- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Re: Mortgage Scores

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Mortgage Scores

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Scores

Why are they so much lower than the other scores. I have never had a Mortgage report on my credit. What goes into calculations to come up with the score. I have 8 auto loans and 7 personal loans and never had anything negative with those. What can I do to increase my Mortgage scores?

Transunion - 686 (1Y5M AA, 30 INQ)

Equifax - 726 (3Y1M AA, 4 INQ)

Total Credit Lines: $99,387

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage Scores

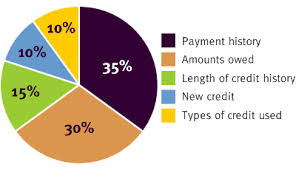

This is how scores are calculated and hope it helps.

To increase your scores, make sure the actions use in calculating the scores are a bit balanced on your report - Minus the mortgage. I also urge you to go to the "how to increase your scores thread"..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage Scores

@Anonymous wrote:This is how scores are calculated and hope it helps.

To increase your scores, make sure the actions use in calculating the scores are a bit balanced on your report - Minus the mortgage. I also urge you to go to the "how to increase your scores thread"..

I understand this is the standard graph but mortagage scores weighs other things more than others. I am trying to see why they are so different than the FICO 8 scores. I want to see what I should focus on to get my scores up to get an approval.

Transunion - 686 (1Y5M AA, 30 INQ)

Equifax - 726 (3Y1M AA, 4 INQ)

Total Credit Lines: $99,387

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage Scores

if your utilization on CC's is really 68.4% as it states in your signature that's what I would work on. That is hurting your scores very badly, and Mortgage scores weigh revolving debt heavily. In your other post you mentioned you had 7-10% down for the purchase of a house, maybe you should consider paying down CC debt with that money instead.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage Scores

Agree with Semo, utilization is extremely high. Excessive inquiries in last 12 months alone, so you are a big credit seeker and new tradelines. Do not apply for any more credit, these inquiries will age off at a year on general FICO 8 scores, mortgages might look at past 2 years. When bringing down the utilization total aggregate under 29% minimum, start PIF before statement cuts on these cards, way too many cards are carrying balances, in excess of 50% of the accounts you have. Work on the negatives, if lates reported, goodwill letters to creditors. If collections or charge offs, contact them and offer a pay for delete-some will oblige others won't.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage Scores

The "mortgage scores" are just an older generation, not a mortgage-specific algorithm.

More detail:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage Scores

@DollyLama wrote:Agree with Semo, utilization is extremely high. Excessive inquiries in last 12 months alone, so you are a big credit seeker and new tradelines. Do not apply for any more credit, these inquiries will age off at a year on general FICO 8 scores, mortgages might look at past 2 years. When bringing down the utilization total aggregate under 29% minimum, start PIF before statement cuts on these cards, way too many cards are carrying balances, in excess of 50% of the accounts you have. Work on the negatives, if lates reported, goodwill letters to creditors. If collections or charge offs, contact them and offer a pay for delete-some will oblige others won't.

I agree the debt is high but the inquires are only 3 in the last 12 months. The rest are 1-2 years old. Do I really need to pay off the old debt? It is 5-6 years old. It will dropping off soon.

Transunion - 686 (1Y5M AA, 30 INQ)

Equifax - 726 (3Y1M AA, 4 INQ)

Total Credit Lines: $99,387

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage Scores

In my case, it was a requirement by my lender that I settled or paid in full on my collections and charge-offs that were on my report. All of mine were from 2011 and were scheduled to be deleted from my report due to age between May 2017-January 2018. Because I want the house before all of them fell off, I had to take care of them.

Besides age, it also matters how much debt is tied to the collection/charge-off and what it was for. I still have 2 medical collections on my report that will be removed due to age in December 2017, but my lender told me not to worry about those because FHA ignores medical debt.

If you want concrete advice from the lenders, realtors, and fellow homebuyers on this thread, it would be helpful if you listed each card you have along with the current balance and it's limit. If you have collections/charge-offs, it would also be helpful for you to list the date the deliquency occured, amount, and type of debt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage Scores

Transunion - 686 (1Y5M AA, 30 INQ)

Equifax - 726 (3Y1M AA, 4 INQ)

Total Credit Lines: $99,387

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage Scores

Here's the information directly from the FHA handbook regarding debt that my lender sent me.

"Thanks to FHA guidelines, the medical collections will be omitted from the file and will not have to be paid." At that time, I had $3.378 in medical collections on 4 different accounts.

Not trying to be negative, but it sounds like from what you're explaining here that FHA might be your only route. Your DTI is already high because of your credit card debt and you have collections as well. I would advise before even submitting an application to show a lender your credit report and all documents that would be submitted to underwriting such as tax forms, W2's, paystubs, 401K/403B statements, etc and being as open and honest as you can about your situation. Doing it this way will also avoid you any extra inquiries.

I can definitely relate to your situation. Back in February, when we signed our contract, my credit and scores were crap! At that time it was either my husband needed to get approved on his own or we had to walk away from a house that we loved. I spent my time on these boards and within 5 months, I was able to clean up my report to at least a satisfactory level and increase my mortgage scores by 102 points!