- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Car Insurance and Store Cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Car Insurance and Store Cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Car Insurance and Store Cards

@Anonymous wrote:

@Subexistence wrote:

@Anonymous wrote:An 820 is not a good score in the TU Insurance model, sorry to say. Here is a post from the CK site from our very own Thomas Thumb. I would scout around on the CK site and see if you can determine whether these are still the same category ranges. (TT's post is from 15 months ago.)

=======

Credit Karma's free credit based Auto insurance score comes directly from TransUnion (TU). I purchased my score direct from TU and it matches what CK lists. Listed below is an approximate rating breakdown by category [score range 150 to 950].

TU Auto insurance score .... Category Rating

895 and above .........................Very Good

860 to 894 ............................... Good

825 to 859 ................................ Fair

760 to 824 ................................ Poor

759 and below .......................... Very Poor

https://www.creditkarma.com/question/what-is-a-good-auto-insurance-score

I have 872 home insurance score. For anyone wondering how to access it here is the linkhttps://www.creditkarma.com/myfinances/scores/insurance

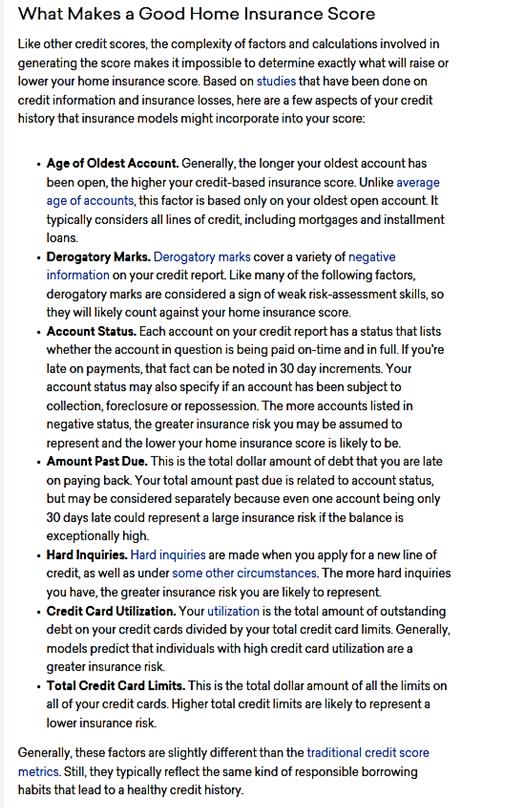

CreditKarma states house insurance factors in age of oldest account and total credit limit. These are in contrast to the traditional average age of accounts and utilization only calculation of traditional scores.

You are right that FICO does not consider credit limits at all in any of its models -- aside from CC utilization.

But actually Age of Oldest Account is a very important factor for FICO. Along with Age of Youngest Account and Total Number of Accounts, it is one of the three factors used in assigning people to one of the 8 clean scorecards -- a very important thing indeed.

PS. Like you, my home insurance score (903) is much better than my auto score (855). As a point of reference, my TU FICO 8 Classic score is 808, which is far better than either of my CBIS scores. (A FICO 8 of 808 is a much higher percentile score than the 903 home insurance score.) Thus you can see how much the Auto Insurance score is weighted with concerns different from the traditional FICO model.

And I have no store cards, no finance company accounts, no auto store accounts, and a very high Average Credit Limit and Total Credit Limit. And still my Auto score is a lot worse! TT speculates that this may have to do with the tremendous emphasis places by the CBIS models on new credit. I have opened a lot of new credit cards in the last 18 months.

Wow you really are a creditpedia! How does total number of accounts factor into FICO calculation? I would assume more accounts means more experience with credit but I'm sure too many accounts would present credit risk.

I also have no store cards,finance company accounts(I don't even know what this is), etc. I do however have very low credit limit and very limited history. Hopefully by the time I get a car, I can boost up my auto insurance score. Thanks to you, I knowwhat I need to avoid doing and what I need to do more.

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Car Insurance and Store Cards

Wealth of knowledge for sure sure CGID, I have you all beat my Auto Score is 631... praise JESSUUUUSS that USAA uses their own properietary model that has allowed me to have a very low rate for my age range and type of vehicle that I drive. Looking back at the history of the score really shows how arbitrary and absurd this model is, no wonder Progressive, Geico etc, thought they were giving me a good deal and calling and harassing me for ONLY $438 a month for liability that is the state minimum.... uhm yeah no bye felicia. Are there any car insurance agencies out there that do use one of the Fico scores rather than one of these BS models or at least a semi non bs model like USAA has?

-tydawg

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Car Insurance and Store Cards

@Anonymous wrote:Wealth of knowledge for sure sure CGID, I have you all beat my Auto Score is 631... praise JESSUUUUSS that USAA uses their own properietary model that has allowed me to have a very low rate for my age range and type of vehicle that I drive. Looking back at the history of the score really shows how arbitrary and absurd this model is, no wonder Progressive, Geico etc, thought they were giving me a good deal and calling and harassing me for ONLY $438 a month for liability that is the state minimum.... uhm yeah no bye felicia. Are there any car insurance agencies out there that do use one of the Fico scores rather than one of these BS models or at least a semi non bs model like USAA has?

-tydawg

USAA website says it uses LexisNexis

https://www.usaa.com/inet/wc/faq_PC_Insurance_Score_index

go to "How is Insurance score determined"

the dropdown states..."USAA partners with LexisNexis, a leader in insurance scoring, to obtain your score. An insurance score is based on information within one's credit report such as the length of credit history, payment history, outstanding debt and types of credit in use. A credit report is obtained by LexisNexis from either Experian or Equifax. For a list of factors that affect insurance scores visit consumerdisclosure.com."

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Car Insurance and Store Cards

You guys are so nice. Actually there's a number of people who know a TON more here than I do.

I do not know what insurance companies use which CBIS. I do not even know what one my own company uses! (Geico) I am pretty sure that some companies use a straight FICO score of some sort -- I think I did a little research and seem to have seen that back in the day.

As far as how FICO uses "total number of accounts".... that is used to determine whether FICO considers your profile to be "thin" or not. More accounts is less thin. FICO counts both closed and open together in making this assessment.

Exactly how these three factors (Age of Oldest Account, Age of Youngest Account, Total Number of Accounts) are used by FICO in assigning a person to one of the eight clean scorecards.... that's something I am pretty sure nobody knows. It is definitely known that, for FICO 8....

There are four dirty scorecards

There are eight clean scorecards

The three factors I mention are used in scorecard assignment for the eight clean scorecards

That's knows because FICO has said all that in one or another of its published white papers. Thomas Thumb knows much more about it than I do, but I think he'd tell you that beyond that it's very speculative.

You can think of the clean scorecards as ranging from our friend SubE at one end (very few accounts, all opened very recently) to a certain type of couple nearing retirement (many accounts, oldest account on report was decades ago, no accounts opened in the last two years).

Each scorecard has a maximum score that can be reached. A few of the scorecards (at one end of the spectrum) can go all the way up to 850. The scorecards at the other end of the spectrum are much more limited: even if the person's utilization is perfect, and he has a great credit mix, and a perfect payment history, he still can't score any higher than 760 (say) or 780.

Exactly what those ceilings are is (again) speculation.

Whithin a scorecard, all the other scoring factors come into play: CC utilization, installment utilization, credit mix, inquiries.... dozens of little factors, all of varying importance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Car Insurance and Store Cards

@Subexistence wrote:

@Anonymous wrote:Wealth of knowledge for sure sure CGID, I have you all beat my Auto Score is 631... praise JESSUUUUSS that USAA uses their own properietary model that has allowed me to have a very low rate for my age range and type of vehicle that I drive. Looking back at the history of the score really shows how arbitrary and absurd this model is, no wonder Progressive, Geico etc, thought they were giving me a good deal and calling and harassing me for ONLY $438 a month for liability that is the state minimum.... uhm yeah no bye felicia. Are there any car insurance agencies out there that do use one of the Fico scores rather than one of these BS models or at least a semi non bs model like USAA has?

-tydawg

USAA website says it uses LexisNexis

https://www.usaa.com/inet/wc/faq_PC_Insurance_Score_index

go to "How is Insurance score determined"

the dropdown states..."USAA partners with LexisNexis, a leader in insurance scoring, to obtain your score. An insurance score is based on information within one's credit report such as the length of credit history, payment history, outstanding debt and types of credit in use. A credit report is obtained by LexisNexis from either Experian or Equifax. For a list of factors that affect insurance scores visit consumerdisclosure.com."

They also have their own proprietary model.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Car Insurance and Store Cards

@Anonymous wrote:You guys are so nice. Actually there's a number of people who know a TON more here than I do.

I do not know what insurance companies use which CBIS. I do not even know what one my own company uses! (Geico) I am pretty sure that some companies use a straight FICO score of some sort -- I think I did a little research and seem to have seen that back in the day.

As far as how FICO uses "total number of accounts".... that is used to determine whether FICO considers your profile to be "thin" or not. More accounts is less thin. FICO counts both closed and open together in making this assessment.

Exactly how these three factors (Age of Oldest Account, Age of Youngest Account, Total Number of Accounts) are used by FICO in assigning a person to one of the eight clean scorecards.... that's something I am pretty sure nobody knows. It is definitely known that, for FICO 8....

There are four dirty scorecards

There are eight clean scorecards

The three factors I mention are used in scorecard assignment for the eight clean scorecards

That's knows because FICO has said all that in one or another of its published white papers. Thomas Thumb knows much more about it than I do, but I think he'd tell you that beyond that it's very speculative.

You can think of the clean scorecards as ranging from our friend SubE at one end (very few accounts, all opened very recently) to a certain type of couple nearing retirement (many accounts, oldest account on report was decades ago, no accounts opened in the last two years).

Each scorecard has a maximum score that can be reached. A few of the scorecards (at one end of the spectrum) can go all the way up to 850. The scorecards at the other end of the spectrum are much more limited: even if the person's utilization is perfect, and he has a great credit mix, and a perfect payment history, he still can't score any higher than 760 (say) or 780.

Exactly what those ceilings are is (again) speculation.

Whithin a scorecard, all the other scoring factors come into play: CC utilization, installment utilization, credit mix, inquiries.... dozens of little factors, all of varying importance.

You know that reminds me of something. My very first thread was me raging about a drop from 709 to 642 on my Vantage and I thought the drop was purely due secu adding new accounts and stuff. Now that I read more about the buckets, I think that perhaps I may have been rebucketed from having just 1 credit line(discover) to a higher bucket(2-3credit line) and it may have resulted in my score drop. Although that theory relies on Vantage also using buckets like FICO does.

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Car Insurance and Store Cards

My understanding is that Vantage uses the same three scoring factors for scorecard assignment as does FICO. (For clean scorecards, that is.) TT can confirm -- and he's the one who knows about all the relevant white papers for Vanatge and FICO on this subject.

It is quite possible that Vantage does not use the three factors in exactly the same way as does FICO, but the general principle is the same, as is the metaphor of a spectrum of scorecards running from a thin, very new profile at one end to an old established thick profile with no new accounts at the other.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Car Insurance and Store Cards

@Subexistence wrote:

@Anonymous wrote:An 820 is not a good score in the TU Insurance model, sorry to say. Here is a post from the CK site from our very own Thomas Thumb. I would scout around on the CK site and see if you can determine whether these are still the same category ranges. (TT's post is from 15 months ago.)

=======

Credit Karma's free credit based Auto insurance score comes directly from TransUnion (TU). I purchased my score direct from TU and it matches what CK lists. Listed below is an approximate rating breakdown by category [score range 150 to 950].

TU Auto insurance score .... Category Rating

895 and above .........................Very Good

860 to 894 ............................... Good

825 to 859 ................................ Fair

760 to 824 ................................ Poor

759 and below .......................... Very Poor

https://www.creditkarma.com/question/what-is-a-good-auto-insurance-score

I have 872 home insurance score. For anyone wondering how to access it here is the linkhttps://www.creditkarma.com/myfinances/scores/insurance

CreditKarma states house insurance factors in age of oldest account and total credit limit. These are in contrast to the traditional average age of accounts and utilization only calculation of traditional scores.

Here is what CK mentions about TransUnion Home CBIS:

Below is from TransUnion late 2015 regarding rating categories for their CBIS scores:

Below shows what Credit Karma used in mid 2013 as rating categories for the same CBIS model

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Car Insurance and Store Cards

@Anonymous wrote:

@Subexistence wrote:

@Anonymous wrote:Wealth of knowledge for sure sure CGID, I have you all beat my Auto Score is 631... praise JESSUUUUSS that USAA uses their own properietary model that has allowed me to have a very low rate for my age range and type of vehicle that I drive. Looking back at the history of the score really shows how arbitrary and absurd this model is, no wonder Progressive, Geico etc, thought they were giving me a good deal and calling and harassing me for ONLY $438 a month for liability that is the state minimum.... uhm yeah no bye felicia. Are there any car insurance agencies out there that do use one of the Fico scores rather than one of these BS models or at least a semi non bs model like USAA has?

-tydawg

USAA website says it uses LexisNexis

https://www.usaa.com/inet/wc/faq_PC_Insurance_Score_index

go to "How is Insurance score determined"

the dropdown states..."USAA partners with LexisNexis, a leader in insurance scoring, to obtain your score. An insurance score is based on information within one's credit report such as the length of credit history, payment history, outstanding debt and types of credit in use. A credit report is obtained by LexisNexis from either Experian or Equifax. "

They also have their own proprietary model.

I tried to check my score but I couldn't USAA due to not being military affiliated. Mind explaining how USAA factors your credit information to generate a score and why their process of doing so is supposedly not BS? My assumption is that using store cards as part of scoring is considered BS by your standards. After searching on Google it appears that Statefarm doesn't use LexisNexis to determine insurance scores and instead use their own model. However their own model may or may not involve store cards.

http://www.insure.com/car-insurance/what-insurer-knows.html

"

Some auto insurance companies have their own "scores"

State Farm — the country's largest auto insurer — decided to use "prior loss history and certain credit characteristics" to create its own model that helps it determine an underwriting score for a policyholder applying for a homeowners or auto policy."

Alternatively you could try to go the states that don't allow insurance to use credit scores. California, Massachusetts and Hawaii for auto insurance and Maryland and Hawaii for homeowners insurance.

I'm in Maryland so I'll probably be moving out of state after college and maybe land some insurance discounts for my credit score.

Edit:All State and Progressive supposedly have an option where you can avoid credit check but you can prepare to face high rates.

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Car Insurance and Store Cards

I have State Farm and CBIS strongly influences insurance premiums (in states that allow CBIS). Insurance companies that say they use their own "internal model" typically mean they use some type of composite model that includes a CBIS from LN, TU or other 3rd party as a primary component. See below for impact of CBIS on premiums.

https://www.valuepenguin.com/how-does-your-credit-score-affect-auto-insurance-rates

http://www.consumerfed.org/pdfs/useofcreditscoresbyautoinsurers_dec2013_cfa.pdf

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950