- myFICO® Forums

- Types of Credit

- Mortgage Loans

- FHA loan limits announced for October 1, 2011 thro...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FHA loan limits announced for October 1, 2011 through December 31, 2011

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FHA loan limits announced for October 1, 2011 through December 31, 2011

New email from Jerrold Meyer on the loan awaited FHA loan limits... in Bold is the letter (parentheses are my comments)

NOTICE OF FHA LOAN LIMIT EFFECTIVE OCTOBER 1, 2011 THROUGH DECEMBER 31, 2011

This provides notice of the posting of the comprehensive update to the Federal Housing Administration’s (FHA) single-family (this also means condominiums, duplex, triplex, 4-plex, modular & manufactured home) loan limits which are effective on or after October 1, 2011 through December 31, 2011 (there are several requirements your FHA loan must meet by September 30 2011 in order to allow to remain under the current FHA loan limits). These limits apply to forward mortgages insured under section 203(b)(2) of the National Housing Act (I suspect it also applies for FHA 203k loans too) and reverse mortgages insured under section 255 (Home Equity Conversion Mortgages (HECM)). A mortgagee letter providing further guidance has been issued August 19, 2011 (that mortgagee letter can be found here, it's a .pdf link)

For Forward Mortgages, the FHA floors (meaning the lowest "maximum FHA loan amount" anywhere in the US) for the period October 1, 2011 through December 31, 2011 are $271,050, $347,000, $419,425 and $521,250 for 1-, 2-, 3- and 4-unit dwellings, respectively. The FHA ceilings (meaning the highest "maximum FHA loan amount" anywhere in the US) are $625,500, $800,775, $967,950 and $1,202,925 for 1-, 2-, 3- and 4-unit dwellings, respectively. For all other areas, i.e., those where 115 percent of the median home price for the area is in between the floor and the ceiling, the limit shall be at 115 percent of the median home price. For areas under Section 214 of the National Housing Act (Alaska, Guam, Hawaii and the Virgin Islands), higher ceilings of $938,250, $1,201,150, $1,451,925 and $1,804,375 for 1-, 2-, 3-, and 4-unit dwellings, respectively, apply (so if you are buying in those areas then FHA loan limits are actually higher than in the 48 contiguous states)

For HECMS, the maximum claim amount will remain at $625,500.

As HUD is not updating median prices at this time, there is no appeal period associated with the change of loan limits on October 1, 2011.

For calendar year 2012, HUD does expect to announce proposed maximum mortgage amounts in November 2011 (meaning it could change yet again, and if it does, we'll know this November). Once the principles set forth in the Mortgagee Letter announcing the loan limits that take effect on October 1, 2011, there will be no further declines in any loan limits for 2012, absent a change in authorizing legislation (further declines in the FHA loan limits are not expected for 2012). As all locality specific maximum mortgage amounts are ultimately tied to the so-called national conforming loan limit of 12 USC 1454(a)(2)(C), and that limit may only go up and not go down over time, county-level loan limits under current statutory authority may only go up in the future and not go down.

Complete schedules of FHA mortgage limits for all areas for forward mortgages will be available through the downloadable file links found at https://entp.hud.gov/idapp/html/hicostlook.cfm (the official website to check FHA loan limits at). The website also provides a current look-up tool that will have the capability of finding loan limits for periods in 2011 and 2012. Please read these FHA Maximum Mortgage Limit FAQs: http://portal.hud.gov/hudportal/documents/huddoc?id=faqfha.pdf (this FAQ has a lot of helpful questions/answers, which I'll copy/paste a few key ones below).

End of Jerrold's message.

Important to note, if you are buying a home with an FHA mortgage, and want to stay under the current loan limits, then by September 30, 2011 you will need Credit Approval, this means:

- A Direct Endorsement (DE) underwriter has approved the loan (i.e., the lender has received and accepted approval via TOTAL Scorecard, or has manually underwritten the loan) on or before September 30, 2011.

- The approval includes the DE underwriter’s review and approval of the appraisal on or before September 30, 2011.

- The HUD/VA Addendum to Uniform Residential Loan Application, Form HUD 92900-A, page 3, must be signed and dated by the underwriter on or before September 30, 2011.

- The FHA Loan Underwriting and Transmittal Summary, Form HUD-92900-LT must be signed and dated by the underwriter on or before September 30, 2011, for manually underwritten loans.

- The Underwriter Approval Date on the Insurance Application Screen in the FHA Connection must be on or before September 30, 2011.

- The Appraisal date must be on or before September 30, 2011, and must be effective at loan closing date.

- Borrower and terms of the loan must be the same as the borrower and the terms approved on or before September 30, 2011.

- The case number has not expired or been cancelled – no assignment or new case numbers permitted.

Other than transactions that meet the bullet points above, there are additional transactions which can exceed the new loan limits, namely:

- FHA loans that have closed before October 1st but haven't been insured by HUD yet

- FHA-to-FHA refinance transactions

When you are doing an FHA-to-FHA refinance transaction, it must meet the following:

- The new mortgage must be a refinance of an existing FHA-insured mortgage.

- The maximum loan amount of the new FHA-insured mortgage, including all fees, closing costs, mortgage insurance premiums (MIP), interest, etc., must not exceed the original principal amount of the existing FHA-insured mortgage. Should the maximum loan amount (based on the original principal balance of the existing FHA mortgage) be insufficient to cover allowable interest, MIP, closing costs, fees, etc., the borrower shall provide cash to cover the costs that exceed the allowable maximum loan amount.

- The new FHA-insured mortgage may not have a term of more than 12 years in excess of the unexpired term of the existing FHA-insured mortgage. The monthly payment due under the new FHA-insured mortgage is less than that due under the existing FHA-insured mortgage for the month in which the new FHA-insured mortgage is executed.

Questions from the FAQ:

Q. What is the effective date for the new FHA loan limits announced in Mortgagee Letter 11-29?

A. The new FHA loan limits are effective from October 1, 2011 through December 31, 2011.

Q. What will FHA do if the current (pre-October) 2011 loan limits are extended?

A. If legislation is enacted to extend the current FHA-insured loan limits, which expire on September 30, 2011, the Department will publish a Mortgagee Letter stating that there will be no change in limits on October 1.

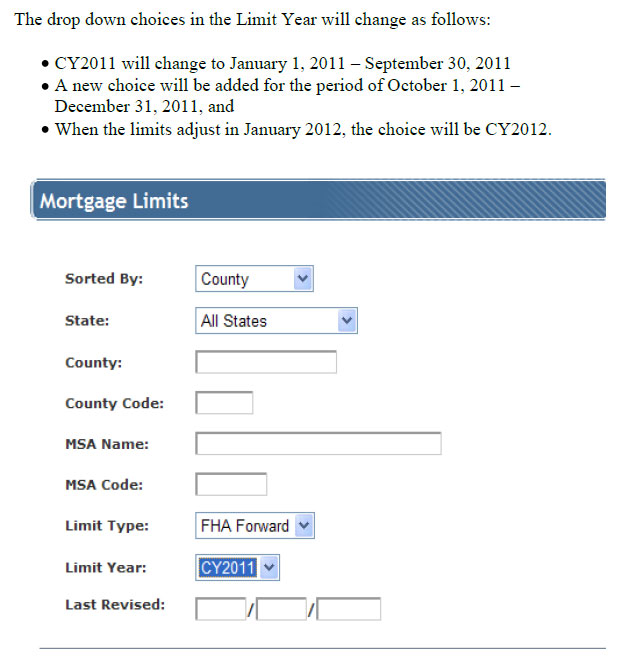

Q. How will I be able to view loan limits for different years?

A. The drop down choices in the Limit Year on the FHA Loan Limit Lookup Website are:

- CY2011 will change to January 1, 2011 – September 30, 2011

- A new choice will be added for the period of October 1, 2011 – December 31, 2011, and

- When the limits adjust in January 2012, the choice will be CY2012.

Areas which have FHA loan limits at $625,500 or above (like the highest cost areas in the continguous US, as well as Hawaii, Alaska, Guam, etc.): http://portal.hud.gov/hudportal/documents/huddoc?id=11-29mlatch1.pdf (if it doesn't work, copy & paste that into a new browser)

Areas which have FHA loan limits above $271,050 and up to $624,499: http://portal.hud.gov/hudportal/documents/huddoc?id=11-29mlatch2.pdf (if it doesn't work, copy & paste that into a new browser)

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA loan limits announced for October 1, 2011 through December 31, 2011

Thanks, Shane. It will be interesting to see now what happens with homes priced above $625,500 in the higher priced areas. Will private lenders meet market demands? Will there be downward pricing pressure because financing isn't as available?

Current Score: EQ 681 (04/05/13); TU 98 728 (01/06/12), TU 08? 760 (provided by Barclay 1/2/14), TU 04 728 (lender pull 01/12/12); EX 742 (lender pull 01/12/12)

Goal Score: 720

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA loan limits announced for October 1, 2011 through December 31, 2011

Shane, this is awesome information, thank you!! I followed the link and for my county, it says that the new limit will be $341,250, see below:

| MSA Name | MSA Code | Division | County Name | County Code | State | One-Family | Two-Family | Three-Family | Four-Family | Median Sale Price | Last Revised | Limit Year |

| COLUMBUS, OH (MSA) | 18140 | FRANKLIN | 049 | OH | $341,250 | $436,850 | $528,050 | $656,250 | $255,000 | 01/01/2009 | CY2011 |

The tricky thing is that our house is currently being built and the guaranteed completion month is January, 2012, but the builder often finishes a month or so early and they have told us we should realistically be prepared to close anytime between mid-December 2011 though January 2012 (of course, right at the cut-off!).

Sooo.... your above post states that these new limits are effective only through December 31, 2011, but can you help me understand when we will know the 2012 limits and, am I reading correctly that the 2012 limits are not expected to be reduced from these new 2011 limits?

THANKS!

July 2017 Current Scores: Approx 710 (waiting for official updates)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA loan limits announced for October 1, 2011 through December 31, 2011

Thanks, Shane!

This sure is going to be painful for some people. The limit in our area is going down ~$150K. I am glad we are in our inspection phase and hoping to close in a few weeks. We'd be in sad shape otherwise. I am thankful to this forum for keeping me on my toes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA loan limits announced for October 1, 2011 through December 31, 2011

Shane, that's great information. Thanks

I see that the limit for one family in my county is still above what I was going to spend ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA loan limits announced for October 1, 2011 through December 31, 2011

What happenned?! Since Shane originally posted this message, the information for my county changed!! I pasted what showed up before and now it says the following:

| MSA Name | MSA Code | Division | County Name | County Code | State | One-Family | Two-Family | Three-Family | Four-Family | Median Sale Price | Last Revised | Limit Year |

| COLUMBUS, OH (MSA) | 18140 | FRANKLIN | 049 | OH | $310,500 | $397,500 | $480,450 | $597,100 | $255,000 | Oct 1, 2011 - Dec 31, 2011 |

NEVERMIND... after looking over it again, it looks like when I first pulled the info, it still showed the current limits and did not yet reflect that lowered amounts that will go into effect on Oct 1.... such a bummer ![]()

July 2017 Current Scores: Approx 710 (waiting for official updates)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA loan limits announced for October 1, 2011 through December 31, 2011

Yup you got it, FHA didn't update the #'s on the website until a couple days later.

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA loan limits announced for October 1, 2011 through December 31, 2011

Shane - are there any creative ways to deal with needing a loan that is above the FHA limits (in our case, it's only about 15K)? I just read an article online that was explaining the possibility of mixing a conforming loan with a non-conforming loan. This possibility was mentioned for areas where the FHA limits are coming down $100-200K and causing real issues, but still, I'm wondering if any lenders out there are getting creative or if there are any options.

My husband and I really don't want to take such a huge, unexpected additional chunk out of our savings and we just don't think we'll qualify for conventional financing.

July 2017 Current Scores: Approx 710 (waiting for official updates)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA loan limits announced for October 1, 2011 through December 31, 2011

Fannie Mae & Freddie Mac loan programs still go up to a $417k loan amount, and just need a 3% down payment (with a 720 FICO score) or a 5% down payment (with a 680 FICO score) - Fannie & Freddie are conforming loan programs, which is a type of conventional mortgage. Non-conforming loans are also a type of conventional financing. Combining an FHA mortgage with a down payment assistance program/2nd mortgage would be one way you could still keep your down payment to a minimum but still get a total combined loan amount above the FHA loan limit.

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA loan limits announced for October 1, 2011 through December 31, 2011

@ShanetheMortgageMan wrote:Fannie Mae & Freddie Mac loan programs still go up to a $417k loan amount, and just need a 3% down payment (with a 720 FICO score) or a 5% down payment (with a 680 FICO score) - Fannie & Freddie are conforming loan programs, which is a type of conventional mortgage. Non-conforming loans are also a type of conventional financing. Combining an FHA mortgage with a down payment assistance program/2nd mortgage would be one way you could still keep your down payment to a minimum but still get a total combined loan amount above the FHA loan limit.

Shane, this will be a conventional loan?

So 3% down if your FICO (is that middle score) is 720

And 5% down if your FICO is 680