- myFICO® Forums

- Types of Credit

- Mortgage Loans

- AUGH - Anyone with Freddie experience? 203k (ful...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

AUGH - Anyone with Freddie experience? 203k (full) question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AUGH - Anyone with Freddie experience? 203k (full) question

My appraisal came in. I'm going to have to renegotiate my purchase price with Freddie Mac.

Previous owner ripped out the kitchen and bath fixtures. My HUD consultant / contractor bid for necessary items is at 28,765 plus 10% contingency. Freddie's list price was $129,900 and my offer (there were others) was 135,000, and I didn't ask for any concessions. Appraisal after (non-improvements): 140k.

Loan is FHA 203k, seeing as there's no kitchen, nor a fully functional bathroom. Lender thinks we're going to have to renegotiate price to 120k because the loan can't be for more than 110% of after-improvement value.

Freddie Mac already rejected a closing date extension that my lender requested - UW wanted 60 days (normal) but the problem is that this is my third lender because of a variety of reasons, not the least of which is that the inspection came back with minor structural issues that would require a full 203k instead of a streamline 203k and I had to change lenders (and forfeit county assistance). Freddie came back and said "no, no extension at this time, we'll see where we are on the original closing date", which is less than ideal, but it's better than "no, we'll take a different offer."

If I have to find another house, I'm going to be annoyed.

Anyone have experience with Freddie Mac in this situation?

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010Previous High Score: EQ 700 TU04 712 EX 726

Current Score: EQ 740 TU(Discover) 750 EX(AMEX) 747

Goal Score: 740+ all around

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AUGH - Anyone with Freddie experience?

it depends on alot of things. say they had a cash offer at 110K if you tell them you have to redo the deal at 120K they will likely say no and go back to the cash offer, especially with all the lender issues, etc. IF they have had zero offers on the place outside of yours then you may have a chance. Typically a smaller piece of pie in hand wins over a possible larger piece of pie but not if they have someone as a backup offer.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AUGH - Anyone with Freddie experience?

Thanks. There were at least 2 other offers. Guess it's yet another wait-and-see try-not-to-languish.

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010Previous High Score: EQ 700 TU04 712 EX 726

Current Score: EQ 740 TU(Discover) 750 EX(AMEX) 747

Goal Score: 740+ all around

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AUGH - Anyone with Freddie experience?

Update:

My realtor talked to the appraiser about the comps he used. The appraiser substituted an older comp that's in another city with a newer one that's a block away (HELLO, why did he not do that to begin with?). He left the other 3 the same.

I'm now at 148k as-improved value for a FHA 203k. He left the as-is evaluation at 119k. Sales contract is for 135k, Freddie listed the house for 129,900.

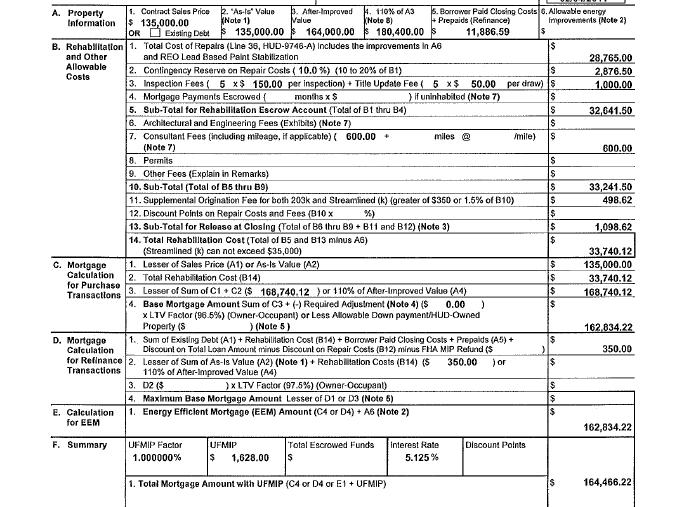

This is the worksheet from my lender from before the appraisal - 110% of 148k is 162,800. Do I need to find $34.22 in improvements to eliminate? Would additional downpayment help? Do I have to ask Freddie to reduce the price? My LO said the UW is not in at this point, but should be able to give me answers tomorrow. I just figured I'd run it by y'all cause, you know, I'm impatient and I like to know what to expect.

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010Previous High Score: EQ 700 TU04 712 EX 726

Current Score: EQ 740 TU(Discover) 750 EX(AMEX) 747

Goal Score: 740+ all around

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AUGH - Anyone with Freddie experience?

After going through this sheet, I think I have it figured out.

I cannot have a total in C3 that is more than 110% of the as-improved price from the appraisal. Paying additional down payment or lowering my renovation budget *will not* help at all, because that box contains the lower of 110% of as-improved value or as-is value plus renovations. There is nothing I can do shy of convincing the appraiser that the as-is value is more than 119k (his current listed assessment) that will get me out of renegotiating this price with the seller if I'm going to finance this house with a 203k loan. Am I correct?

A friend of mine said that if they had a solid cash offer, they would have taken it over mine. Same with a conventional offer. She also mentioned that an FHA appraisal is available to anyone else doing a FHA loan on this property for 6 months (I read up and it seems that that may be 4 months) - which means that no one else can get a 203k on this property, either, and they'll be dealing with the same appraisal. The only buyer that Freddie can hope for is a competing cash offer or a competing conventional offer. Is this accurate? My realtor wants to go back to Freddie with the strongest argument that we've made a good-faith effort to avoid asking for a price reduction. He has actually never dealt with a 203k before, though, so despite his excellent house knowledge (he's excellent, I really don't have any complaints), he's not in familiar territory, loan-wise.

Am I missing something? Have I made a glaring error? I'm coming to terms with the idea that I may have to find a new house. Feedback much appreciated.

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010Previous High Score: EQ 700 TU04 712 EX 726

Current Score: EQ 740 TU(Discover) 750 EX(AMEX) 747

Goal Score: 740+ all around

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AUGH - Anyone with Freddie experience?

We have been looking into these loans as well to do some work on our current home, kept reading that the loans can go to 110% of the improved value of the house, but everyone I talked to said they only go to 96.5% of the improved value.. So what exactly does that 110% mean?

I have also heard that doing some of this work under an EEM can help if you are off just a little on the LTV, but we haven't go that far with ours, still working on getting our mid score above 640..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AUGH - Anyone with Freddie experience?

Update: I'm now waiting on the seller to respond to a price reduction request.

We got the appraisal up by 8k (still seems really low) for the as-improved value.

My realtor talked to the LA and it sounds like it's very possible that this will be resolved amicably. We sent the as-is opinion letter, a letter from my lender giving an expected timeline for closing with quick resolution, and the appraisal. Essentially, the message was: "There's a 16k gap between contract price and as-is value determined by appraiser, and purchaser can't make up that difference to proceed". Seller had balked before, when I had to change lenders and ask for a closing extension because the UW wanted it, but this lender letter does give a much closer timeline than we had previously asked for. It's a 2-3 week improvement for them from what I was forced to ask for previously.

Here's hoping. I really don't want to have to go see another house. The top of my "haven't seen" list is a short sale that has a dire "45-60 days for response" warning in the listing.

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010Previous High Score: EQ 700 TU04 712 EX 726

Current Score: EQ 740 TU(Discover) 750 EX(AMEX) 747

Goal Score: 740+ all around

Take the myFICO Fitness Challenge