- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Need help with a plan to pay down high utiliza...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Need help with a plan to pay down high utilization

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with a plan to pay down high utilization

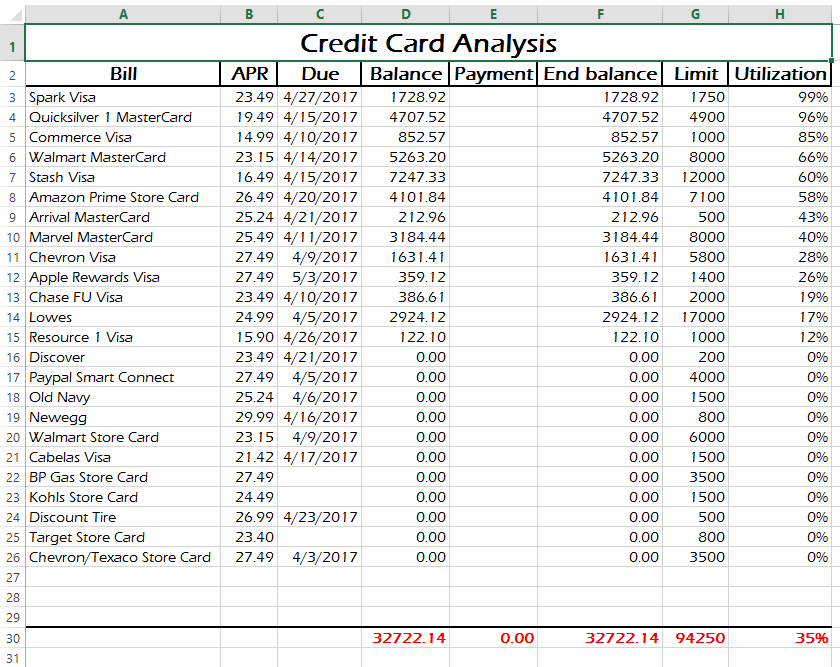

I spent too much across several cards and find myself in a bind that could very well lead me to bankruptcy. I have been trying to figure this out myself but I think I need help. Below are my cards, balances, limits, UTIL, and APR in an Excel spreadsheet I made that calculates various totals using formulas. I only had about an hour to make this so its still very basic. I am working on adding pay down amounts over time too but for now, this serves my purpose.

I need a plan of attack. Lowes is at 0% until 7-2018. Amazon has several 0% periods going on but they won't last another couple of months. I don't have enough money to pay them down to a manageable amount that I can afford each month without going under so my plan is to pay them down enough to make my scores go up by reducing my UTIL on each card (My overall will drop with the payments so I am not too worried about it since its not far from under 30) in hopes I will be able to get a balance transfer card to consolidate at least some of the higher interest ones.

I am open to other suggestions as well. My plan is to pay down the high UTIL cards to under %50 and then with the money I have left pay off the lower balances. I have about $10k I can put towards these right now but after that it will be slim pickings until the years end unless my side business picks up which is not likely since it relies heavily on the political landscape. So I need to make a big impact now so my future payments make a bigger impact than just paying interest. I no longer use theses cards except to pay my monthly bills for the cash back. They go on Chase and I pay it off. I don't eat out or party or anything else anymore. I work all the overtime I can and I already have a business that I am trying to increase my profits while moving more products.

Please help. I am not proud and I am not beyond admitting when I am wrong. I know it is bad and I know I might get some tough reposnes, I am ok with that. I want to own this and get it taken care of. I have filed Ch7 before and I do not want to go through that again.

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with a plan to pay down high utilization

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with a plan to pay down high utilization

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with a plan to pay down high utilization

Chase Slate

Citi Diamond Preferred

BOA BankAmericard

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with a plan to pay down high utilization

From there, I would then throw as much as I can at Amazon so you can avoid back interest if those promo periods expire.

After that, I would concentrate on paying off the next lowest balance card, and then the next, etc. The idea being that as you eliminate more minimum payments, you're able to pay off the next card quicker.

If you're able to work out a plan, that's preferable to BK.

NFCU MR: $25K | Venture: $21K | Amex ED: $18K | NFCU CR: $18K | Amex BCE: $15K | IT #1: $17.5K | PNC Core: $15K | PPMC: $12K | Wells Fargo: $11K | Savor: 12K | Cap1 QS: $8.5K | Barclays Rewards: $7.75K | IT #2: $7.3K | MLife: $9.5K | Sportsman's Guide: $8.7K | PenFed PR: $5.5K | Elan Plat: $2.3K | TRV: $3.6K | BotW: $3K

Current FICO 8 Scores: EQ: 828| TU: 805 | EX: 814

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with a plan to pay down high utilization

of all the cards, the one with the highest need to pay down is Amazon the promotions are cool, and can save money but you get in trouble fast because if you miss the zero percent interest window they hit you with all accrued interest you would of paid, so missing by $10 can cost you 100's... I read the stories, I often use them, love amazon but always move heaven and earth to get it paid off on time.

step 1 check all your existing VISA/MC/AMEX/DISC for balance transfer deals, most of them do them even if your not new. If none you can apply for a new card with a 0% offer, but if not may need to bite bullet and transfer to another high interest card just to remove the interest bomb AMAZON will deliver, check your promotional offers statement under activities, "Interest Deferred, But not Charged" is the amount to be charged if not PIF in time.

after that is defused you can take a look at many of the pay off methods to pay down your cards, you aren't the first to need to pay off massive amounts of credit debts lots of posts here.

Landmarkcu Personal Loan 10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with a plan to pay down high utilization

No judgement, we have all been through tough times. ![]()

Now ,y advice... google dave ramsey debt snowball plan. It is just what you need.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with a plan to pay down high utilization

A chapter 7 might be in most ends best option, depends on your income and so on, no credit or debt is worth loosing health over it.try what ever u can but it might get there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with a plan to pay down high utilization

Sorry to see you are in a bind.

You do not need new cards. or start the money shuffle games.

First -- STOP spending on the credit cards.

Pay all your bills, food, etc with debit, cash, checks.

Cut back you spending, you are spending more than you should if you cc's are going up.

Pay a little more than the minimum due this month, and do not

lower it next month.(Continue paying this months minimum or more).

You have approx $34,000 at an average of 16%-int, depending on cc's about 700-800 total min payments.

If you pay 800 each month you will be clear in about 5-6 years. If you lower each payment

to the new minimum payment the loan will not be paid for 25-years. Spend less, pay more and you

could see daylight in about 4-years. ($1000/mo)

Good Luck - It will be hard - no movies, and beans.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with a plan to pay down high utilization

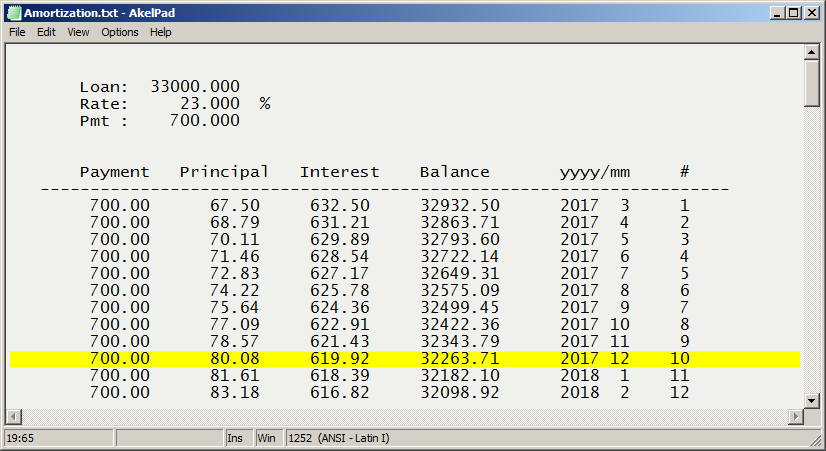

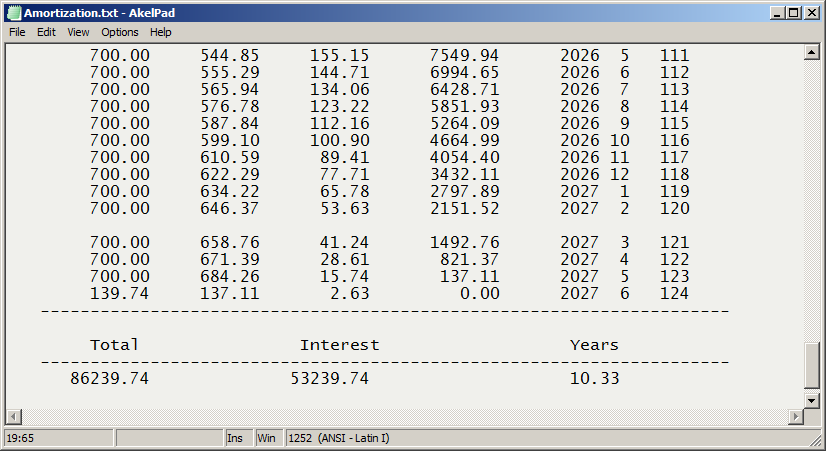

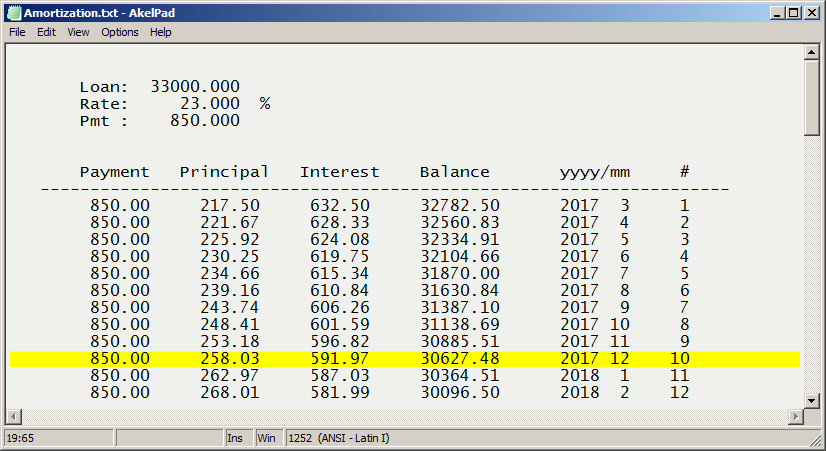

In my above response, I was using average CC-APR, your APR is about 23%, and if you did not add more debt about $33,000

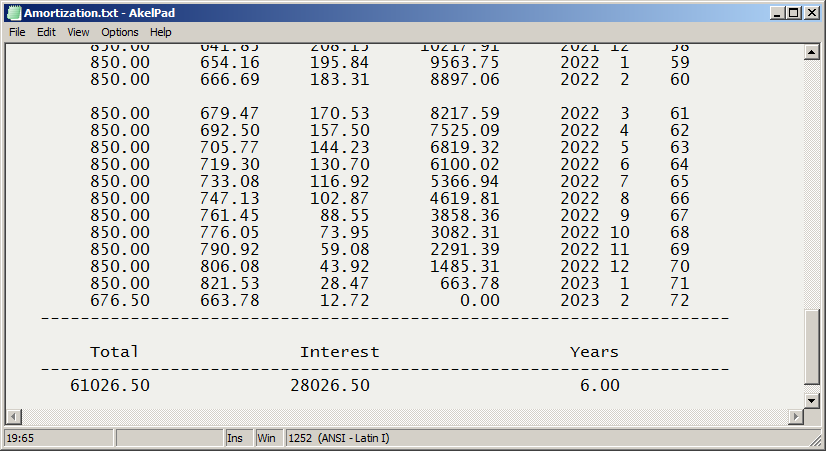

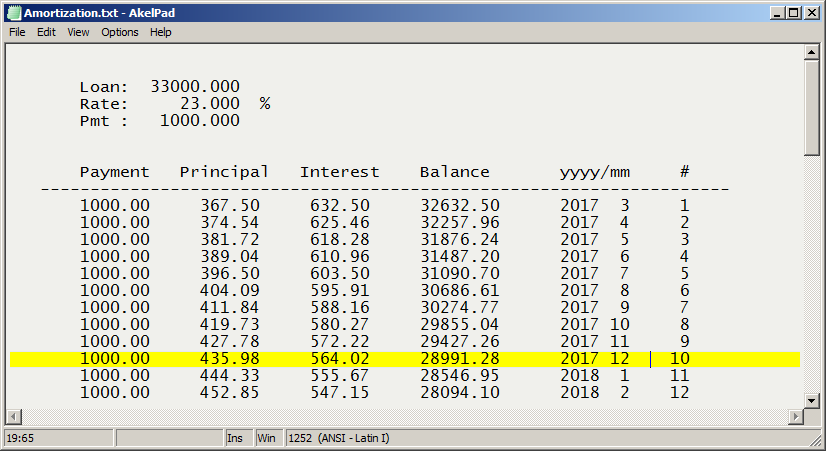

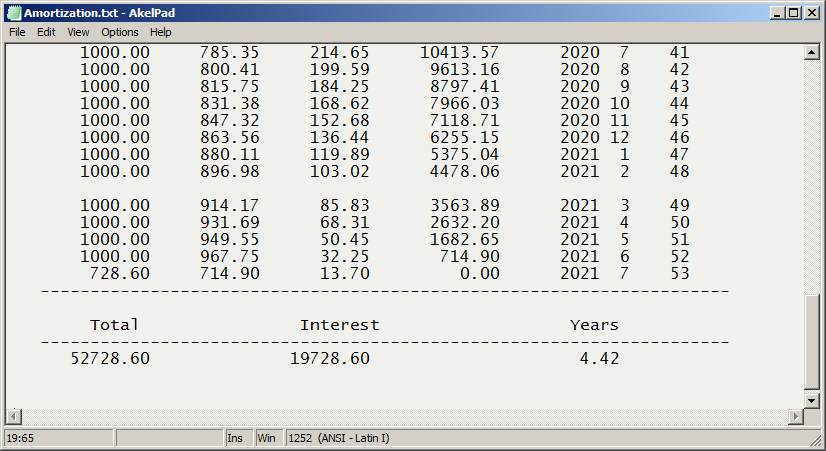

Here are amortization chart top-bottoms for 700, 850, and 1000 dollars a month