- myFICO® Forums

- Types of Credit

- Mortgage Loans

- FHA Mortgage Approval in 2012 - Help me Get Ready!...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FHA Mortgage Approval in 2012 - Help me Get Ready!!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FHA Mortgage Approval in 2012 - Help me Get Ready!!

Okay, so at the suggestion of mickie08, I'm going to lay out all of the facts about my (and my husband's) financial situation to get opinions/advice/feedback on what we need to do over the next 14 months to prepare for mortgage approval. I will outline everything I can think of, but let me know if I'm leaving anything important out!

Income

2010 Wife Income = $108,500 ($94K from salary; $14K in bonuses including a $10K sign-on bonus)

2010 Husband Income = $12K from part-time hourly wages where he works exactly 32 hours every week; $4200 from a high school football coaching contract that he has been doing for 4 years straight (Husband graduated in May 2010 and because he's a teacher, began work in August 2010)

2010 Dependent SS Income to Stepson = $11,040 (He has received this every year since 2006 and is entitled to it until he's 18 years old; 7 years old now)

Anticipated 2011 Wife Income = $112K ($104K from salary; $8K in bonuses)

Anticipated 2011 Husband Income =$35K from regular wages; $4200 from a high school football coaching contract (Husband is hoping to change jobs to a full-time, salaried position which could affect his actual income, method of payment, etc)

2010 Dependent SS Income to Stepson = $11,040 (He has received this every year since 2006 and is entitled to it until he's 18 years old; 7 years old now)

Debt

Car Payment = $527 per month

Consumer Loan Payment = $542 per month

All SL Payments combined = $1,980 per month*

* In December 2009, I had 11 SL accounts charge-off which total nearly $100K - Since that time, I have entered into payment plans on each loan where I make a required monthly payment. I will be able to provide evidence of the payment plan and at least 12 months of regular, on-time payments when we apply for a mortgage loan next year.

Anticipated Savings/Assets

401k (all vested) = $10,000

Company Stock Grant (vested at time of mortgage application) = $3,260

Additional Stock Account (all vested) = $1,030

We realistically plan to have savings for downpayment, closing costs, etc = $20K

Anticipated Credit Scores

Wife = Just above the minimum of 640

Husband = Low 700s

Desired Mortgage/Home

FHA Mortgage Loan

Purchase Price = $300K

Property Tax (gag) is 2.5%

Please advise on overall possibility of being approved for a loan in May 2012, the amount of likely approval, any problems/issues that you see and how you suggest moving forward with those issues so we have the best chance of being approved. Thanks!!

July 2017 Current Scores: Approx 710 (waiting for official updates)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA Mortgage Approval in 2012 - Help me Get Ready!!

No bites... did I provide TOO much information??

July 2017 Current Scores: Approx 710 (waiting for official updates)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA Mortgage Approval in 2012 - Help me Get Ready!!

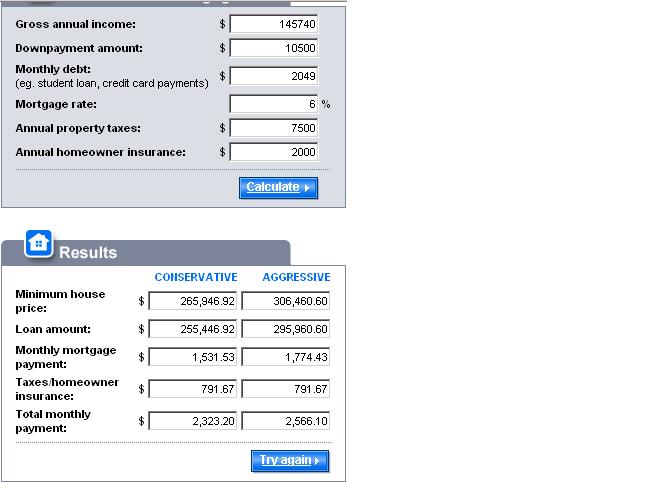

Check this out:

http://cgi.money.cnn.com/tools/houseafford/houseafford.html

I assumed they'd count your base salary, 8k for bonus, his salary, and the SS income for 2010 and 2011. Took the average. I assumed 3.5% downpayment (the balance of that 20k for closing stuff), and put in your debt payments. I guessed at homeowner's insurance, but I have no idea for that value of house. I hope this helps.

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010Previous High Score: EQ 700 TU04 712 EX 726

Current Score: EQ 740 TU(Discover) 750 EX(AMEX) 747

Goal Score: 740+ all around

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA Mortgage Approval in 2012 - Help me Get Ready!!

Oh, and I made a wild guess about interest rates in a year.

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010Previous High Score: EQ 700 TU04 712 EX 726

Current Score: EQ 740 TU(Discover) 750 EX(AMEX) 747

Goal Score: 740+ all around

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA Mortgage Approval in 2012 - Help me Get Ready!!

Thanks mauve... I love that CNN calculator and play around with it all of the time. With a $300K purchase price, a 3.5% downpayment and factoring in all of the relevant PMI, tax, interest, etc (I've done research to estimate those very closely), I've come up with a back-end DTI of about 40-41%. So I'm feeling okay about the DTI and how it will be viewed.

At this stage, I feel good about where we are froma pure financial standpoint. I know we can handle the mortgage payment we want. I'm more concerned about any credit or other "issues" that may prevent actual approval.

July 2017 Current Scores: Approx 710 (waiting for official updates)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA Mortgage Approval in 2012 - Help me Get Ready!!

I think the issues you're working with on the other board are where you need to focus - it looks to my untrained eye like you're in the right zone for the income / payments / DTI

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010Previous High Score: EQ 700 TU04 712 EX 726

Current Score: EQ 740 TU(Discover) 750 EX(AMEX) 747

Goal Score: 740+ all around

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA Mortgage Approval in 2012 - Help me Get Ready!!

Agreed and luckily, those other issues are quickly be resolved ![]() At this stage, it's just those COs that scare me!

At this stage, it's just those COs that scare me!

July 2017 Current Scores: Approx 710 (waiting for official updates)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA Mortgage Approval in 2012 - Help me Get Ready!!

I can't remember the date on those, but we're talking about 2012, so you should have at least a year (2?) of payments on that debt. IIRC (if i recall correctly), you have some revolving balances that you're getting down, too that should give you a good score boost by then - enough to qualify for FHA.

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010Previous High Score: EQ 700 TU04 712 EX 726

Current Score: EQ 740 TU(Discover) 750 EX(AMEX) 747

Goal Score: 740+ all around

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA Mortgage Approval in 2012 - Help me Get Ready!!

You are correct.

The COs happenned in Dec 2009 so by the time we apply, it will be over 2 years since the actual COs occurred and I will have a payment history of over 12 months (not 2 years because I didn't start the payment plans immediately).

I still have very high util % on my CCs (78%) so paying those down, which I will have finished in about 4-6 months, should definitely bring me up a lot. I'm failry confident that the combo of paying down the util % (all but one card off and that card under 9%) and allowing everything to age another year, should get be above 640. The FICO Simulator on here says I'll be between 699-739 but I'm not that optimistic!!

July 2017 Current Scores: Approx 710 (waiting for official updates)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA Mortgage Approval in 2012 - Help me Get Ready!!

Have you played with scoreinfo.org?

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010Previous High Score: EQ 700 TU04 712 EX 726

Current Score: EQ 740 TU(Discover) 750 EX(AMEX) 747

Goal Score: 740+ all around

Take the myFICO Fitness Challenge