- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Problem with CCT data

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Problem with CCT data

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem with CCT data

I think I have figured this issue out.

Amazon: 800; Kohls: $1,500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Problem with CCT data

@MrsCHX wrote:I have a question and wondering if I'm just out of luck here.

Was eligible for a new CCT trial and have been waiting for an erroneous late to be corrected.

I know I wasn't late on anything recently and still combed through my accounts one by one. There is no late payment.

Seems like it's just some data caching. Give it a few days to correct.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Problem with CCT data

Ah. That makes sense. I knew I shouldn't have pulled the trigger yet on a new CCT report. It just ended up stressing me out!

Amazon: 800; Kohls: $1,500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Problem with CCT data

So I've updated CCT and pulled another FICO 08 from another site and it still shows incorectly.

And my Barclay's card just updated my score to the same 630 I'm seeing across the other two sources. And has "recent late payment".

I'm freaking out.

Amazon: 800; Kohls: $1,500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Problem with CCT data

My CCT shows 8 late account but I can only find 4. Not sure what is up with them.

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Problem with CCT data

Are you sure you don't have high utility or collection accounts, too? Something definitely seems off. My lates are more recent than yours and my score is significantly higher.

I think the "recent late" thing is there no matter what. Mine is near 2 years and it also says it was recent. I think recent must mean the last several years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Problem with CCT data

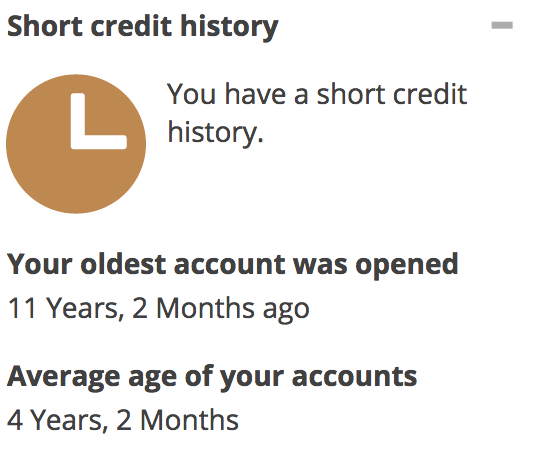

Mine also has this:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Problem with CCT data

Forgive my frustration. I am watching my reports like a hawk.

That indicator was NOT there on 2/15 when my TU was 697. Now it's 630.

I have 4% utilization. I have $50,000+ plus in credit. It doesn't say a general negative, it specifically says "missed payment'. I have not had any collections on TU for over a year.

It is not that it says "recent" it is that it says time since late 0 months when time since late is actually 2 years and 8 months.

Amazon: 800; Kohls: $1,500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Problem with CCT data

well, 4 years is a short credit history. It looks at the average age of accounts.

I don't have 'short history' as a factor. My oldest account is 19 years old and AAoA is almost 7 years.

Amazon: 800; Kohls: $1,500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Problem with CCT data

@Anonymous wrote:My lates are more recent than yours and my score is significantly higher.

I think the "recent late" thing is there no matter what. Mine is near 2 years and it also says it was recent. I think recent must mean the last several years.

I'm not sure what this first sentence means?? Your TU shows as 674. Mine was 697 before someone did something funky and now it has dropped to 630. Without this mysterious late payment, my TU is 3 points from 700. What do you mean significantly higher?

Amazon: 800; Kohls: $1,500