- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Thoughts of what to do with this loan?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Thoughts of what to do with this loan?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thoughts of what to do with this loan?

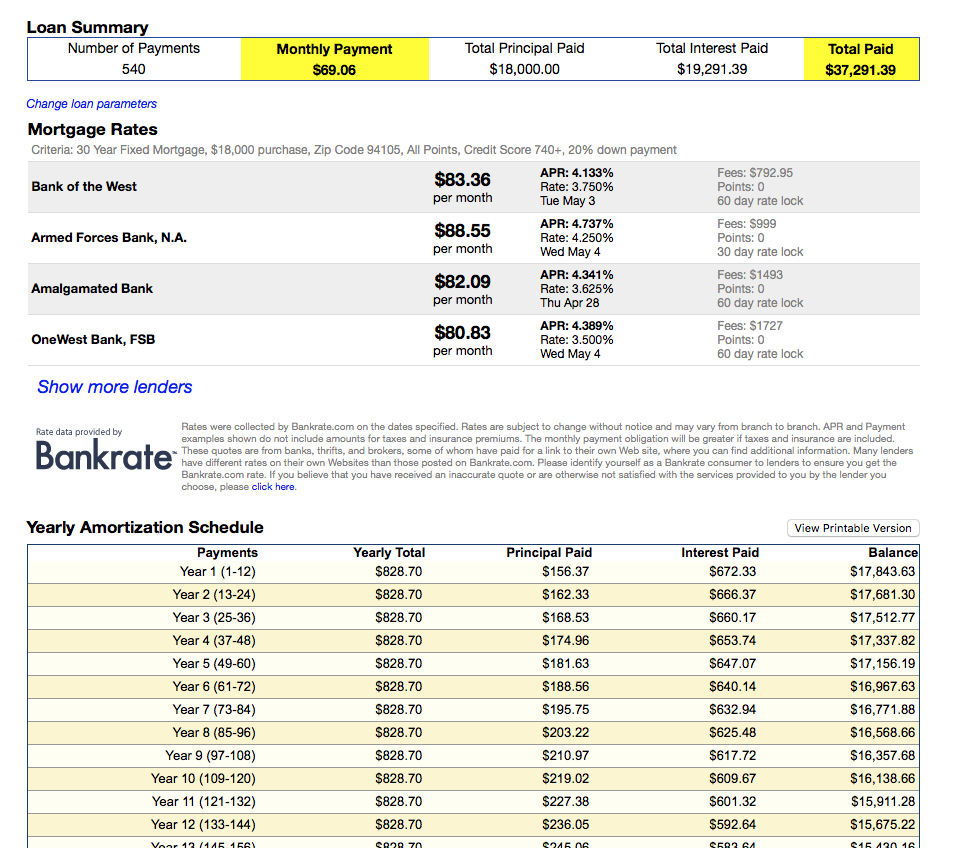

I'm facing a dilemma that I'm sure has been faced a million times before. I have a student loan (I put this question here because the SL sub-forum isn't as high traffic as here) that has just over an $18K balance left on it. I have saved enough money to pay it off completely but I'm a little hesitatant. It's a lot of money to pay to get rid of a $69 monthly payment. The payment isn't inhibiting my financial existence. In fact that is the only payment I have. It would be really nice to say I'm debt free, but I feel like I'd be starting over. I put the numbers into an amortization table and based on my monthly payment I will be paying for 45 years and the interest is literally more than the principal. I'll post a chart I created showing this.

My dilemma is I feel like I could make cash off of my cash (more than the interest rate of the loan) and keep on building the savings. If I pay off the loan then I wouldn't have a ton of working capital and more importantly I feel like I'll be starting over. On the flipside I'm giving A LOT of my money to Navient.

Another idea I thought was to pay it down to $1K-$2K so I can keep my installment loan going and not have to search for some type of a credit builder loan.

Thoughts?

Personal:

Personal:

Business:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thoughts of what to do with this loan?

If my calculations are correct your interest rate is 3.75%. Of course you'll end up paying alot of interest but we're talking 45 years.

If I had 18k saved to payoff the student loan I definitely wouldn't.

I would invest it in high quality, dividend paying, blue chip stocks.

The historical compounded average rate of return of the S&P 500 is 9.8%. Nothing is guaranteed in the stock market but that's the historical average.

$18,000 invested today for 45 years with just a 4% rate of return would yield you $105,141.16.

myFico Score Equifax: Start (4/30/14) 694 Current (5/6/16) 838

myFico Score Transunion Start (5/01/2014) 727 Current (5/7/16) 842

Discover (4/24/14) 659 (5/5/16) 842

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thoughts of what to do with this loan?

@dman23 wrote:If my calculations are correct your interest rate is 3.75%. Of course you'll end up paying alot of interest but we're talking 45 years.

If I had 18k saved to payoff the student loan I definitely wouldn't.

I would invest it in high quality, dividend paying, blue chip stocks.

The historical compounded average rate of return of the S&P 500 is 9.8%. Nothing is guaranteed in the stock market but that's the historical average.

$18,000 invested today for 45 years with just a 4% rate of return would yield you $105,141.16.

Interesting thought

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thoughts of what to do with this loan?

Definitely an interesting thought! I was worried when the stock market starting hitting my Roth pretty hard. That's sorta what I'm thinking.

Personal:

Personal:

Business:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thoughts of what to do with this loan?

I have an investment for you that will GUARANTEE you a return. Pay off your debt. The guarantee return is the interest rate your debt is at, you will no longer pay it. If you have the cash, pay it all off. What'ss happen if you don't is something in life will come up where you won't have the cash anymore and you will be in a worst off position. Pay off the debt, get a guarantee return by saving on the interest rate payments and then start over and save up boatloads of cash again. You can thank me later for this advice.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thoughts of what to do with this loan?

@RM21 wrote:

@dman23 wrote:If my calculations are correct your interest rate is 3.75%. Of course you'll end up paying alot of interest but we're talking 45 years.

If I had 18k saved to payoff the student loan I definitely wouldn't.

I would invest it in high quality, dividend paying, blue chip stocks.

The historical compounded average rate of return of the S&P 500 is 9.8%. Nothing is guaranteed in the stock market but that's the historical average.

$18,000 invested today for 45 years with just a 4% rate of return would yield you $105,141.16.

Interesting thought

Of course, who wants to have this debt on your list for 45 years. If you paid $150/month it'd be paid off in 12.5 years. Or each each make a $1000 payment towards principal.

myFico Score Equifax: Start (4/30/14) 694 Current (5/6/16) 838

myFico Score Transunion Start (5/01/2014) 727 Current (5/7/16) 842

Discover (4/24/14) 659 (5/5/16) 842

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thoughts of what to do with this loan?

@youdontkillmoney wrote:I have an investment for you that will GUARANTEE you a return. Pay off your debt. The guarantee return is the interest rate your debt is at, you will no longer pay it. If you have the cash, pay it all off. What'ss happen if you don't is something in life will come up where you won't have the cash anymore and you will be in a worst off position. Pay off the debt, get a guarantee return by saving on the interest rate payments and then start over and save up boatloads of cash again. You can thank me later for this advice.

So if he pays it off...$18,000. Now you're saying if he doesn't and something in life comes up where he won't have the cash anymore he'll be worse off. That doesn't make sense. If he pays it off and somethin in life comes up then he'll have no money.

If he doesn't pay it off and something in life comes up he'll have $18,000 to deal with that and have no problem making his tiny $69 payment.

myFico Score Equifax: Start (4/30/14) 694 Current (5/6/16) 838

myFico Score Transunion Start (5/01/2014) 727 Current (5/7/16) 842

Discover (4/24/14) 659 (5/5/16) 842

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thoughts of what to do with this loan?

@dman23 wrote:

@RM21 wrote:

@dman23 wrote:If my calculations are correct your interest rate is 3.75%. Of course you'll end up paying alot of interest but we're talking 45 years.

If I had 18k saved to payoff the student loan I definitely wouldn't.

I would invest it in high quality, dividend paying, blue chip stocks.

The historical compounded average rate of return of the S&P 500 is 9.8%. Nothing is guaranteed in the stock market but that's the historical average.

$18,000 invested today for 45 years with just a 4% rate of return would yield you $105,141.16.

Interesting thought

Of course, who wants to have this debt on your list for 45 years. If you paid $150/month it'd be paid off in 12.5 years. Or each each make a $1000 payment towards principal.

Or 10 years....$180.11/month. total interest paid $3,613.23. ($361 in interest each year...big deal)

Also, say you pay it off in ten years. That's a great tradeline to have on your report.

myFico Score Equifax: Start (4/30/14) 694 Current (5/6/16) 838

myFico Score Transunion Start (5/01/2014) 727 Current (5/7/16) 842

Discover (4/24/14) 659 (5/5/16) 842

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thoughts of what to do with this loan?

OP, your question has a lot to do with your tolerance for risk, your age and your goals.

I too am of the school of "debt-free" is better. However, don't wipe yourself out of savings either. As one of the others above pointed out you could acclerate your payments to substantially reduce your interest. Or you could make a lump sum and smaller payments thereafter.

There are many variables. The important part is what makes you feel more in control of your finances? Getting rid of the debt or reducing it to an amount that the interest won't eat you alive and investing the rest? Play around with that bankrate payment calculator and you can see the difference in the various approaches.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thoughts of what to do with this loan?

Thanks for the post guys. My initial thought is no way am I going to pay this for 25 years to hope that it'll be wiped away only to have something change and I am stuck with the very same balance 25 years later. Navient said that if I continue to make this payment for 25 years the debt will be forgiven, but not really. In 25 years I will have paid off the principal of $25K and their "interest" will be forgiven. Either way they get their money. However if I counted on that something could very well change and I'm still stuck with a similar balance way down the road.

I like the idea of accelerated payments. I am a big advocate of being debt free but also want to keep an e-fund while my savings is low paying this debt off.

Personal:

Personal:

Business: