- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- can getting insurance quotes hurt?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

can getting insurance quotes hurt?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: can getting insurance quotes hurt?

@RobertEG wrote:Unfortunately, most consumers dont realize that pulls of their credit report are not limited to only application for new or extended credit, and dont need separate and express written consent.

IF you intitiate a "business transaction," such as application for a rental car, an apartment lease, or a insurance, then the busines is entitled, without prior consumer express permission, to access to your full credit report., FCRA 604(a)(3)(F).

Most businesses will inform you, but they are not requried to.

oh, i totally understand what you are saying. but i don't consider getting an insurance quote on a car i haven't bought from a company i already have a long business relationship with "initiating a business transaction". i do realize they are not required to inform me, but i don't see why it would have killed them to do so. that's all i was saying.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: can getting insurance quotes hurt?

I've never had a hard pull for insurance inquiries - but I've been softed by State Farm (!) but that was about a year ago; Nationwide and Liberty.

Soft pulls do not impact your credit, btw.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: can getting insurance quotes hurt?

You might see the insurance inq on your reports, but you'll know if it somehow was coded as a hard inq if you suddenly have a flag for an inq, where you didn't have one before, or if it shows up as an inq affecting your score.

Insurance inqs are like employer inqs --they shouldn't affect your score, if they're coded correctly. I've had two insurance inqs and one employment inq, and none have counted against me.

Again, IF they're coded correctly.

FICO's: EQ 781 - TU 793 - EX 779 (from PSECU) - Done credit hunting; having fun with credit gardening. - EQ 590 on 5/14/2007

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: can getting insurance quotes hurt?

@haulingthescoreup wrote:You might see the insurance inq on your reports, but you'll know if it somehow was coded as a hard inq if you suddenly have a flag for an inq, where you didn't have one before, or if it shows up as an inq affecting your score.

yep, all of our monitoring alert things picked up on it right away, & it is on the FICO reports.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: can getting insurance quotes hurt?

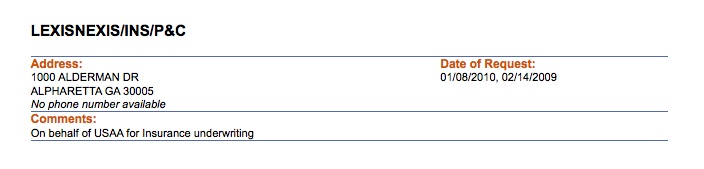

My insurance inqs are on Experian, and Experian doesn't provide the prefix codes that specify the justification for the pull. But they're definitely in the soft inq category, separate from my AmEx hard inq from 2/2009:

So it's pretty obvious that insurance companies can use soft inquiries instead of hard if they want to.

FICO's: EQ 781 - TU 793 - EX 779 (from PSECU) - Done credit hunting; having fun with credit gardening. - EQ 590 on 5/14/2007

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: can getting insurance quotes hurt?

Practically every insurance company uses your credit to determine your rates, and with the amount of shopping around for home and car insurance one does every renewal, if their credit enquiries were hard pulls, the credit record would probably be steeped in red!!