- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Lender score does not match ScoreWatch score

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Lender score does not match ScoreWatch score

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lender score does not match ScoreWatch score

Our broker said we needed to get our middle score to 620. ScoreWatch says my Equifax score is 643. Broker did a Transunion pull, which showed 690. So my middle score should be at least 643. But when the broker pulled Equifax and Experian to process the loan, middle score was only 617. :-( I though ScoreWatch on MyFico gave REAL FICO scores, not FAKOs. Why such a big discrepancy (which disqualified us)?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lender score does not match ScoreWatch score

FICO has multiple version. Score Watch here gives us EQ Beacon (correct me if i am wrong), which may or may not match with all lenders versions of scores. For me most of the lenders i applied with matched with my EQ middle score that i get from here. For my wife, Score Watch gave 742, while lender pulled a score of 725 (of a scale of 250 - 900). It all depends on which version they are pulling.

Shell FCU : 5K

Shell FCU : 5K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lender score does not match ScoreWatch score

This is typical. My scores were better on the lender pull then my scorewatch scores. Its always a gamble. If you still have credit card utilization I would pay them down and it should boost you up enough. There are a few version of the fico scores and what we get and what lenders pull are diffrent.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lender score does not match ScoreWatch score

My guess is lender pulled EQ04 which used to be offered here. EQ08 is now offered and this complaint is beginning to be a common one.

FYI, there are MANY FICO scoring models. There really is no "One True Score." It all depends on lender and what type of credit you are applying for.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lender score does not match ScoreWatch score

There is nothing to pay down in credit cards. My Transunion score 2 months ago was 520 and now is 690. MyFico said Equifax started at 494 and is now claiming 643 (lender claiming 617). So I've paid everything and done everything possible to max my score. I'm not sure what else to do to get it up 3 more points...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lender score does not match ScoreWatch score

How long will it take to go up 3 points by doing nothing?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lender score does not match ScoreWatch score

@LovelyAngel315 wrote:How long will it take to go up 3 points by doing nothing?

If anyone could answer that question with precision, they'd be rich. Just keep working it and apply for your home mortgage when a lender-pulled credit report shows that your middle score is over 640.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lender score does not match ScoreWatch score

TU FICO 5/14 - 520 | FICO 2/15 - 704 | FICO 6/21 - 702 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lender score does not match ScoreWatch score

Are all of your credit cards paid to a zero balance? For optimum scoring you want all of them at 0, and one of them at 1-9% of that card's limit. All of them with a balance, or all of them at 0 will ding your score.

Goal Score: 700 Seedling again as of 07/29/14

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lender score does not match ScoreWatch score

@Jeff532003 wrote:

You could always try another lender. Many are working with 620's for FHA anyway. I've heard some even dealing lower.

Another lender will pull the same numbers.

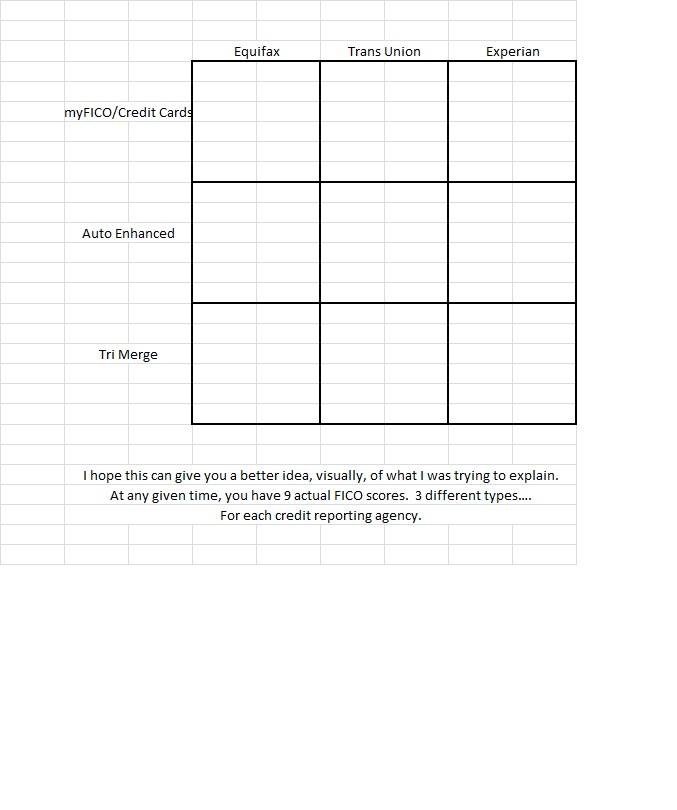

It is a little hard to explain, but here's what I learned here years ago... The scores we have here use the FICO algorythms used for Credit Card Apps.

When you want to buy a car & need an auto loan, a different algorythm is used called an "auto enhanced score" It's still a FICO, still real, just different than what's used for credit cards.

Finally, when you apply for a mortgage, they use what is called a "tri-merge" pull. This also uses a different scoring algorythm than the CC or auto FICO's. Still a real FICO...but different.

Ok....now don't laugh, because this is NOT my forte', but here is a crude drawing of what I'm trying to explain.

All of those squares will have your FICO scores, whenever you may have them pulled, and for whatever the reason.