- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Does a mortgage with zero or one point not make se...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Does a mortgage with zero or one point not make sense?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does a mortgage with zero or one point not make sense?

I am asking for quotes on a 15 year fixed (refinancing) and have a broker suggesting I do not want a quote at zero points or one point. Explanation is below.

The other two brokers I've gotten quotes from both quoted at zero and 1 point, so I'm curious if anyone has experience with this, or if the below explanation makes sense. It is a bit confusing to me.

"Since the closing costs are already included in the loan amount, I wouldn’t add them back to your total costs. I think a better way to look at would be to adjust the loan amount by the difference in points and then calculate your 180 months. That, of course, assumes that you keep the loan for the full 15 years and you never pay more than the minimum payment.

As for the rate quote, it doesn’t really work out to have a zero point quote or a 1 point quote due to the rate/point spreads. For instance, I could quote you zero points but the rate today would be 3.125. I would be doing a disservice to you if I quoted or have you take that rate. The 3.00% with .125% is the way to go. The spread of .125% less up front (.125 cost to zero points) for .125% in rate doesn’t make any sense. Your breakeven would be in about a year. The same goes for the one point quote. Today the rate options would be 2.875 with 0.50% or 2.75 with 1.375% (these can change with the market). That spread also does not make a lot of sense. That’s .875% for an .125% in rate. We normally like to see about a .50% cost to .125% in rate. That said, the better option would be the 2.875% with ½ point. Even though the numbers may work out for the lower rate option, it would take a long time for the lower rate option to show those savings. If it’s too long of a period, the numbers will be subject to change due to various life events.

Does that make sense?"[

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does a mortgage with zero or one point not make sense?

@Anonymous wrote:I am asking for quotes on a 15 year fixed (refinancing) and have a broker suggesting I do not want a quote at zero points or one point. Explanation is below.

The other two brokers I've gotten quotes from both quoted at zero and 1 point, so I'm curious if anyone has experience with this, or if the below explanation makes sense. It is a bit confusing to me.

"Since the closing costs are already included in the loan amount, I wouldn’t add them back to your total costs. I think a better way to look at would be to adjust the loan amount by the difference in points and then calculate your 180 months. That, of course, assumes that you keep the loan for the full 15 years and you never pay more than the minimum payment.

As for the rate quote, it doesn’t really work out to have a zero point quote or a 1 point quote due to the rate/point spreads. For instance, I could quote you zero points but the rate today would be 3.125. I would be doing a disservice to you if I quoted or have you take that rate. The 3.00% with .125% is the way to go. The spread of .125% less up front (.125 cost to zero points) for .125% in rate doesn’t make any sense. Your breakeven would be in about a year. The same goes for the one point quote. Today the rate options would be 2.875 with 0.50% or 2.75 with 1.375% (these can change with the market). That spread also does not make a lot of sense. That’s .875% for an .125% in rate. We normally like to see about a .50% cost to .125% in rate. That said, the better option would be the 2.875% with ½ point. Even though the numbers may work out for the lower rate option, it would take a long time for the lower rate option to show those savings. If it’s too long of a period, the numbers will be subject to change due to various life events.

Does that make sense?"[

Are you working with a broker? a lot of brokers make their money off of something called a Yeild Spread Premium.

If he's making money off of the YSP, then you won't ever get him to quote you different options...

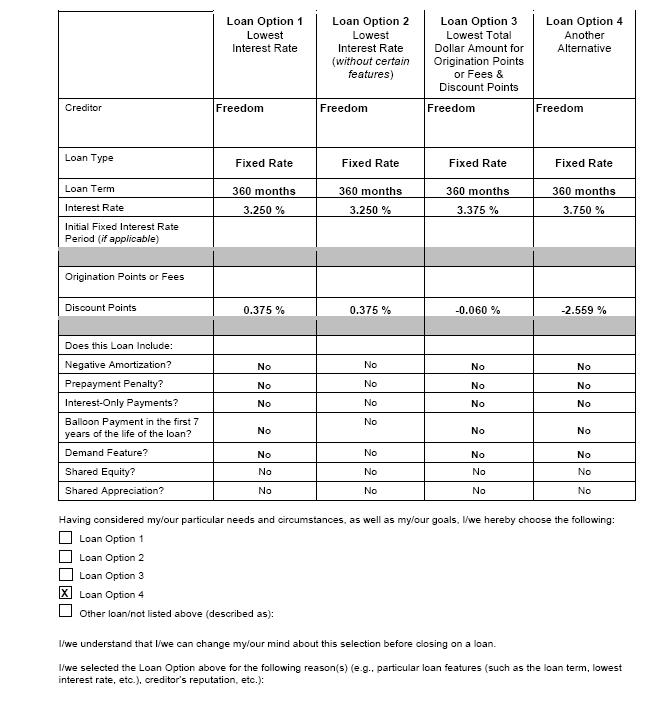

I think they are required to give you something called a Loan Options Disclosure... I had to sign one of these, It was a form with 4 options with different "points" and I had to indicate which one I chose, which I already knew which one I wanted, so it was just a paperwork thing for me.

In my case, I chose a loan option that gave me a 9k credit towards closing costs. since I wasn't allowed to roll any closing costs into the new loan. I still went from 6.125% to 3.75%

Filed Chapter 13 on 6/1/2017 after job loss. Discharged 6/1/2022.

Goal: Gardening!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does a mortgage with zero or one point not make sense?

Filed Chapter 13 on 6/1/2017 after job loss. Discharged 6/1/2022.

Goal: Gardening!