- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- My journey to zero balances

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

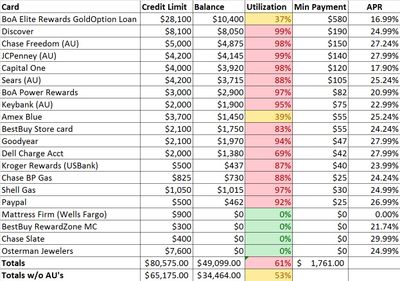

My journey to zero balances

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My journey to zero balances

WOW, it hurts my heart to see those balances. Congratulations on your journey to zero balances. Although, I would not close any of those cards after you pay them off, once they are all paid off I would sit down and re-evaluate the purpose of each card and begin closing at that point.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My journey to zero balances

@Pway wrote:WOW, it hurts my heart to see those balances. Congratulations on your journey to zero balances. Although, I would not close any of those cards after you pay them off, once they are all paid off I would sit down and re-evaluate the purpose of each card and begin closing at that point.

There's another column on the spreadsheet now that wasn't there when I posted this. It indicates which cards will be kept and which cards will be closed. Once utilization drops below 50%, I intend to start closing the micro-limit cards one every month or two months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My journey to zero balances

@Anonymous wrote:

@Pway wrote:WOW, it hurts my heart to see those balances. Congratulations on your journey to zero balances. Although, I would not close any of those cards after you pay them off, once they are all paid off I would sit down and re-evaluate the purpose of each card and begin closing at that point.

There's another column on the spreadsheet now that wasn't there when I posted this. It indicates which cards will be kept and which cards will be closed. Once utilization drops below 50%, I intend to start closing the micro-limit cards one every month or two months.

First off, I wish you the best of luck! I've been there and done that and really, when you get to paying that last card off you will experience such a feeling of accomplishment! (And relief!)

These are my suggestions:

1. I wouldn't close any of the cards. I would suggest cutting them up and let a lender close them for lack of use if they want to. There really isn't any benefit to closing them but the longer you keep them open the better your AAoA will be in the long run. I mean if you really want to you can get rid of some of the BS store cards but I would keep the closing of cards to a minimum. Your AAoA will become indestructible.

2. I would suggest snowballing the cards from lowest balance to highest balance. I mean there is only 3% difference in most of your APRs and that really isn't much of a difference. The faster you get any of the cards to report $0 the better. For each card more than one that reports a balance you lose 3 to 5 points. Well, most people lose 3 to 5 points and I'm sure that you have met the upper limit in that point loss category with your 22 cards.

If you are successful in getting these cards paid off I envision you having scores of 780 to 800 as long as your AAoA is over 3 years.

At that point you can use some of the saved credit card money to get the house refinanced at a lower rate!

Thanks for sharing your journey!

Starting Score: EQ 653 6/21/12

Current Score: EQ 817 3/10/20 - EX 820 3/13/20 - TU 825 3/03/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My journey to zero balances

@jamie123 wrote:

@Anonymous wrote:

@Pway wrote:WOW, it hurts my heart to see those balances. Congratulations on your journey to zero balances. Although, I would not close any of those cards after you pay them off, once they are all paid off I would sit down and re-evaluate the purpose of each card and begin closing at that point.

There's another column on the spreadsheet now that wasn't there when I posted this. It indicates which cards will be kept and which cards will be closed. Once utilization drops below 50%, I intend to start closing the micro-limit cards one every month or two months.

First off, I wish you the best of luck! I've been there and done that and really, when you get to paying that last card off you will experience such a feeling of accomplishment! (And relief!)

These are my suggestions:

1. I wouldn't close any of the cards. I would suggest cutting them up and let a lender close them for lack of use if they want to. There really isn't any benefit to closing them but the longer you keep them open the better your AAoA will be in the long run. I mean if you really want to you can get rid of some of the BS store cards but I would keep the closing of cards to a minimum. Your AAoA will become indestructible.

2. I would suggest snowballing the cards from lowest balance to highest balance. I mean there is only 3% difference in most of your APRs and that really isn't much of a difference. The faster you get any of the cards to report $0 the better. For each card more than one that reports a balance you lose 3 to 5 points. Well, most people lose 3 to 5 points and I'm sure that you have met the upper limit in that point loss category with your 22 cards.

If you are successful in getting these cards paid off I envision you having scores of 780 to 800 as long as your AAoA is over 3 years.

At that point you can use some of the saved credit card money to get the house refinanced at a lower rate!

Thanks for sharing your journey!

My AAoA is 9 years and my total history is over 18 years. My spreadsheet has updated significantly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My journey to zero balances

Wow, I didn't realize so many of your cards are so close to their CLs. I might suggest paying all the really high UTI cards to less than 90% of their CL before attempting to pay off cards.

Your lenders are probably freaking out and soft pulling you daily to keep an eye on you. When your UTI starts getting close to your CL it sends up red flags to the lenders.

Your scores really aren't that bad with so much UTI. I bet you get into the 800s once you get these balances paid down.

Starting Score: EQ 653 6/21/12

Current Score: EQ 817 3/10/20 - EX 820 3/13/20 - TU 825 3/03/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My journey to zero balances

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My journey to zero balances

@Anonymous wrote:

Believe it or not I've only had two AA's taken on me in all the years I've been carrying balances. Chase CLD then close on one card and Amex closed another. Other than that I've had no problems. Even gotten a few auto CLI's along the way. I'll look into paying some of those down below 90 though. Interesting idea and hadn't thought of it.

What reasons did Chase give you for the CLD then close, and AMEX?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My journey to zero balances

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My journey to zero balances

I'm approved for a loan from Lending Club that I'm going to use to pay down a large chunk of this debt. Does anyone have opinions on how I should pay these off? Should I go for the lowest possible monthly payment or pay off the accounts with the highest interest rates? The loan covers all but 14-15k of the 49k outstanding balance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My journey to zero balances

Good luck on your journey! ![]()

Starting Score: EQ 615 (MyFICO) TU 588 (Walmart) EX 576 (EX Website) Started this journey 06/26/2014

Current Score: EQ 710 (MyFICO) TU 673 (Walmart) TU 726 (MyFICO) EX 706 (MyFICO) As of Sep 2015

Goal Score: 750 or higher across the board

Take the myFICO Fitness Challenge