- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Discover Card Fico Score

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Discover Card Fico Score

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Card Fico Score

MyFico has a different scoring TU model

Discover,Barclay,Walmart all use the same TU model TU08 which is a newer model

Thus you may see different scores but both models are true Fico's

Most mortgage companies use the MyFico model

Have you done your research of the CC?

Does it fit your spending?

Do you have a plan for the bonus w/o going into debt?

Can you afford the AF?

Do you know the cards benefits? Is it worth the HP?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Card Fico Score

@Uppingmyscore wrote:@unc0mm0n1 do you know when the Walmart score was pulled ...that could be the difference depending on your utilization.

My util has never been above 5% and it's normally below 3%. I'm talking about a discover fico t a discover fico

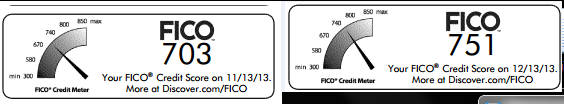

It's a one month difference, yet my score went up by nearly 50 points. The only difference is I added a Citi CC account. Util still about 3% as usual. Just doesn't make any sense. But myjourney said in a different thread that sometime credit cards start you off with the wrong card opening date, that seems like a reasonable explanation. unfortunately she said the boost only lasts for a month ![]() .

.

Current Score: 766 EX 734 EQ 780 TU 6/30/2015Starting Score/Goal Score: 580s/780s across the board

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Card Fico Score

I see :-)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Card Fico Score

@unc0mm0n1 wrote:

@Uppingmyscore wrote:@unc0mm0n1 do you know when the Walmart score was pulled ...that could be the difference depending on your utilization.

My util has never been above 5% and it's normally below 3%. I'm talking about a discover fico t a discover fico

It's a one month difference, yet my score went up by nearly 50 points. The only difference is I added a Citi CC account. Util still about 3% as usual. Just doesn't make any sense. But myjourney said in a different thread that sometime credit cards start you off with the wrong card opening date, that seems like a reasonable explanation. unfortunately she said the boost only lasts for a month

.

MJ is a He Lol![]()

And I've only seen Barclay do the year thing Lol

So maybe your at the point in your credit where everything looks good and you were rewarded ...It does happen

Hit the magic AAOA

Perfect number of TL's

Right number of INQ's

Perfect history to date

Perfect UTL

Bottom line enjoy the scoring bump somewhere along the lines you deserve it.

Have you done your research of the CC?

Does it fit your spending?

Do you have a plan for the bonus w/o going into debt?

Can you afford the AF?

Do you know the cards benefits? Is it worth the HP?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Card Fico Score

I don't know why I thought you were a woman this entire time. Sorry, but thanks for the kind words. I'll let you know if my CS keeps the 50 point jump!

Current Score: 766 EX 734 EQ 780 TU 6/30/2015Starting Score/Goal Score: 580s/780s across the board

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Card Fico Score

@unc0mm0n1 wrote:I don't know why I thought you were a woman this entire time. Sorry, but thanks for the kind words. I'll let you know if my CS keeps the 50 point jump!

Hopefully you keep it

Look out high 700's here you come

Wooo Hooo

Have you done your research of the CC?

Does it fit your spending?

Do you have a plan for the bonus w/o going into debt?

Can you afford the AF?

Do you know the cards benefits? Is it worth the HP?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Card Fico Score

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Card Fico Score

Is this only for the Discover IT cards? How about other Discover cards?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Card Fico Score

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Card Fico Score

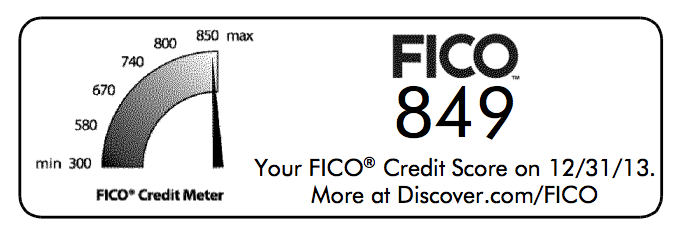

@Anonymous-own-fico wrote:I don't know what's going on here, lol.

Gardening pays of big time I would say

Congrats

Have you done your research of the CC?

Does it fit your spending?

Do you have a plan for the bonus w/o going into debt?

Can you afford the AF?

Do you know the cards benefits? Is it worth the HP?