- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Can Someone Please Explain This (Equifax)

Options

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Can Someone Please Explain This (Equifax)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-15-2017

06:24 AM

08-15-2017

06:24 AM

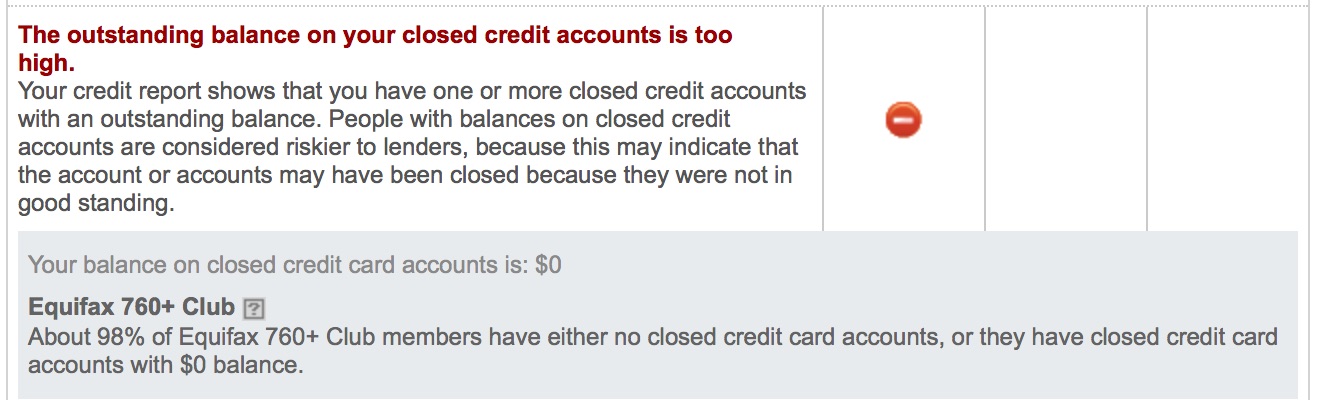

Can Someone Please Explain This (Equifax)

Hello, I have an EQ membership and noticed this on my credit score details. I've noticed it for a while, but I finally looked at it closer. Note, it says this is one of the factors hurting my score. However, I can't find anything in my credit report that lines up with the message. It even says $0 right underneath it.

Anyone have any idea why this is there and who I can reach out to in order to get it removed?

Starting EQ: 601 | EXP: 623 | TU: 637 (2/17)

Update 4/18/20: Current EQ: 760 | EXP: 708 | TU: 724

Goal EQ: 750 | EXP: 750 | TU: 750 (12/17)

Credit Card Debt Free Goal: March 2018

*NEW* Chase Sapphire Preferred $0 ($17,600) 4/18/20 | Chase Freedom Unlimited $0 ($5,500) | Chase Slate $0 ($2,100) | PNC Visa $11,100 ($12,500) | Citi Costco $0 ($5,500) | Citi Simplicity $0 ($2,700) | Discover It $0 ($8,000) | Barclay Card NFL Extra Points $0 ($12,000) | Marvel Mastercard $0 ($6,000) | Nordstrom Visa $0 ($17,000) | American Express Every Day $0 ($3,000) | Bayport Credit Union $6,876 ($7,500) | American Express Delta $700 ($12,000) | Macy's $601 ($5,000) | JC Penney $0 ($3,500) | Synchrony Amazon $2,728.40 ($6,500)

Update 4/18/20: Current EQ: 760 | EXP: 708 | TU: 724

Goal EQ: 750 | EXP: 750 | TU: 750 (12/17)

Credit Card Debt Free Goal: March 2018

*NEW* Chase Sapphire Preferred $0 ($17,600) 4/18/20 | Chase Freedom Unlimited $0 ($5,500) | Chase Slate $0 ($2,100) | PNC Visa $11,100 ($12,500) | Citi Costco $0 ($5,500) | Citi Simplicity $0 ($2,700) | Discover It $0 ($8,000) | Barclay Card NFL Extra Points $0 ($12,000) | Marvel Mastercard $0 ($6,000) | Nordstrom Visa $0 ($17,000) | American Express Every Day $0 ($3,000) | Bayport Credit Union $6,876 ($7,500) | American Express Delta $700 ($12,000) | Macy's $601 ($5,000) | JC Penney $0 ($3,500) | Synchrony Amazon $2,728.40 ($6,500)

Labels:

Message 1 of 4

0

Kudos

3 REPLIES 3

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-15-2017

07:48 AM

08-15-2017

07:48 AM

Re: Can Someone Please Explain This (Equifax)

Is the their own scoring model? If it is, I wouldn't worry about it. I've never seen FICO use this comment before.

EQ 778 EXP 782 TU 729

EQ 778 EXP 782 TU 729

Message 2 of 4

0

Kudos

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-15-2017

07:54 AM

08-15-2017

07:54 AM

Re: Can Someone Please Explain This (Equifax)

@medicgrrl wrote:

Is the their own scoring model? If it is, I wouldn't worry about it. I've never seen FICO use this comment before.

That's a good point. Do you recommend I drop that account and just use what myFICO offers?

Starting EQ: 601 | EXP: 623 | TU: 637 (2/17)

Update 4/18/20: Current EQ: 760 | EXP: 708 | TU: 724

Goal EQ: 750 | EXP: 750 | TU: 750 (12/17)

Credit Card Debt Free Goal: March 2018

*NEW* Chase Sapphire Preferred $0 ($17,600) 4/18/20 | Chase Freedom Unlimited $0 ($5,500) | Chase Slate $0 ($2,100) | PNC Visa $11,100 ($12,500) | Citi Costco $0 ($5,500) | Citi Simplicity $0 ($2,700) | Discover It $0 ($8,000) | Barclay Card NFL Extra Points $0 ($12,000) | Marvel Mastercard $0 ($6,000) | Nordstrom Visa $0 ($17,000) | American Express Every Day $0 ($3,000) | Bayport Credit Union $6,876 ($7,500) | American Express Delta $700 ($12,000) | Macy's $601 ($5,000) | JC Penney $0 ($3,500) | Synchrony Amazon $2,728.40 ($6,500)

Update 4/18/20: Current EQ: 760 | EXP: 708 | TU: 724

Goal EQ: 750 | EXP: 750 | TU: 750 (12/17)

Credit Card Debt Free Goal: March 2018

*NEW* Chase Sapphire Preferred $0 ($17,600) 4/18/20 | Chase Freedom Unlimited $0 ($5,500) | Chase Slate $0 ($2,100) | PNC Visa $11,100 ($12,500) | Citi Costco $0 ($5,500) | Citi Simplicity $0 ($2,700) | Discover It $0 ($8,000) | Barclay Card NFL Extra Points $0 ($12,000) | Marvel Mastercard $0 ($6,000) | Nordstrom Visa $0 ($17,000) | American Express Every Day $0 ($3,000) | Bayport Credit Union $6,876 ($7,500) | American Express Delta $700 ($12,000) | Macy's $601 ($5,000) | JC Penney $0 ($3,500) | Synchrony Amazon $2,728.40 ($6,500)

Message 3 of 4

0

Kudos

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-15-2017

08:59 AM

08-15-2017

08:59 AM

Re: Can Someone Please Explain This (Equifax)

I definitely recommend monitoring your FICO scores... whether it's here or thru another site. To monitor your credit only, you can sign up for free sites like Credit Karma and Wallethub....just ignore their score's. Depending on how often you want to see your scores, there are various ways to obtain them for little money. Do you have any open accounts that give you free FICO scores?

EQ 778 EXP 782 TU 729

EQ 778 EXP 782 TU 729

Message 4 of 4

0

Kudos

† Advertiser Disclosure: The offers that appear on this site are from third party advertisers from whom FICO receives compensation.