- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Mortgage Inquires

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Mortgage Inquires

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Inquires

Within what timeframe will mortgage inquires count as one? I've seen 14 days, 30 days and even 45 days. Which is it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage Inquires

I'm curious to hear what anyone more knowledgeable has to say. But since nobody has taken a shot at answering your question yet, here is what I think is the right answer, and which also explains the diversity of window-numbers you have gotten so far.

Every few years FICO releases a big family of models. Here are most of the families still being used:

FICO 98 (released in 1998 and used for the EX mortgage score)

FICO 04 (released in 2004 and used for the TU/EQ mortgage scores)

FICO 8 (released in 2008/2009 and used for a lot of non-mortgage stuff)

FICO 9 (released in 2014 and starting now to be adopted by some CC issuers and lenders)

The earliest models had a 14-day window to enable consumers to engage in rate shopping.

Later models expanded that to 30 day or even 45 day.

So suppose you want to get your credit pulled by 10 different mortgage lenders. Suppose that you have 8 pulls on Nov 1-14 and two pulls on Nov 18.

FICO 8 has the liberal larger window, so if you apply for a credit card in three months and they use FICO 8, then all ten inquires will be counted as one. If you go through final underwriting for a house in two months from now, however, and they use FICO 98, then it will be grouped as two inquires (Nov 1-14) and Nov 18.

Basically, old models use the 14-day window -- newer models give you more leeway.

I think that is how it works. Happy to be corrected.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage Inquires

Thanks for the reply! It helped a lot. I received my credit score from the lender once they pulled it but the paperwork they sent to me in the mail, did not specifiy which FICO model they used.

I applied to 4 different lenders (2 credit unions and 2 mortage brokers-- I think) and onl one pulled my credit. I talked with two of the four by phone and pretty comfortable with one, so I didn't go any further with the others. The one that I ended up 'going with' pulled my credit before I submitted any documentation. Should I expect any more hard pulls from the other companies that I didn't end up going with?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage Inquires

If you gave any of the others your social, then they will likely pull your credit. If not, it is unlikely. Look at your reports in a week and you'll be able to tell who pulled.

Ask the ones who pulled your scores what the scores were. All mortgage lenders use the same scoring models -- the old ones.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage Inquires

CreditGuy,

Using the older model, once outside of the 14 days does all of the enquires hit the score as individual pulls or are they all rolled up into one?

Helpful response, thank you -

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage Inquires

@Anonymous wrote:CreditGuy,

Using the older model, once outside of the 14 days does all of the enquires hit the score as individual pulls or are they all rolled up into one?

Helpful response, thank you -

Any mortgage inquiry within a 14 day window is counted as one on FICO 98 models; it expanded on FICO 04 and later.

So if you took a second inquiry 16 days later, EX Risk Model v2 (one of the mortgage trifecta) would count it as another inquiry, both EQ and TU (EQ 30 days to my knowledge, public documentation on TU says 45) would roll it up into the preceding one.

It's really doubtful the others will pull your credit: it costs money to do that, if you're not going with them, they almost assuredly won't. Don't sweat it.

ETA: no mortgage inquiry counts against you at all under any FICO version for the first 30 days anyway - grace period.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage Inquires

Great reply from Revelate. Just to follow up on that, you ask:

"Using the older model, once outside of the 14 days does all of the enquires hit the score as individual pulls or are they all rolled up into one?"

So let's suppose you have ten mortgage related inquiries between Nov 1 and Nov 12. Then you have 4 more inquiries on Nov 16, Nov 18, Nov 19, and Nov 22.

From a scoring perspective, the extra four inquiries will NOT be scored as four separate inquiries. That is because, as you can see, the four extra inquiries are all within another 14-day window. Thus you will be scored as if you had two distinct inquiries.

If however the last inquiry were on Dec 1 rather than Nov 22, then you would be scored for three distinct inquiries -- the last inquiry would fall outside either 14-day window.

Pull your reports and see exactly when your inquiries were. Also look to see that the inquiries are coded as being of type Mortgage. If an inquiry is inadvertantly not coded by the lender as a mortgage inquiry it could be treated separately.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage Inquires

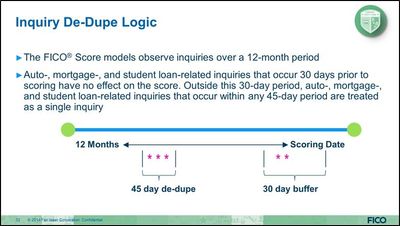

FICO's official term for this is "inquiry de-dupe logic". They actually expanded the window to 45 days, but there is also a buffer before your score actually gets dinged. More here on the window: http://www.fico.com/en/blogs/risk-compliance/a-better-way-to-treat-inquiries/

The buffer:

So not only do you have a 45 day window to count inquiries, but you also have a 30 day buffer before the bundle of inquiries are even scored.

If you were mortgage shopping last week, those inquiries haven't been scored yet, nor have they been counted and de-duped, until the window is closed and the buffer date is pasted. I (of course I did) wrote a calculator to try to figure out when the window closes and when the buffer is over, based on the dates of inquiries.

Once the window is closed, a new window is open as soon as one inquiry hits outside of the first window, and the new window is also 45 days.

Older FICO scores have smaller windows. FICO 04 was 30 days, FICO 98 was 14 days.