- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Finally made the 800 club!! To app spree or not to...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Finally made the 800 club!! To app spree or not to app spree...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Finally made the 800 club!! To app spree or not to app spree...

that's awesome man, congrats! i'm looking forward to knowing how great this feels

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Finally made the 800 club!! To app spree or not to app spree...

Thanks everyone!

@Anonymous wrote:Wonderful achievement! This is somewhat of a lifechanging moment since you've crossed a threshold you probably thought impossible.

I have a couple questions though.

- How much CC debt did you consolidate through the low interest personal loan?

- And what score decrease did you see from getting an installment loan versus the point increase from paying off the CC debt?

Was it neutral or more positive paying off the CC balances?

I'd say...hold off and let that beautiful score of 805 stick around for a month, and in the meantime evaluate which card or cards best fit your longterm objectives and then apply in a month. Congrats again.

@Anonymous CC consolidation was about 20k @ 6.41% through SoFi and hasn't posted to my credit report. So I'm sure I'll take a small hit when that happens. According to the simulators, which have been mostly accurate, I'll drop 5 points.

I'm still waiting for TU to post all of this months credit card payoffs, but they seem to be taking forever so I'm not sure what my score with them will be, but they've been consistent with Experian, so I hope they also put me > 800.

The simulators also show that a new CC will drop me to 770.. I wanted to BT a majority of my loan over to the Slate assuming I could get a high SL with them, but something in me just wants to deal with the interest I'm paying on the loan (~$450ish by the time it's paid off) and keep the high score lol.

I got in with my Mortgage at 3.375% when I hit the 700s in 2012, So aside from paying off this last consolidation loan, I have no other short term credit goals so technically I have room to play and wouldn't mind getting a few more cards to stiffen my AAOA for years down the road.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Finally made the 800 club!! To app spree or not to app spree...

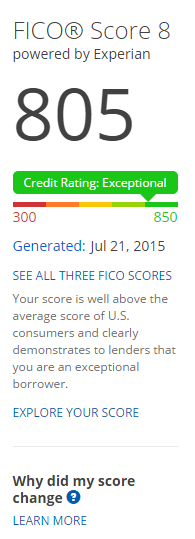

@ceejx wrote:So I've been waiting for my NFCU payoff to post after my credit card debt was consolidated onto a low interest personal loan. I've been saving up the CreditCheckTotal $1 trial until I noticed the balance was paid so I didn't have to wait for myFico to update (yes, I'm that impatient, you have no idea). Well, 3 days after the statement posted, EQ and EX were finally updated, and I went ahead with the CCT trial and got this:

This is a first! I was in the 400s in 2011/2012 when I started on the rebuilding section of the board, so this has been a journey for me. Never would I have imagined I'd been in the 800s, especially with my horrible credit past.

Now the dillema, I've been waiting for this so I could app for a few cards I've been wanting, mainly the Slate for the 0% BT offer, and the CSP to pair with my Freedom for rewards and the Amex BCE. Also considering one of the Chase hotel cards.. but now that I have an 800+ score, I'm not sure I want to apply anymore and ruin this great score!

Don't know what to do.. decisions, decisions! I've been itching to go on an app spree....

Awesome, Congrats, what a beautiful sight to behold lol

Comenity 57.5k| Navy Fed 52.5k| Capital One 32.3k| Synchrony 23k| BBVA Compass 5.5k| First Commerce 4k| Barclays 1.9k|

GARDENING UNTIL APPING....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Finally made the 800 club!! To app spree or not to app spree...

So it seems a loan versus a new CC is a far smaller hit. 5 versus 30 points. 30 points is a lot and surprised you'd suffer such a fall. Installment loans seem to have a much less or negligible effect on a Fico score than a CC. It's very strange.

Our Fico score is basically our CC score in essence.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Finally made the 800 club!! To app spree or not to app spree...

This is great news! I read that individuals with 800 credit scores typically have no more than 6 cards and never max out. You got your eye on some great cards. Especially that CSP! I would be cautious with my choices - only premium cards for sure. Good luck

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Finally made the 800 club!! To app spree or not to app spree...

Maybe installments have a smaller hit versus Cc because once installments are paid off- thats it. Revolving credit can keep you in debt

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Finally made the 800 club!! To app spree or not to app spree...

Congrats to you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Finally made the 800 club!! To app spree or not to app spree...

Regarding an app spree, it's the same advice that I give everyone. App because you need something not because you want something. You reached 800 because you developed a plan and you followed that plan. You have to ask yourself, "Do I really need to deviate from it?"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Finally made the 800 club!! To app spree or not to app spree...

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Finally made the 800 club!! To app spree or not to app spree...

@Anonymous wrote:So it seems a loan versus a new CC is a far smaller hit. 5 versus 30 points. 30 points is a lot and surprised you'd suffer such a fall. Installment loans seem to have a much less or negligible effect on a Fico score than a CC. It's very strange.

Our Fico score is basically our CC score in essence.

I've read installment loans don't take as much of a hit since it doesn't extend you any more risk outside of your fixed monthly payment. Since it's a one time payout, versus revolving credit that you can max out on a continous basis.

And I would assume that it being a fixed payment and fixed APR versus a credit card that has a higher APR and once you max it out your payment might go beyond what you're able to pay.