www.salliemae.com/credit-cards/sallie-mae-card/

You may want to look into obtaining 1 or 2 US Bank Cash+ cards, as they have 2 user selectable 5% categories. That card is very useful for filing in some of the gaps in your category coverage. Or if you are near a Huntington Bank, the Voice card has one selectable 3% category that is very useful. Now that I have some good cash back cards, I find the Freedom and Discover It are of very limited use, though I like the Discover online shopping portal for discounts.

If you like your Arrival+ and Quicksilver, then you might be OK in that regard. Otherwise the Fidelity Amex is a good 2% cash back card with no annual fee, though some people have problems with places that do not accept American Express. NASA FCU Visa card is almost as good as the Fidelity (only $17.50 less cash back per year) but you only get the cash back credited annually.

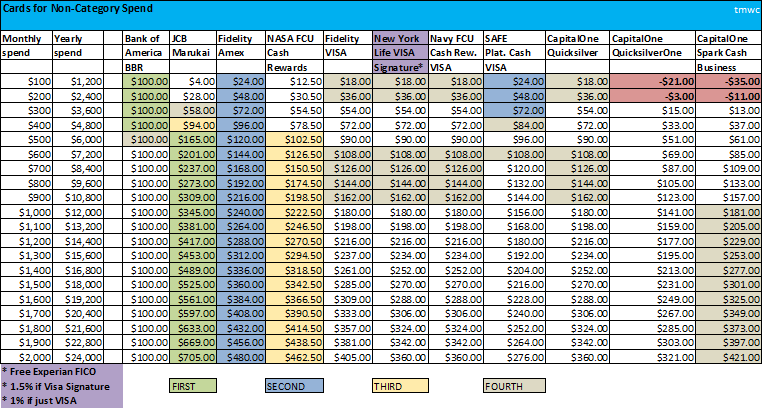

People have obtained 3 or 4 Bank of America Better Balance Rewards cards, so I'm working towards that as well.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: thoughts on my monthly lineup

I am going to look further into the Sallie mae card too. I haven't heard of the others. I like putting a lot on the Barclays because I can use it for travel expenses. I go on about 7-10 trips a years and it come in handy. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: thoughts on my monthly lineup

I am just curious how exactly are you using BBR to get those numbers for cash back, i am curious about tryin to pick one up , just trying to figure out how you are getting those high cash back values?

EX Fico 804 11/16/16 Fako 800 Credit.com 11/16/16

EQ SW bank enhanced 11/16/16 839 CK fako 822 11/16/16

TU Fico discover 10/19/16 814 Fako 819 Creditkarma 11/16/16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: thoughts on my monthly lineup

@mongstradamus wrote:I am just curious how exactly are you using BBR to get those numbers for cash back, i am curious about tryin to pick one up , just trying to figure out how you are getting those high cash back values?

THat is simply the $25 cash back per quarter for paying more than the minimum etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: thoughts on my monthly lineup

@Anonymous wrote:

Yeah I have a spreadsheet that I have all my expenses on. I reach the 6k cap on Amex and then I use my BOA cash rewards card for 3% the rest of the year.

I am going to look further into the Sallie mae card too. I haven't heard of the others. I like putting a lot on the Barclays because I can use it for travel expenses. I go on about 7-10 trips a years and it come in handy. Thanks!

The Sallier Mae rewards mastercard is actually issued by Barclays. Its just not offered from their web site, you have to apply at that link I posted.

Your heavy use of a previous Barclay card will help in obtaining the Sallie Mae.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: thoughts on my monthly lineup

@Themanwhocan wrote:

People have obtained 3 or 4 Bank of America Better Balance Rewards cards, so I'm working towards that as well.

Trying not to side rail this discussion but can one apply for multiple BBR cards? Or can you only apply for one and then you have to convert other cards such as the 123 into a BBR? Anyone know?

Credit Lines: Diners Club 20k | Penfed Plat Rewards 7k | SDFCU 5k | Amex BCE - 10.5k | Chase Freedom 4.5k | CSP - 10.6k | Discover IT - 9k | Sallie Mae 3.8k | BofA 123 - 4.9k | CITI Double Cash 9.1k | Total Rewards 3.25k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: thoughts on my monthly lineup

@Hockeyplayrr wrote:

@Themanwhocan wrote:

People have obtained 3 or 4 Bank of America Better Balance Rewards cards, so I'm working towards that as well.

Trying not to side rail this discussion but can one apply for multiple BBR cards? Or can you only apply for one and then you have to convert other cards such as the 123 into a BBR? Anyone know?

Both methods work.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: thoughts on my monthly lineup

@Themanwhocan wrote:

@Hockeyplayrr wrote:

@Themanwhocan wrote:

People have obtained 3 or 4 Bank of America Better Balance Rewards cards, so I'm working towards that as well.

Trying not to side rail this discussion but can one apply for multiple BBR cards? Or can you only apply for one and then you have to convert other cards such as the 123 into a BBR? Anyone know?

Both methods work.

If you log in to your card on BankofAmerica.com/BetterBalanceRewards and link it to your BoA checking the 100 turns to 120/year per card. I do that for both of my BBR. Just an extra 20, but hey it's an extra 20. lol ![]()