- myFICO® Forums

- Types of Credit

- Credit Cards

- top 5 visa cards and mastercards to have

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

top 5 visa cards and mastercards to have

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: top 5 visa cards and mastercards to have

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: top 5 visa cards and mastercards to have

I wanna play too... I will just list the ones I have, am aiming for, or could obtain in the future. I am/will be a cash back chaser so I try to cover everything

Not listing in order of "best" because it's too vague a statement for me. I think this looks like a decent lineup for my needs as it covers almost everything. Some are a little redundant, but it's the lineup I like for me.

1 - Chase Freedom 5% restaurants, home improvement, movies, retail, etc. even though rotating.

2 - Fort Knox Federal Credit Union Platinum Visa 5% cash back on gas all year around (don't have to chase rotating gas category)

3 - Huntington Voice MC 3x points for utilities

4 - US Cash+ 5% groceries, restaurants, etc.

5 - Sallie Mae 5% groceries (help with the US Cash+ cap), 5% books (DD starting college soon)

The one below may interest others. I refuse to bank with LMCU so it's not in my list......

*Lake Michigan Credit Union Prime Platinum Visa (low 6.25% APR not introductory) for those that may have to carry a balance outside of 0% inital rates.

TU713, EQ 731 , EX 726 (As of 12/13/14) - Personal Goal = 760

“Beware of little expenses. A small leak will sink a great ship” – Benjamin Franklin

Gardening since 3-26-15

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: top 5 visa cards and mastercards to have

@VirtualCuriosity wrote:I wanna play too... I will just list the ones I have, am aiming for, or could obtain in the future. I am/will be a cash back chaser so I try to cover everything

Not listing in order of "best" because it's too vague a statement for me. I think this looks like a decent lineup for my needs as it covers almost everything.

1 - Chase Freedom 5% restaurants, home improvement, movies, retail, etc. even though rotating.

2 - Fort Knox Federal Credit Union Platinum Visa 5% cash back on gas all year around (don't have to chase rotating gas category)

3 - Huntington Voice MC 3x points for utilities

4 - US Cash+ 5% groceries

5 - Sallie Mae 5% groceries (help with the US Cash+ cap), 5% books (DD starting college soon)

The one below may interest others. I refuse to bank with LMCU so it's not in my list......

*Lake Michigan Credit Union Prime Platinum Visa (low 6.25% APR not introductory) for those that may have to carry a balance outside of 0% inital rates.

I would love to get the Huntington Voice card if it was possible..But I don't live near a branch ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: top 5 visa cards and mastercards to have

@B335is wrote:1) Sallie Mae

2) Sallie Mae #2

3) US Bank Cash +

4) US Bank Cash + #2

5) Penfed Cash Rewards

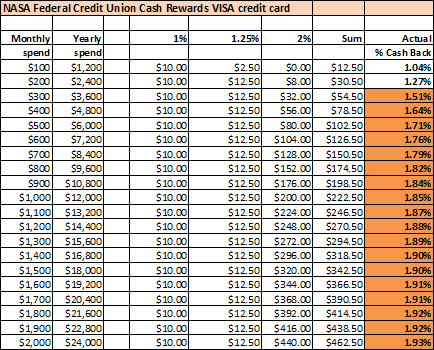

Close. but #5 (since we can only consider VISA and MasterCards) is the NASA FCU Cash Rewards card.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: top 5 visa cards and mastercards to have

@Themanwhocan wrote:

@B335is wrote:1) Sallie Mae

2) Sallie Mae #2

3) US Bank Cash +

4) US Bank Cash + #2

5) Penfed Cash Rewards

Close. but #5 (since we can only consider VISA and MasterCards) is the NASA FCU Cash Rewards card.

Yeah but Nasa pulls EX and I value those lenders that pull others even if it means losing out on a few cents here or there ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: top 5 visa cards and mastercards to have

@VirtualCuriosity wrote:I wanna play too... I will just list the ones I have, am aiming for, or could obtain in the future. I am/will be a cash back chaser so I try to cover everything

Not listing in order of "best" because it's too vague a statement for me. I think this looks like a decent lineup for my needs as it covers almost everything.

1 - Chase Freedom 5% restaurants, home improvement, movies, retail, etc. even though rotating.

2 - Fort Knox Federal Credit Union Platinum Visa 5% cash back on gas all year around (don't have to chase rotating gas category)

3 - Huntington Voice MC 3x points for utilities

4 - US Cash+ 5% groceries

5 - Sallie Mae 5% groceries (help with the US Cash+ cap), 5% books (DD starting college soon)

The one below may interest others. I refuse to bank with LMCU so it's not in my list......

*Lake Michigan Credit Union Prime Platinum Visa (low 6.25% APR not introductory) for those that may have to carry a balance outside of 0% inital rates.

Just curious why you refuse to bank with LMCU?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: top 5 visa cards and mastercards to have

@B335is wrote:

@VirtualCuriosity wrote:I wanna play too... I will just list the ones I have, am aiming for, or could obtain in the future. I am/will be a cash back chaser so I try to cover everything

Not listing in order of "best" because it's too vague a statement for me. I think this looks like a decent lineup for my needs as it covers almost everything.

1 - Chase Freedom 5% restaurants, home improvement, movies, retail, etc. even though rotating.

2 - Fort Knox Federal Credit Union Platinum Visa 5% cash back on gas all year around (don't have to chase rotating gas category)

3 - Huntington Voice MC 3x points for utilities

4 - US Cash+ 5% groceries

5 - Sallie Mae 5% groceries (help with the US Cash+ cap), 5% books (DD starting college soon)

The one below may interest others. I refuse to bank with LMCU so it's not in my list......

*Lake Michigan Credit Union Prime Platinum Visa (low 6.25% APR not introductory) for those that may have to carry a balance outside of 0% inital rates.

Just curious why you refuse to bank with LMCU?

It is because of a really bad experience with a customer service rep prior to executing the final application. The low APR didn't mean enough to me to join after reading the reviews and my own personal experience.

TU713, EQ 731 , EX 726 (As of 12/13/14) - Personal Goal = 760

“Beware of little expenses. A small leak will sink a great ship” – Benjamin Franklin

Gardening since 3-26-15

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: top 5 visa cards and mastercards to have

@VirtualCuriosity wrote:

@B335is wrote:

@VirtualCuriosity wrote:I wanna play too... I will just list the ones I have, am aiming for, or could obtain in the future. I am/will be a cash back chaser so I try to cover everything

Not listing in order of "best" because it's too vague a statement for me. I think this looks like a decent lineup for my needs as it covers almost everything.

1 - Chase Freedom 5% restaurants, home improvement, movies, retail, etc. even though rotating.

2 - Fort Knox Federal Credit Union Platinum Visa 5% cash back on gas all year around (don't have to chase rotating gas category)

3 - Huntington Voice MC 3x points for utilities

4 - US Cash+ 5% groceries

5 - Sallie Mae 5% groceries (help with the US Cash+ cap), 5% books (DD starting college soon)

The one below may interest others. I refuse to bank with LMCU so it's not in my list......

*Lake Michigan Credit Union Prime Platinum Visa (low 6.25% APR not introductory) for those that may have to carry a balance outside of 0% inital rates.

Just curious why you refuse to bank with LMCU?

It is because of a really bad experience with a customer service rep prior to executing the final application. The low APR didn't mean enough to me to join after reading the reviews and my own personal experience.

I agree their Customer Service is about average in my experience. I joined to get that low APR but was denied. They don't like new accounts and cited pyramids, just like Penfed. They are conservative.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: top 5 visa cards and mastercards to have

@B335is wrote:

@VirtualCuriosity wrote:

@B335is wrote:

@VirtualCuriosity wrote:I wanna play too... I will just list the ones I have, am aiming for, or could obtain in the future. I am/will be a cash back chaser so I try to cover everything

Not listing in order of "best" because it's too vague a statement for me. I think this looks like a decent lineup for my needs as it covers almost everything.

1 - Chase Freedom 5% restaurants, home improvement, movies, retail, etc. even though rotating.

2 - Fort Knox Federal Credit Union Platinum Visa 5% cash back on gas all year around (don't have to chase rotating gas category)

3 - Huntington Voice MC 3x points for utilities

4 - US Cash+ 5% groceries

5 - Sallie Mae 5% groceries (help with the US Cash+ cap), 5% books (DD starting college soon)

The one below may interest others. I refuse to bank with LMCU so it's not in my list......

*Lake Michigan Credit Union Prime Platinum Visa (low 6.25% APR not introductory) for those that may have to carry a balance outside of 0% inital rates.

Just curious why you refuse to bank with LMCU?

It is because of a really bad experience with a customer service rep prior to executing the final application. The low APR didn't mean enough to me to join after reading the reviews and my own personal experience.

I agree their Customer Service is about average in my experience. I joined to get that low APR but was denied. They don't like new accounts and cited pyramids, just like Penfed. They are conservative.

Yeah, my experience with the application process wasn't that good either. Only worthwhile point was that it didn't cost me an HP since I was really going after the 3% interest rate on the checking account. It's in the sock drawer indefinitely.

INQs: EQ(7) EX(16) TU(8)

Last INQ: 13 Jul 23

Total Credit Limit - $2.0M

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: top 5 visa cards and mastercards to have

@nyancat: "How can you redeem for a student loan or mortgage if you don't have a student loan or a mortgage?"

___________________________________________________________________________________

Easiest thing in the world and it makes the card a 5% cash back card ^_^

You call in, ask for the student loan/mortgage rebate option (doesn't matter if you have one, I have neither), they'll ask you who your loan provider is (I just said 'Bank of America', you would just say whatever you want it to go towards), and they mail you a check made out to the bank. I literally just went to the nearest BofA and deposited the check right into my checking account through their outdoor ATM.

I've even seen some people that had the check made out to Citibank and mailed it in as a payment on the card itself without an issue =p