- myFICO® Forums

- Types of Credit

- Credit Cards

- what should my next move be? need to app!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

what should my next move be? need to app!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what should my next move be? need to app!

I need to do some moving around per say with my current line of cards. Figured I would ask the pros if there is anything better to maximize my rewards.

2% util. last month i attempted to purchase a vehicle at a dealer so 6 inquiries on transunion from the dealer same day then back in march I attempted a cli on my freedom and was denied (util was too high) then about over a year ago I did a cli on my boa 123 and was approved from 1k-3k.

same 6 inquiries on equifax from dealer then another 2 from nfcu one same day car shopping then earlier this year attempted a cli on my cash rewards and was shot down due to util being around 50%

same 6 inquiries on experian from auto shopping but thats it.

No baddies on transunion or equifax and on experian i have a paid closed child support tradeline that is 5 yrs old and I believe that is the deal breaker from me getting an amex. I applied for amex about 3 yrs ago for the zync and was denied but I also had some negative tradelines at the time.

My oldest account is 3 yrs old and my newest is about 6 mos old and AAOA is sitting around 2 yrs. Income is 60k

I'd like to add one rewards card and another low apr card that i can use cause my nfcu plat. card @ 16.99% is no good to me even though they advertise that it can go as low as 8%.

Im ready for suggestions. Thanks

Chase Freedom 1.5k | Amazon 3K | Walmart 3K | Buckle 300 | AMEX BCE 2.5K | CHASE CSP 12K | CITI sears 6k | Kay 2k

On the prowl for Chase Sapphire Preferred! APPROVED 12K!

scores 7/14 647 622 630 (85%util)

scores 8/14 767 760 758 Boom! finally in the 700 club

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: what should my next move be? need to app!

@rootpooty wrote:I need to do some moving around per say with my current line of cards. Figured I would ask the pros if there is anything better to maximize my rewards.

2% util. last month i attempted to purchase a vehicle at a dealer so 6 inquiries on transunion from the dealer same day then back in march I attempted a cli on my freedom and was denied (util was too high) then about over a year ago I did a cli on my boa 123 and was approved from 1k-3k.

same 6 inquiries on equifax from dealer then another 2 from nfcu one same day car shopping then earlier this year attempted a cli on my cash rewards and was shot down due to util being around 50%

same 6 inquiries on experian from auto shopping but thats it.

No baddies on transunion or equifax and on experian i have a paid closed child support tradeline that is 5 yrs old and I believe that is the deal breaker from me getting an amex. I applied for amex about 3 yrs ago for the zync and was denied but I also had some negative tradelines at the time.

My oldest account is 3 yrs old and my newest is about 6 mos old and AAOA is sitting around 2 yrs. Income is 60k

@I'd like to add one rewards card and another low apr card that i can use cause my nfcu plat. card @ 16.99% is no good to me even though they advertise that it can go as low as 8%.

Im ready for suggestions. Thanks

Hey root!

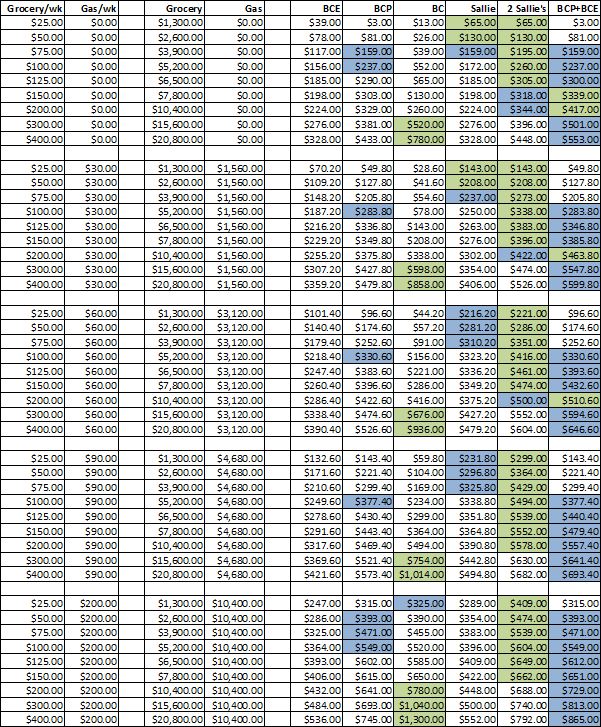

If you're looking for rewards, it'd be good to know what you spend the most on? A very popular one on here right now is the Sallie Mae through Barclay's: 5% on gas and groceries (capped at $250/month each) and bookstores aka amazon (capped at $750/month).

BBR through BOA offers $100 per year for paying the minimum or more every month. With a BOA banking account, that's $120 a year!

In terms of low APR, Barclay's has the Ring at 8%, but if you're going for the Sallie Mae I wouldn't recommended apping for both. Instead, check out other CU cards, such as DCU's Platinum.

Good luck on your journey ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: what should my next move be? need to app!

Chase Freedom 1.5k | Amazon 3K | Walmart 3K | Buckle 300 | AMEX BCE 2.5K | CHASE CSP 12K | CITI sears 6k | Kay 2k

On the prowl for Chase Sapphire Preferred! APPROVED 12K!

scores 7/14 647 622 630 (85%util)

scores 8/14 767 760 758 Boom! finally in the 700 club

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: what should my next move be? need to app!

@rootpooty wrote:

I spend roughly 10-11k on groceries per year then another 300 monthly on gas. Dine out a few times a month family of 5

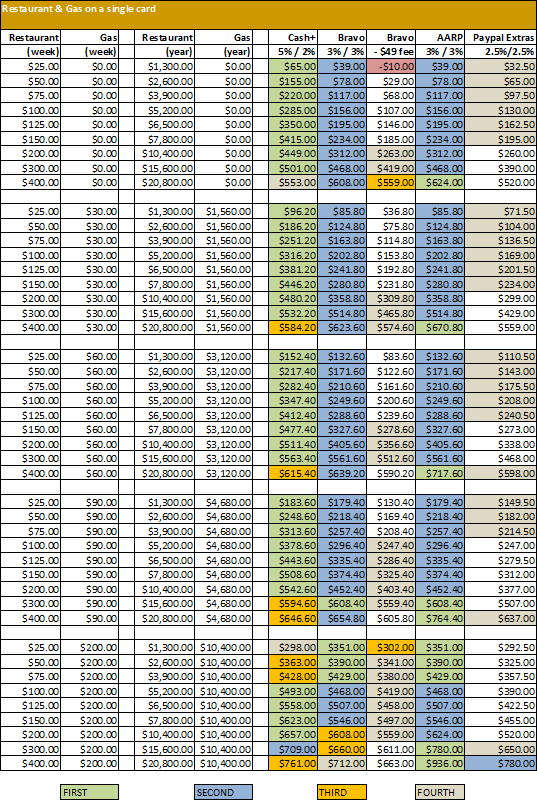

For Restaurant cash back, nothing beats a US Bank Cash+ card, though it has spending caps. Second best is Chase AARP card.

For Grocery store and Gas stations, several Sallie Mae cards would be best (like 3 or 4). Assuming you don't want that, start by geting one Sallie Mae card at least, and then the rest of your grocery spend, probably an American Express Blue Cash Preferred. Unless you also spend a lot at Drugstores.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: what should my next move be? need to app!

Really though out of the 4 accounts I mentioned I believe I can get approved for at least 2

Chase Freedom 1.5k | Amazon 3K | Walmart 3K | Buckle 300 | AMEX BCE 2.5K | CHASE CSP 12K | CITI sears 6k | Kay 2k

On the prowl for Chase Sapphire Preferred! APPROVED 12K!

scores 7/14 647 622 630 (85%util)

scores 8/14 767 760 758 Boom! finally in the 700 club

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: what should my next move be? need to app!

Have you checked the pre-qual sites to see if you're approved for any of the cards you want?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: what should my next move be? need to app!

Chase Freedom 1.5k | Amazon 3K | Walmart 3K | Buckle 300 | AMEX BCE 2.5K | CHASE CSP 12K | CITI sears 6k | Kay 2k

On the prowl for Chase Sapphire Preferred! APPROVED 12K!

scores 7/14 647 622 630 (85%util)

scores 8/14 767 760 758 Boom! finally in the 700 club

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: what should my next move be? need to app!

@rootpooty wrote:

Wow I was originally planning on apping for the CSP to go along my freedom and checking. Then possibly apping for Barclay's ring. Citi dividend and discover it for rotating 5 percent categories.

Really though out of the 4 accounts I mentioned I believe I can get approved for at least 2

I would App in order:

CSP

Barclay's ring

Citi Dividend

Discover

Discover 5% rotating is pretty much the same as Chase Freedom so you wont be missing much if you get Declined.

on the SM card Why app for more then 1 imo I rather diverse myself with other cards and not waste a HP for another SM card ...

My Cards: Amex BCE: $9,000, Amex Hilton HHonors: $2,000, Amex ED: $12,000, Barclays NFL extra points: $3,000, Bank of America MLB cash rewards: $17,000, BBVA compass NBA Amex triple double rewards: $17,000, Chase Amazon: $1,000, Chase Freedom: $9,000, Chase Sapphire: $5,000, Chase Slate: $5,000, Chase Disney: $4,000, Citi Double Cash: $5,400, Citi AA plat: $5,500, Citi Simplicity: $3,000, Citi Thank you preferred: $8,800, Capital one GM: $2,000, Capital one PlayStation: $3,000, Gamestop: $1,150, Amazon Store: $5,000, Ebay MasterCard: $5,000, American Eagle Storecard: $750, Macy's: $500

EX: 744, TU:750, EQ: 740