- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Getting baddies off problems + MyFico analysis

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Getting baddies off problems + MyFico analysis

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting baddies off problems + MyFico analysis

My wife had many late payments from a student loan that was mailing her at a wrong address many years later when payments needed to be made. With another student loan, she has on 30 days late payment. Anyhow, she called around and they agreed to take these baddies off the reports since she has been paying on time for a long time. What happened is that on Transunion the whole account was removed (even though it's still active). Her scores are good, but on MyFico it still shows 82% or 91% payments on time.

Basically, Equifax+Transunion+Experian all have that one 30 day payment thing which we are taking care of. But then Equifax also supposedly shows 60+ days late.. but when we look in the report, we can't trace what it is. And then the on-time payments don't match the removal of baddies. So is this supposed to change? It's from 2011. And even if her score is 750-780, should we worry about these things when applying for CCs?

Free services like Creditkarma or Nerdwallet show 100% on-time payments now. So how does this work? Does MyFico count the late payments even when they are taken off?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Getting baddies off problems + MyFico analysis

If the late payments are on your reports, they are factored into your FICO score. Other monitoring software like CK may make it seem like they don't count after a certain amount of time (usually 2 years) but with FICO scoring models they will impact your score for 7 years.

If the late payments you are seeing are accurate, the only way to get them removed is through the use of "goodwill" which can come by request using phone calls (which it sounds like you did), emails, letters, etc. Basically you want to get the company to do you a favor and remove the negative information (late payment) early. As you found already, it is possible to have success with this. I recommend NOT doing this via telephone as there is no written record of your conversation, so in the event that they agree to do something and it doesn't happen you really have no recourse to fall back on... where if it was in writing you could reference their letter dated X or what have you. If they agreed to remove something and you are still seeing it, I would follow up with a kind letter asking them to resubmit their request to the major reporting agencies to remove the late mark.

If the late payments you are seeing are not accurate, you can also contact the company and let them know this and should they agree with you they'll remove them promptly. If they don't agree, you can file a dispute through each of the bureaus (or whichever ones are showing the inaccurate info).

Hopefully that helps. If you head over the the rebuilding forum there's a lot of great information there regarding the use of goodwill letters and removing negative items from reports.

As for seeking out credit cards or credit with scores in the mid/upper 700's, generally speaking even with the presence of a few late payments obtaining new lines of credit will not be a problem with those scores. Those scores indicate a profile that outside of those baddies must be quite stellar, and potential creditors will easily recognize this. Getting rid of those last few negative marks however would look great to a potential creditor doing a manual review of your file though, and could result in even more favorable decisions. For example, while you may get approved for a credit card regardless of the late payments being present, perhaps without them there a greater credit line (limit) would be achieved, a more favorable interest rate, etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Getting baddies off problems + MyFico analysis

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Getting baddies off problems + MyFico analysis

As near as I can tell there's some data cacheing in the credit monitoring system for both Transunion and EQ which can skew things.

Really the place to check is via annualcreditreport.com; if it's not there, I wouldn't worry about it... if it is, well yeah. All the 3rd party report services have some idiosyncracies though this one is a bit irritating with MF in my experience.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Getting baddies off problems + MyFico analysis

Exactly.. it seems to be some sort of cache thing. Well, we just paid for fico and we got the report, so I should hope it's current. We are about to go an app spree for my wife and I'm afraid if these baddies do show, they'll give trouble.. even if her scores are 750ish..

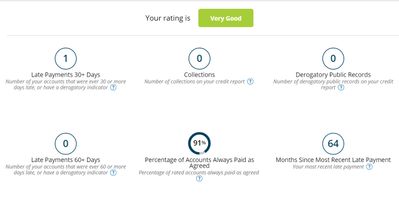

So this is what is going on. All three bureaus have one 30 days late payment, which we're working on to get off. But.. the % of on time payemnts should be 99% even with this one payment. Yet Experian and Transunion show the following:

Does a "very good" rating even apply to 91%?

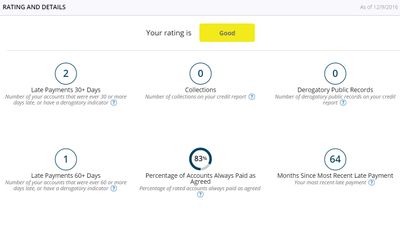

Equifax is an bigger problem. There it's claimed there is some 60+ days late payment. But nowhere in the report can I find it. Clicking "negative" shows only the 30 days late payment account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Getting baddies off problems + MyFico analysis

We just tried AnnualCreditReport and we got a weird prompt saying that a condition exists preventing us from retrieving Equifax and Experiean.. so only Transunion..

Transunion only shows the 30 days late payment.. So I don't know why Fico shows those weird %s..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Getting baddies off problems + MyFico analysis

@Anonymous wrote:We just tried AnnualCreditReport and we got a weird prompt saying that a condition exists preventing us from retrieving Equifax and Experiean.. so only Transunion..

Transunion only shows the 30 days late payment.. So I don't know why Fico shows those weird %s..

I think I misread your original account when I was suggesting caching in this case (which does seem to exist but I don't think it's applicable here in a second read).

On myFICO it's percentage of accounts paid as agreed, not payments made... at least that's what I'm figuring is the confusion based on your first post.

91% accounts paid on time means something like 10 tradelines in good standing and one with the blemish. I don't know on Nerdwallet, but I do know on Credit Karma: if the account is closed it doesn't get factored into their own presentation (which is flat out wrong, open and closed tradelines count for the vast majority of all FICO algorithms and lates do absolutely on all). CK also measures payments on time which is a different metric. Different services have different presentation formats, CK's wonderful for getting access to the bureau datasets (well EQ / TU anyway) on a regular basis but some of their interpretations of the report simply aren't based in reality. I use their service, just I do my own analysis of my report rather than relying on them for it haha.

Ultimately the relevant stats are:

1) Score

2) Number of tradelines

3) Time since lates

My file is worse, my scores are lower, and at various points my lates were more recent than that and I've had no problems getting approvals in batches of 3-4. Apply with confidence from a credit perspective at any rate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Getting baddies off problems + MyFico analysis

I see. Well, we want a CLI on her cashback BOA card, and BOA travel card in same HP. Then Chase freedom unlimited and sapphire,.. and lastly, capital venture.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Getting baddies off problems + MyFico analysis

@Anonymous wrote:I see. Well, we want a CLI on her cashback BOA card, and BOA travel card in same HP. Then Chase freedom unlimited and sapphire,.. and lastly, capital venture.

Other than the CLI which is anyone's guess (why get a CLI on the BOFA cash rewards card when it's rewards capped anyway?) and good luck getting that in the same HP which is kinda irrelevant anyway TBH. Personally I'd rather open new than get a CLI unless it's a default spender or a primary travel card if I have to travel a bunch.

As for the rest of your targets you can certainly get them on the credit side, hell I have all 3 (well CSP not CSR) as case in point on that one and my old tax lien and at that point collection makes my file unilaterally worse than your wife's.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Getting baddies off problems + MyFico analysis

Well, we want bigger limits for her so the utilization isn't such a hassle. The BOA card is only at $500. She is also authorized for my CC at BOA, 6500 limit and currently 0 balance. Also on best buy citi, 4K limit, zero balance.. so some higher limits show on her report, even if AU.