- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Re: Getting Prepared.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Getting Prepared.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Getting Prepared.

Since the negatives are over 2 years old they shouldn't hold you back any longer, plus you have a valid explanation. The scores you listed are fine, although the lenders scores may not be as high as what you are getting here off myFICO.

Debt ratios look fine.

Looking at Maumelle though, a lot of the town is in an ineligible area, although north of the railroad tracks seem to be in an eligible area. Oct. 1st will add a lot more to ineligible areas though (north of the tracks & even north of 365).

If it says "Consumer disputes after investigation complete" I've found underwriter's still consider that in dispute.

If the dispute meets any of the below then it can remain in dispute, otherwise if it doesn't then the loan needs to be manually underwritten (which many USDA loans are manually underwritten anyway).

1) The disputed trade line has a zero dollar balance.

2) The disputed trade line is marked “paid in full” or “resolved.”

3) The disputed trade line has a balance owed of less than $500 and is more than 24 months old.

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Getting Prepared.

Sounds good, we've found a house in mayflower which will remain eligible after the Oct 1st switch.

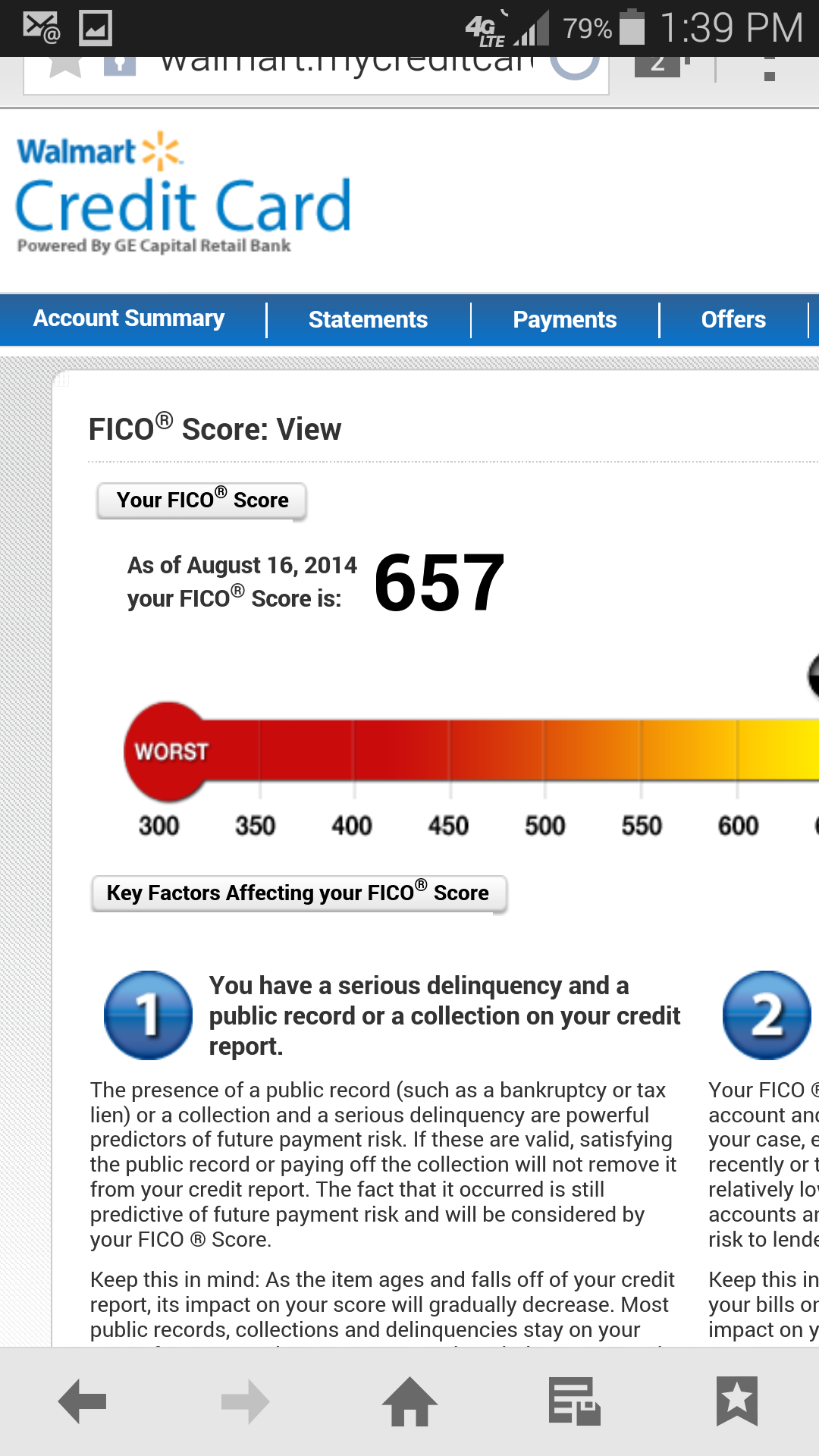

All dispute comments have been removed as of yesterday, scores are still going up due to paying down utilization. It is currently at 65 % overall with 5 maxed out cards (95% each due to wedding expenses) in 2 weeks it will be 28% overall with no maxed out cards and far less than half of all accounts reporting a balance. Currently i have 18 out of 26 accounts reporting a balance. That number will be 7 out of 24 in 20 days. My auto loan should report as paid in full by then as well as an old auto loan that has been reporting as open since two years ago that is paid and closed.

I'm really anticipating a nice score increase from all of this.

I messaged you back over on the other side.... looking forward to hopefully making this happen ![]() )

)

Will be my first home purchase... seems very stressful

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content