- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- How's your credit journey coming along?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How's your credit journey coming along?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How's your credit journey coming along?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How's your credit journey coming along?

Good work!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How's your credit journey coming along?

Great work - that's awesome for 6 months! We have a lot of similar goals and card profiles. I'm gardening this whole year unless something super exciting comes along, but I don't see what it would be. I have dining, gas, groceries, drugstores, department stores, and general spend covered so there's really nothing else to get.

I went through a bit of a spree in October that was ill advised and ended up with cards I did not want long term - three of them! Chase Freedom, Citi TYP, and Double Cash. I realized a Freedom was completely silly to have with my Discover IT, and I don't get any special use out of UR points, so I closed it in Dec. and moved the limit to my Amazon Visa. The Citi TYP is a joke of a card IMO, yes you get "2x points" on dining/entertainment but the points aren't even close to a penny for most redemptions so you may as well call it a 1% back card. It will seem absurd that I got rid of Double Cash, but the limit and APR were not good and I prefer Quicksilver's reward structure as it's much less of a hassle. And as I always mention, Citi loves nerfing things, so I'm not too confident it will be around forever.

It temporarily dinged my score to have a few accounts come and go, but I opened my final cards in December, the Amazon Visa (good no AF dining card for me), and Sallie Mae. I typically don't exceed the Sallie cap on gas, but I occasionally do w groceries, so I'm keeping my BCE (plus the department store 2% on BCE). Sallie Mae is nicer in that the rewards post much more quickly vs. a one month delay for Amex. The only thing I don't like about Sallie is the lack of variety in redemption options, but honestly it's meant to be a student targeted card not really for a non student like me. Oh well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How's your credit journey coming along?

Execellent work. keep it up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How's your credit journey coming along?

kdm31091 I completely understand the Freedom + Discover issue. Didn't make sense for me to keep both either and I definitey prefer Discover. Also realized I didnt need Citi DC since most of what I want covered works with the cards I already have. Except the utilities and shipping supplies....which I hope Ink Cash covers under *office supplies* but I probably should research that a little further to be sure. You're doing great! Small mishaps here and there are not an issue. Its all a learning experience. As long as I'm not repeating the same mistakes I feel like everythings ok ![]() Dont regret closing any cards, I regret opening certain cards in the first place

Dont regret closing any cards, I regret opening certain cards in the first place

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How's your credit journey coming along?

Yeah, I definitely regret ever opening certain things like the Citi TYP. Should have done my homework and realized the points/"2x categories" are basically useless.

But I'm glad I found these forums, I've learned a lot and wouldn't make a mistake like that again!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How's your credit journey coming along?

Great work, keep it up! Gives me the incentive to keep working on impro

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How's your credit journey coming along?

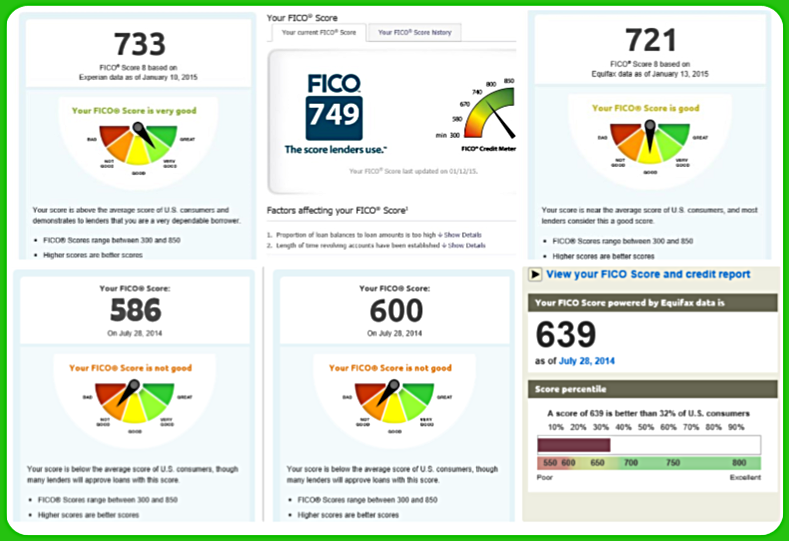

Here's how I'd summarize mine.

Before September 2013 - Had been trying to find myself and trying all sorts of things to get my credit off the ground. First major experience I had applying for any kind of credit was trying to get a student loan from Discover and Citizen's Bank without really understanding how credit worked yet or why they kept denying me and why none of my teachers, as nice as they were, wanted to sign any of my private or public student loan applications. In hindsight, I can see exactly why now and just how valuable credit can be to the point where people for good reasons want to be cautious and careful with theirs. I had been taking a year long gap year from college and had been writing for a blog and getting paid every week for it through Paypal in the meantime. Had made attempts at applying for other colleges in state rather than the one I was going to attend out of state and I got accepted to all of them but it wasn't financially feasible at the time for me to attend those and my parents didn't want me to go to a trade school either or join the Air Force. Long story short right there.

September 2013 - I had a Citi checking account for quite a while and this was also when I really returned to college. I applied for a Citi Forward card and after some verification of my student status, they gave me a $1k credit line that I maintain to this day and that has been increased to 2.3k.

March 2014 - Acquired a Capital One Journey card that I was able to upgrade to a Quicksilver and I think my FICO scores generated. I was in the late 650s at the time and also when I really started reading this forum.

April 2014 - Approved for the Discover It for students. Made the mistake of applying for junk like the Target RED card and Fingerhut (though that was the very first thing that gave me a CLI). Made it more a pain to get in with Chase and Barclays later on.

June 2014 - Instantly approved for my very first Amex card. CLIs on my Walmart, Amazon, and Paypal Smart Connect cards.

August 2014 - Was able to get in with Chase finally and get my first Visa Signature card and $5k card. Got another Amex card and a 2x counteroffer on my Delta. Closed crappy cards like the RED Card too this month.

September 2014 - Got in with Barclays and I think at this time I was able to get the EO to lower my APR on my Citi Forward card

October 2014 - Got in with BoA and got my second Chase card. CLI on my Forward card either this month or the month before.

November 2014 - Approved for the BCE and my second $5k limit card (Ebates)

December 2014 - Finally got in with US Bank, HP $500 CLI on my Discover It card which had been upgraded to a regular version automatically

Now - all my scores are presently in the 700s even though I've been in that club several other times before. Got several cards over the $5k limit mark. Was able to get my first double digit limit card. I'm very hopeful for what the future will bring.

Current FICOS: Mid 640s-50s on all reports, Ch 7 BK D/C Aug 2019

Starting scores: EX - 534, EQ - 574, TU - 516 | Total TLs: $91k approx | Total Utilization: 17%, getting this back down

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How's your credit journey coming along?

My score increase seems to be mainly from the switch to FICO 08 (the magnitude and direction of the change depends on your profile), so not a lot of good lessons to be learned from that! My FICO 04s were around 780, and now look a lot better.

Most inqs dropped away, but I was "forced" to apply for some more cards when Amex closed my $50K card. The two news inqs on EX is probably what that score is lower. NASA SP meant no inq for that, but I got one from Golden One in my unsuccessful bid to get their card. That is on EQ, but doesn't appear to deduct anything.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How's your credit journey coming along?

I'll try to keep this succinct.

Started credit repair: Nov 2012

FICO: 629 (EQ04)

Derogatory Accounts: 2 defaulted student loans totaling approximately $19,000 (OC, Collections). 1 collection account.

Revolving Credit: 2 accounts. 75-90% util. Total CL $600.

Installment Credit: Auto loan

During credit repair: Dec 2013

FICO: 669 (EQ04), 671(EX08)

Derogatory Accounts: 2 defaulted student loans. (OC, Collections)

Revolving Credit: 5 accounts. 20% util. Total CL $2,900

Installment: Auto loan.

Repair (complete): May 2014

FICO: 751 (EQ04), 767 (TU08), 757 (EX08)

Derogatory Accounts: 0

Revolving Credit: 10 accounts, 1% util, Total CL $34,400

Installment: Auto Loan, Two Student Loan

Today: January 2015

FICO: 789 (EQ08), 801 (TU08), 779(EX08)

Derogatory Accounts: 0

Revolving Credit: 20 accounts, 3% util, Total CL $189,900

Installment: Auto Loan, Two Student