- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: credit statistics question?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

credit statistics question?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

credit statistics question?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: credit statistics question?

I just answered this in another thread. Posting the same question twice in not good MB etiquette ![]()

And I've found the trick is not to stop the sliding

But to find a graceful way of staying slid

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: credit statistics question?

700 is a good score. 678 is the ave score of all americans.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: credit statistics question?

Unfortunately, there's a lot of different numbers quoted out there as far as the average credit scores, and even the average FICO scores.

On my Scorewatch when my EQ FICO is 711, it says my score is greater than 46% of other folks. That means that 54% are doing better than me. Yep - I'm below average. ![]() But I'm getting there.....

But I'm getting there.....

That kind of ties in with the most commonly quoted FICO average which is about 723 or so.

You might like to see this stat, though:

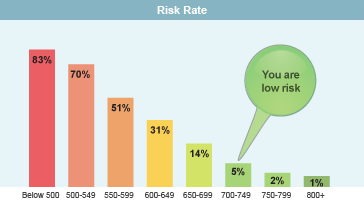

The risk rate help you know how lenders look at you and what risk rates are for various FICO scores.

Hope that helps a little.

ETA: Just noticed this original post is from 2007! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: credit statistics question?

A while back I posted the best available statistics on the distributions of FICO scores and of Vantage FAKO scores.

This posting also contains a link to an earlier posting that links to an interesting study conducted by the Federal Reserve on credit scores.

EX always was my highest when we could pull all three

Always remember: big print giveth, small print taketh away

If you dunno what tanstaafl means you must Google it

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: credit statistics question?

A few months ago there were a whole flurry of articles about 25% of Americans having a FICO score of less than 600 and as such would have difficulty getting approved for a mortgage loan. I would call that poor/bad credit. 700 is much better, as anyone who's been shopping for a loan would know.

Somewhere around 678 is the average score, but that tells you nothing about the distribution of scores. You may have heard the average American owes $8-10,000 in credit card debt. Actually most Americans have no credit card debt. Only about 1 in 20 households owes more than $8,000 or more (or a lot more!) on credit cards.

If an elephant and two mice walk across a bridge and one of the mice says, We sure weigh a lot, it's good joke, but that's all it is! The average of 1 2 9 is 4, but the median, the middle, is 2. Half of American credits are about or below 723, while the other half is above.

I have always found it to be interesting that 27% are in the 750 to 799 range, which makes for a rather slanted bell curve. I have located some data to be more specific than 50 point ranges, but need percentiles for the most upper range, which is my sole excuse for still working on my score. ![]()