- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Re: Credit Union Mortgage Rates

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Union Mortgage Rates

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit Union Mortgage Rates

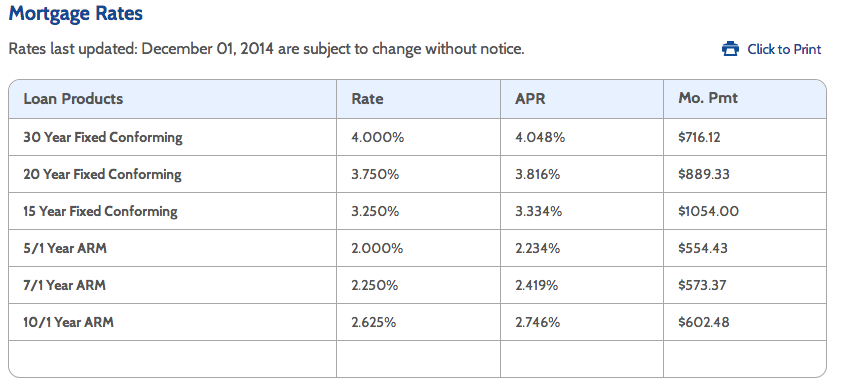

I've been looking around for about a month now at mortgage rates and it seems like the rates offered by my credit union are by far the best i've see. Is it normal for a credit union to be able to offer the best mortgage rates? This is what my credit union is currently offering: . . 30 Year Fixed Conforming APR 4.048%..... 5/1 Year ARM APR 2.234% ..... 10/1 Year ARM ARM 2.746% . The max LTV they will do is 97% with a 720 FICO. The origination fee is $500 but they're offering a $995 discount in closing costs until the end of the year. 60 day rate lock, no fee. Since this will be my first home, i'm leaning towards one of the ARM mortgages because who knows how long i'll be in my first home (single, no kids). Any thoughts? Has anyone seen better rates?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Union Mortgage Rates

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Union Mortgage Rates

@nycsimone wrote:I've been looking around for about a month now at mortgage rates and it seems like the rates offered by my credit union are by far the best i've see. Is it normal for a credit union to be able to offer the best mortgage rates? This is what my credit union is currently offering: . . 30 Year Fixed Conforming APR 4.048%..... 5/1 Year ARM APR 2.234% ..... 10/1 Year ARM ARM 2.746% . The max LTV they will do is 97% with a 720 FICO. The origination fee is $500 but they're offering a $995 discount in closing costs until the end of the year. 60 day rate lock, no fee. Since this will be my first home, i'm leaning towards one of the ARM mortgages because who knows how long i'll be in my first home (single, no kids). Any thoughts? Has anyone seen better rates?

Rates don't matter until you are ready to lock. Have you already been pre-approved and have a purchase agreement on a house? If not, know that those are fairly good rates ... if your were locking one now. Credit unions generally offer competitive mortgage products and programs and I personally encourage folks to use credit unions when possible. Credit unions are in business to serve local folks and communities ... generally.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Union Mortgage Rates

When you are rate shopping, try to do it in one day,

in todays markets you might call Bank 1 on Monday, and Bank 2 on Tuesday not knowing that the market changed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Union Mortgage Rates

Today I talked to the Branch Manager at my credit union and she said they don't do risk based interest rates. You're either approved for a mortgage at that rate or you're not. Generally they'd like to see a 680-690 FICO to approve a mortgage, and a 720 is required if you want to do only 3% down.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Union Mortgage Rates

My CU is doing 3.75% with no points, but I am in California. I think rates are lower here due to the housing market

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content