- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Having Consumer Loan on Credit Report is BAD?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Having Consumer Loan on Credit Report is BAD?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Having Consumer Loan on Credit Report is BAD?

I have 2.... 1 from lending club and 1 from prosper....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Having Consumer Loan on Credit Report is BAD?

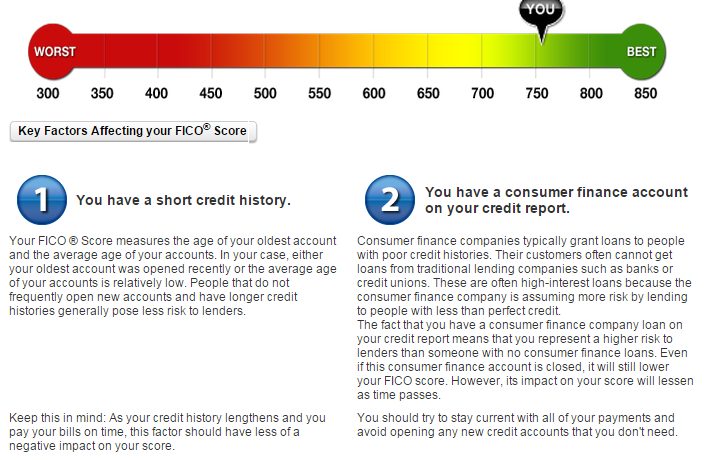

Yes, as it says, having a loan from a finance company is a negative in FICO scoring models.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Having Consumer Loan on Credit Report is BAD?

I just took a loan out from prosper. I was told this reports as installment.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Having Consumer Loan on Credit Report is BAD?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Having Consumer Loan on Credit Report is BAD?

--------$32,000-------------$30,000-----------$30,000-----------$30,000-----$13,000---------$18,200----------$15,000---------$6,500----

FICO - TU: 780 EX: 784 EQ: 781

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Having Consumer Loan on Credit Report is BAD?

@waiter wrote:I have 2.... 1 from lending club and 1 from prosper....

How much are your loans for and what is your intrest? I was just reading they report differently for different loans. Do you remember the grade you got when you wre approved? My loan from prosper hasn't reported yet. I really hope my sc ores don't take a hit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Having Consumer Loan on Credit Report is BAD?

That's a shame.

While I don't wanna put a new couch (could be as much as $2,000), on one of our CC's and deepen our UTL%, I may go with this option vs opening a store card or using one of the available financing plans.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Having Consumer Loan on Credit Report is BAD?

@Anonymous wrote:I just took a loan out from prosper. I was told this reports as installment.

Right. It is both a positive (active tradeline, installment loan for a better 'mix' of credit types, etc) and a negative (New credit, a Finance company account, etc)

If it was an installment loan from a Bank or Credit Union, that would have been better. How much better... is open for debate. FICO just uses Finance companies as an example of a lender that is also considered a negative factor.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Having Consumer Loan on Credit Report is BAD?

@Themanwhocan wrote:

@Anonymous wrote:I just took a loan out from prosper. I was told this reports as installment.

Right. It is both a positive (active tradeline, installment loan for a better 'mix' of credit types, etc) and a negative (New credit, a Finance company account, etc)

If it was an installment loan from a Bank or Credit Union, that would have been better. How much better... is open for debate. FICO just uses Finance companies as an example of a lender that is also considered a negative factor.

Ok so as I make my payments and once it's no longer a new line my scores will be positively affected? Just not as much as if it was from a different lender? I don't see where the difference is. From what I read from OP it seems they are saying you would be better off without it on your reports

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Having Consumer Loan on Credit Report is BAD?

@Anonymous wrote:

@Themanwhocan wrote:

@Anonymous wrote:I just took a loan out from prosper. I was told this reports as installment.

Right. It is both a positive (active tradeline, installment loan for a better 'mix' of credit types, etc) and a negative (New credit, a Finance company account, etc)

If it was an installment loan from a Bank or Credit Union, that would have been better. How much better... is open for debate. FICO just uses Finance companies as an example of a lender that is also considered a negative factor.

Ok so as I make my payments and once it's no longer a new line my scores will be positively affected? Just not as much as if it was from a different lender? I don't see where the difference is. From what I read from OP it seems they are saying you would be better off without it on your reports

Having a Finance company show up on your credit reports is always going to be a negative. Having only credit cards, with no Installment or morgage or etc, is always a negative. I suspect the installment loans affect the Bankcard adjusted fico scores less than, say, a car loan or maybe an insurance score. But we have no way of knowing. Between different types of targeted fico scores, different buckets, different mix of credit, etc, etc, trying to say exactly how negative a particular negative is, just isn't possible.

Sometimes, removing a negative item from your reports actually causes your scores to drop (you were top dog in a bad bucket, now you are low dog in a bucket full of people with no negatives on your report), etc. In other words, anyone who knows the fico answers for sure, is sadly mistaken.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800