- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Re: Advice needed for Mortgage Loan by August 2015

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Advice needed for Mortgage Loan by August 2015

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Advice needed for Mortgage Loan by August 2015

Hi all,

This is my first post here, and I am hoping that I can get some advice from my fellow bloggers.

I am hoping to be qualified for a home mortgage by August 2015. My current FICO scores is 710 (I think it is mediocre due to the fact that I have only 8 years of credit history).

I have the following debt on these CC:

RH: $0/ $6,000; 25% APR

CapOne: $0/ $4,000; 22.9% APR

CapOne: $0/ $1,400; 19.24%

WE: $0/ $3,000; 22.88% APR

AE: $1,600/ $6,700; 15.24% (UTIL 24%)

Chase: $0/ $2,400; 19.24% APR (UTIL 0%)

Chase: $1,700/ $6,800; 16.99% APR (UTIL 25%)

Credit card history: 8 years

0 late payment

3 closed auto loans

I have $2,500 per month to pay off credit card debt, or I can save this amount towards my down payment ($2500/ month would have saved another $17,500 by August).

Should I be saving money for down payment? Or should I be paying these credit card debts first?

On a side note, what would be the best way to boost up the scores from 710 to 760?

Any comment is appreciated.

Thanks,

joshall

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice needed for Mortgage Loan by August 2015

Paying your cards down will boost your credit a ton. Do not open or close any. If you have no derogatory trade lines or marks you are in good shape. Just pay them down as much as possible. That willincrease your scores. Your best bet is to get them all to zeroexcept for 1 and have that one at 5% or less. Do not take it below 1%.

Then start saving for your downpayment. Witha good enough score, no debt, and amazing historyyou have great chances at a 0% or 3.5% down loan.

Spacebar broken. Watch for finger.

02/04/2015 || TU 08: 728 EX 08: 709 EQ 08: 748

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice needed for Mortgage Loan by August 2015

Thanks for your advice!

wow- I have never heard of 0% down. I am aiming to apply for a conventional loan, with 5% down. First time home buyer here. What do you think my chances are for getting pre-qualified? I am located in Southern California.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice needed for Mortgage Loan by August 2015

I know we only needed 640 to get approved for our 5% down conventional loan. But our intrest rate would have been super high. Being at 700 made our intrest rate easier to swallow.

Spacebar broken. Watch for finger.

02/04/2015 || TU 08: 728 EX 08: 709 EQ 08: 748

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice needed for Mortgage Loan by August 2015

agree with Newstart,

the rate tiers (at least for conventional) are 660-679, 680-699, 700-720, 720+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice needed for Mortgage Loan by August 2015

I have always thought 720+ for auto loan but 760+ for mortgage?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice needed for Mortgage Loan by August 2015

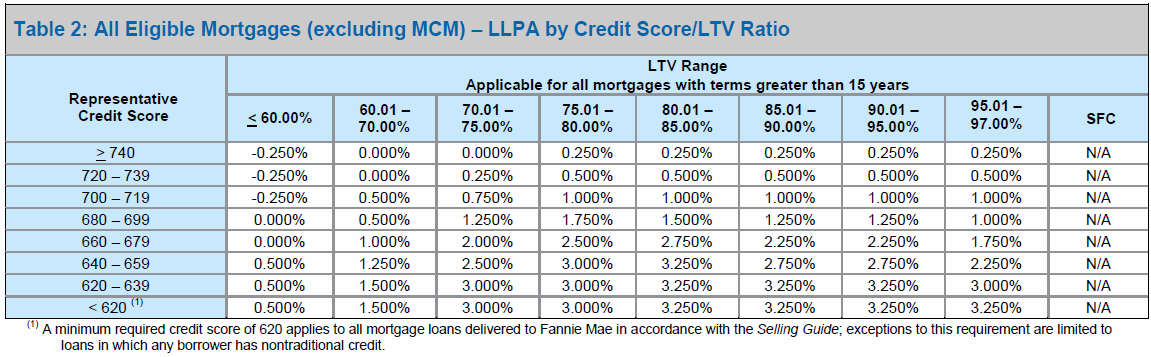

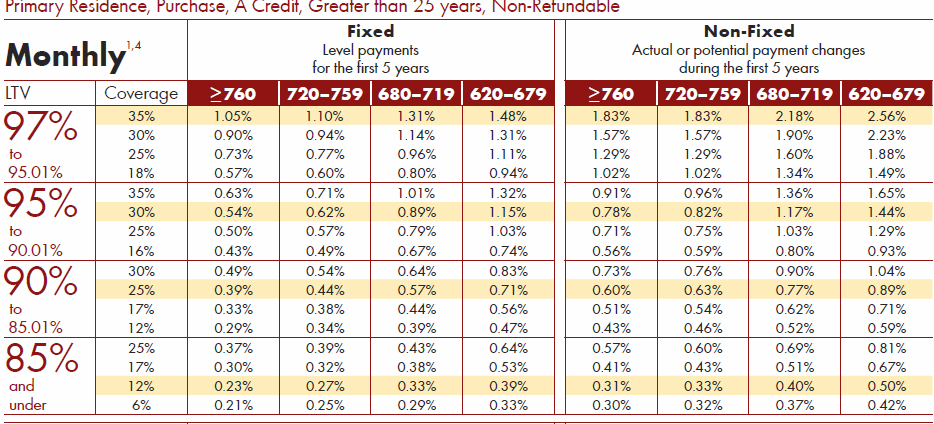

It's 740+ for mortgage rates, it's 760+ for PMI rates.

Interest rate pricing adjustments based on FICO/LTV:

PMI rates based on FICO/LTV:

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice needed for Mortgage Loan by August 2015

Thank YOU! That is a very informative chart.

One more question, we might be loaning $5000 from 401k. Will that be reported to Credit Reporting Bureau? What is the impact of a 401k loan on the mortgage pre-qualifying and application process?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice needed for Mortgage Loan by August 2015

It's fine to take a loan out against your 401k for down payment and/or closing costs. It isn't reported on your credit report. The $ for loan you will be taking from the 401k will be trasnferred to your checking account from the 401k.

So since you mentioned you had $42k in savings, and $21k in the 401k, then after the loan will be taken out it'll be $47k in savings and $16k in the 401k (then 60% of the vested balance is what qualifies as reserves).

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice needed for Mortgage Loan by August 2015

That makes sense.

Is a 401(k) loan subjetced to 20% federal tax withholding and a 10% tax penalty?