- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Re: Mortgage delinquencies triggered by HAMP trial...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Mortgage delinquencies triggered by HAMP trial period

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage delinquencies triggered by HAMP trial period

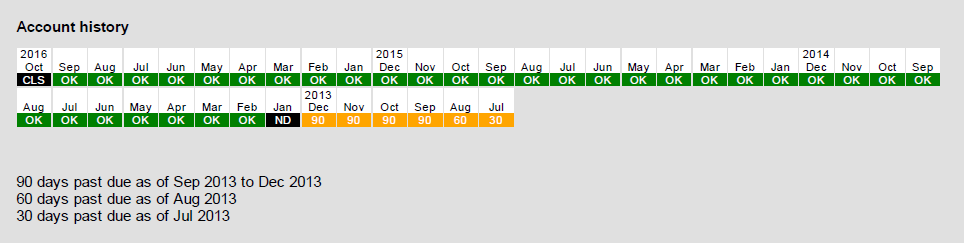

Due to financial hardship I was 30 days behind on my mortgage payment when the loan was first reported by a new sub-servicer, PHH Mortgage, in July of 2013. At the end of that month, to my great relief, I was put into a HAMP trial.

The trial period offer prescribed four reduced payments starting in September of that year. Under that offer, no payment was prescribed for July or August, and indeed any early or extra payments would have jeopardized the trial. The servicer specifically instructed me (verbally) not to make any payments until after September 1st.

I made the reduced payments exactly according to schedule starting in September, but since there was no payment scheduled for August the account was reported as 60 days late for that month. Since the trial payments did not satisfy the original monthly payment amount the loan was escalated to 90 days late in September. It was reported as 90 days late for the months of October through December as well, until a permanent modification thankfully went into effect in January 2014.

I have no issue with the servicer's reporting of the loan as 30 days late in July 2013; it is a fact that I missed the June payment.

I have attempted to challenge the servicer's escalation to 60- and 90-day late status for the later months, insofar as I made all subsequent payments precisely according to the trial period agreement and the servicer's instructions. I have filed multiple disputes with the various credit bureaus as well as a CFPB complaint on this matter but have made no headway.

So... is there any legal / procedural basis for my position? Have others had any relevant experiences, with PHH or other servicers?

And if anyone believes that my position may be correct, is there a recommended course of action?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage delinquencies triggered by HAMP trial period

the lates are a result of not paying according to the original promissory note.... not the hamp payment plan.

it is the only way to measure you for risk.

it is also a deterrent for some people who would try to game the system for reduced pmts/interest charges.

the servicer is correct if they calculate your late pays based on the original promissory note.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage delinquencies triggered by HAMP trial period

Thank you for your explanation.

> the servicer is correct if they calculate your late pays based on the original promissory note.

Is it that cut and dry?

I seem to recall the previous administration making a big push on this at one point.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage delinquencies triggered by HAMP trial period

i dont think the reduction plans void the original promissory note.

but i am no expert on that. never seen the paperwork.

i just know i have heard this exact story over and over

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage delinquencies triggered by HAMP trial period

I have the same thing on my report, only I had to gt to 60 days before Chase would help. So I have a couple each of 60, 90 and 120 (ouch!). However, we did NOT pay them as we agreed. Yes, it stinks, but we were living on credit cards in order to pay the really high payments. We were able to reduce the pymts by $500 and havent missed any pymnts in 3+ yrs. The lates arent really impacting our scores much. Have almost all that debit paid off too. In the end, I called it a win.