- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Credit Mix - What should I get?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Mix - What should I get?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit Mix - What should I get?

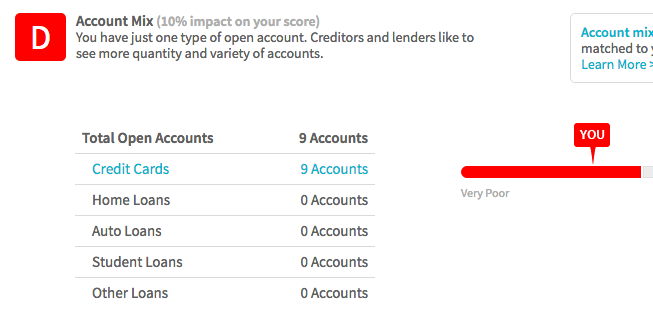

So this is what I'm seeing on one of the credit reporting sites:

8 are regular CCs and 1 is a store card...

I don't really need any loans but should I get any to increase my credit score? It says 10% impact and that's like 65-70 points which seems a lot (unless that's not the way it's calculated)...

What's "Other Loans"? Should I get one? Should I get more than one? Should I pay them right away? Who offers them online (i.e. no need to go to a bank or provide bunch of papers/verification - a la a credit card application in a single web form with instant decision)?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Mix - What should I get?

You should let your financial needs dictate the credit products that you use and not let score drive your decisions.

That said, there are those that get a shared secured loan for Credit Mix if they don't have installments. Don't overlook existing discussions as a resource. There are prior threads on shared secured loans if you're interested.

Also note the impact of the factor. Your screenshot and this page both indicate that it is typically 10%.

http://www.myfico.com/crediteducation/whatsinyourscore.aspx

Don't sweat the smaller factors if you have issues with the bigger factors. Start on the factors with the biggest impact. If the rest of your profile is good then you really just need to build your profile with time and responsible usage versus looking for quick fixes.

@russum wrote:I don't really need any loans but should I get any to increase my credit score? It says 10% impact and that's like 65-70 points which seems a lot (unless that's not the way it's calculated)...

It does not work that way. You're not going to instantly get 65-70 points from opening an installment. You also need to consider all factors at play. You will drop your AAoA (Length of Credit History) by opening a new account. You will incur a hard pull. You will have a new account on your reports (and many seem to overlook the impact of having new accounts). If the balance to loan ratio is high then that will impact Amounts Owed -- though not to the same degree that high Revolving Utilziation would impact Amounts Owed.

@russum wrote:Should I pay them right away?

If you pay off your only installment you lose the benefit to Credit Mix.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Mix - What should I get?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Mix - What should I get?

@takeshi74 wrote:You should let your financial needs dictate the credit products that you use and not let score drive your decisions.

That said, there are those that get a shared secured loan for Credit Mix if they don't have installments. Don't overlook existing discussions as a resource. There are prior threads on shared secured loans if you're interested.

+1

Agree fully with this. Just be careful and smart when making these types of decisions.

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Mix - What should I get?

@RM21 wrote:

@takeshi74 wrote:You should let your financial needs dictate the credit products that you use and not let score drive your decisions.

That said, there are those that get a shared secured loan for Credit Mix if they don't have installments. Don't overlook existing discussions as a resource. There are prior threads on shared secured loans if you're interested.

+1

Agree fully with this. Just be careful and smart when making these types of decisions.

100% agree with all of the above

Dont make a move until you have read 30 or 40 past threads on installment loans....and creditguyindixie's (I think it is him)bank loan thread.

Your scores will get better ..just sitting tight.

No hurry, please.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Mix - What should I get?

Please do not open an account that you don't need just to boost your score. You'll get the highest boosts from aging your current accounts, paying them on time, and keeping your utilization down. That is far, far more important.

Apple Card MC $10,000

BofA Cash Rewards VS $10,000

5/3 Cash/Back WEMC $10,000

Discover IT $7,500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Mix - What should I get?

Unless you are planning on applying for credit in the near future (for something you actually need it for... an auto loan, mortgage, new CC, etc) there's no need to attempt to artifically boost your score at this time. Yes using the share secure loan method will yield you maybe 20-30 points, but what good are those points if you aren't going to use them for anything? I would just sit tight and garden for now and cross that bridge when you get to it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Mix - What should I get?

@Anonymous wrote:

@RM21 wrote:

@takeshi74 wrote:You should let your financial needs dictate the credit products that you use and not let score drive your decisions.

That said, there are those that get a shared secured loan for Credit Mix if they don't have installments. Don't overlook existing discussions as a resource. There are prior threads on shared secured loans if you're interested.

+1

Agree fully with this. Just be careful and smart when making these types of decisions.

100% agree with all of the above

Dont make a move until you have read 30 or 40 past threads on installment loans....and creditguyindixie's (I think it is him)bank loan thread.

Your scores will get better ..just sitting tight.

No hurry, please.

+1

And many CU's will issue share secured loans without a HP as you are literally borrowing against your own money. Yes...get the facts first. If you choose to go this route, you want to make sure that you will not take a HP and that the account reports to ALL 3 major CRA's. If you choose not to go this route, you will do well as each of your revolving accounts age. Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Mix - What should I get?

@Anonymous wrote:Unless you are planning on applying for credit in the near future (for something you actually need it for... an auto loan, mortgage, new CC, etc) there's no need to attempt to artifically boost your score at this time. Yes using the share secure loan method will yield you maybe 20-30 points, but what good are those points if you aren't going to use them for anything? I would just sit tight and garden for now and cross that bridge when you get to it.

Blasphemy!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Mix - What should I get?

Your average age of accounts will be lowered. You will have a new credit inquiry (likely not a big deal). You will have a new account reporting (overlap with the first item). And your "proportion of balance to installment loan amount" will be too high (unless you're going to pay off a large portion immediately - which is another argument to not take out a loan just to increase your credit mix). Also, presumably but not definitely, you'll be paying interest on taking on a debt you don't need. Even if you have the money today to pay the entire loan off, if you don't and things change, you could wind up with a loan you can't pay because you took it out for an artificial boost in your credit score.