- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Re: 7k Closing Cost

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

7k Closing Cost

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

7k Closing Cost

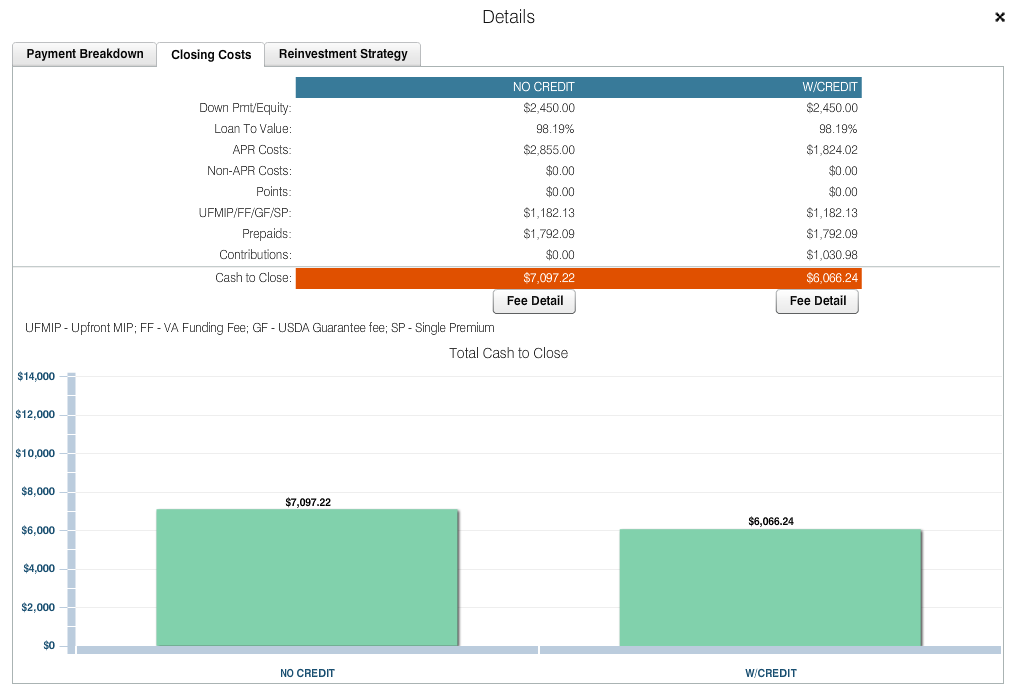

Morning everyone, I recently got approved for a $70,000 15year mortgage and plan on putting down 3.5% Does $7,000 in closing cost sounds reasonable?

Down Payment: $2500

APR Costs: $2855

UFMIP/GF/SP:$1183

Prepaids: $1793

This was the cost breakdown that i've received.

Im located in Houston, TX and the lender stated that my middle score was 631. Salary is $55,000 and been at this job for 2years and 6years in the industry

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 7k Closing Cost

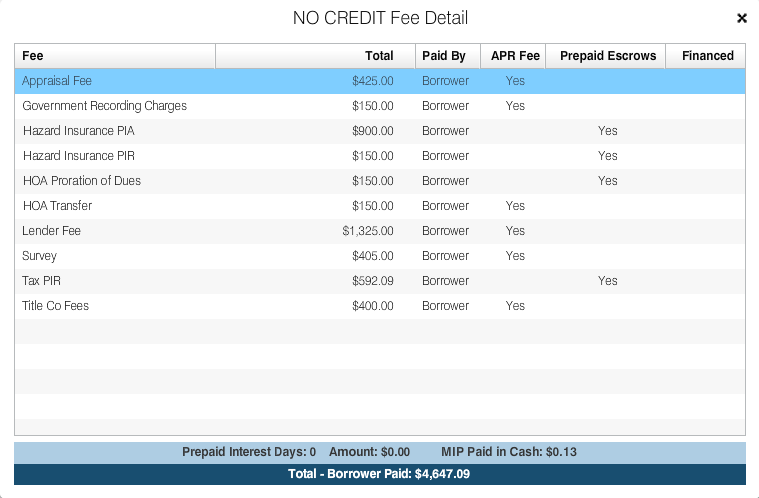

What is APR costs? Are these points charged by the lender? Or is it all the lender fees?

Where are the government fees and title fees associated with the purchase?

The UFMIP is typically added to your loan and not a cash amount brought to closing so that would remove $1183 from your cash needed to close.

Pre-paids are dependant on your interest rate (per diem interest from closing date through the end of the month of closing) and your insurance costs (usually 12 months up front and then another 2 months in your escrow account).

Is the insurance an estimate or an actual quote for the property by an insurance agent?

You need to ask the LO for a detailed, itemized list of closing costs and pre-paid expenses. This is provided with a GFE or when you are just looking a Cash to Close worksheet type page that is very detailed. The short response you received with 4 items for your cc is not normal IME.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 7k Closing Cost

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 7k Closing Cost

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 7k Closing Cost

@shyboy wrote:

That is the informatin I was looking for - you have to see the whole quote as well as the interest rate. The lender fee of $1325 is huge on a $70k loan if they aren't paying any of your costs and still charging you 3.5% interest rate. They may be charging you a higher rate and higher costs because of the low amount ($70k is low in the mortgage world).

Is this a broker or do they originate and fund their own loans?

Consider getting other quotes - try Chase or a small regional bank in your area. I bet their fees are lower and the rate is lower too. JMO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 7k Closing Cost

I believe they are a mortgage broker. Cornerstone Home Lending. The 3.5% is the amount that i'm putting down. The interest rate is 4.000%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 7k Closing Cost

lender fees of 1325 is pretty normal.

looks like everything else is adding up pretty quick

try a bank, not a wholesale lender. they seem to price these better

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 7k Closing Cost

@shyboy wrote:I believe they are a mortgage broker. Cornerstone Home Lending. The 3.5% is the amount that i'm putting down. The interest rate is 4.000%

Sorry, I scanned too quickly and misread the down payment/interest rate amount. 4% is high for a 15 year rate with the costs you are being charged.

Check with DallasLoanGuy here on this forum - pm him and he can give you a quote too. Also check with your local community banks - they do small loans (hence, 'community bank') It makes a difference. I don't know if there is something on your file that keeps you from getting market rate on the 15 year. Ask your LO that question.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 7k Closing Cost

Also the smaller the loan amount, the worse the rate is. Though I would agree 4.00% seems high on a 15 year FHA.