- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Being removed as an AU

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Being removed as an AU

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Being removed as an AU

I was an AU on my mom's USAA American Express while I was in high school (opened in 2008), but she removed me as an AU (in 2010). However, it still shows up on my credit reports. The opening date is reported, but the balance is $0 and hasn't updated since 2010 (when she removed me). Is this helping my AAoA or not factored in at all? If factored in, is the account "2 years old" (from when I was added through when I was removed) or is it still "aging"?

In addition, I am still an AU on one of her cards with Chase. I contemplated being removed from the account earlier this year because she was carrying a balance, but she paid it off around that time and it has definitely helped with my AAoA (it was opened in 2007 and is my oldest reported account). She has recently been carrying a hefty balance again (more than 30% of the CL), and I think it's finally time to be removed as an AU. So... if I call Chase and have them remove me, should I still leave it on my CRs ( I guess this also ties to my questions about the USAA AMEX and what actually happens to these accounts)? Will the balance that's being reported now remain the reported balance, or will it drop to $0 (should I wait to be removed until she finally pays it off)? Will it still factor into my AAoA (this is the only reason I've remained an AU for so long)?

Sorry if the answers to any of this stuff is "obvious," but I need to make sure I'm making decent, informed decisions.

Thanks in advance for your input!

History — AAoA: 42 months | Oldest account: 119 months (including AU) | Inquiries: 1 EX 0 EQ 0 TU | Score: 765 (Discover TU) 750 (USAA CreditCheck Monitoring EX FAKO)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being removed as an AU

It's an account in good standing 0 balance. Awesome! AAOA uses both open and closed accounts. Closed accounts report for 10 years after closure, this account will continue to help you until 2020.

Sorry, stopped reading too early. If removed as an AU before zero balance last reported balance will continue to report. You can have the account removed butusually not just the balance. I would remove myself after it is zero balance again. Same as above applies for AAoA.

Hope this helps.

Current FICO Scores EX: 715 EQ: 756 TU: 762

Last APP April 21, 2015.

Victim of The great AMEX HP heist of Dec 1st, 2nd and 3rd of 2014.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being removed as an AU

If only an AU, then removal of the AU would remove the authority for any information on that account to appear in your credit report.

If in doubt, it is best, in my opinion, to remove an AU.

While any AU continues to show in your CR, it means that any score produced is, by definition, not representative of only your own personal credit history.

Any credit wishing to use your credit score as an indication of only your own personal risk (which is the basic purpose of a credit score) cannot do so, and cannot exclude the effect of individual AU accounts and produce such a score.

AUs are great for building/reduliding where creditors often dont do a manual review, but when apping for credit where a manual review can be expected, AUs can impact the usefulness of your credit score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being removed as an AU

@RobertEG wrote:If only an AU, then removal of the AU would remove the authority for any information on that account to appear in your credit report.

If in doubt, it is best, in my opinion, to remove an AU.

While any AU continues to show in your CR, it means that any score produced is, by definition, not representative of only your own personal credit history.

Any credit wishing to use your credit score as an indication of only your own personal risk (which is the basic purpose of a credit score) cannot do so, and cannot exclude the effect of individual AU accounts and produce such a score.

AUs are great for building/reduliding where creditors often dont do a manual review, but when apping for credit where a manual review can be expected, AUs can impact the usefulness of your credit score.

I agree. AU's can be a good tool but they are not a panacea for all credit woes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being removed as an AU

Thanks for your reponses...

Looks like I'll keep taking the utilization hit for the foreseeable future and request to be taken off the account when the balance is back down to $0.

History — AAoA: 42 months | Oldest account: 119 months (including AU) | Inquiries: 1 EX 0 EQ 0 TU | Score: 765 (Discover TU) 750 (USAA CreditCheck Monitoring EX FAKO)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being removed as an AU

No need to wait. Being removed as an AU should remove the TL from your reports.

Not all creditors or scoring models factor in accounts where you're an AU anyway.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being removed as an AU

@takeshi74 wrote:No need to wait. Being removed as an AU should remove the TL from your reports.

Not all creditors or scoring models factor in accounts where you're an AU anyway.

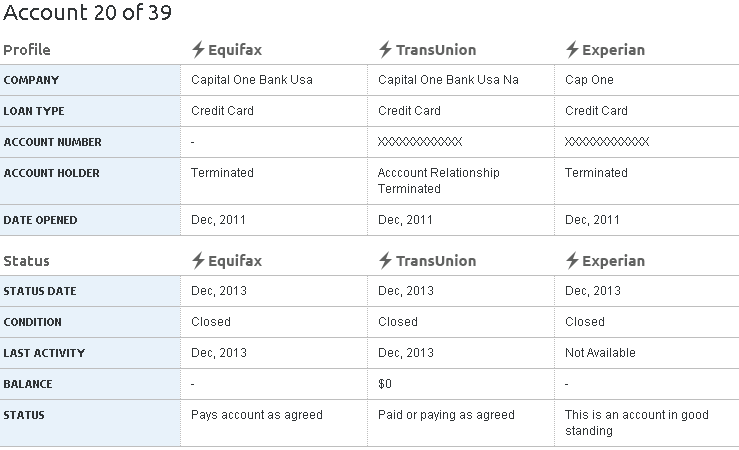

nope, i have a cap-one TL showing on my report... i was removed almost a year ago.

Landmarkcu Personal Loan 10k