- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Mortgage score debacle

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Mortgage score debacle

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage score debacle

Riddle me this, my Equifax FICO is 741 but the mortgage FICO is 678. On the same report Experian FICO is 731 (10 less than Equifax) but the mortgage FICO is 712, 34pts higher. How in the world is that possible?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage score debacle

Each of the scores uses different algoriums - they measure different attributes within your credit report. Go to the top of the mortgage section and it will tell you briefly, in the stickies, about the mortgage score or at least what we know about it (which is not much).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage score debacle

Thanks for the input. The "stickies" stink as they say I have too much CC debt utilization at 3% they claim. Laughable.

@StartingOver10 wrote:Each of the scores uses different algoriums - they measure different attributes within your credit report. Go to the top of the mortgage section and it will tell you briefly, in the stickies, about the mortgage score or at least what we know about it (which is not much).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage score debacle

@tjmolly wrote:Thanks for the input. The "stickies" stink as they say I have too much CC debt utilization at 3% they claim. Laughable.

@StartingOver10 wrote:Each of the scores uses different algoriums - they measure different attributes within your credit report. Go to the top of the mortgage section and it will tell you briefly, in the stickies, about the mortgage score or at least what we know about it (which is not much).

The mortgage scores weigh installment debt heavily. Do you have student loans or vehicle loans and are they close to their full amounts that you originally borrowed? That alone will drop your score.

Is this first post in this thread the one you read? http://ficoforums.myfico.com/t5/Mortgage-Loans/FICO-scores-used-for-mortgage-and-where-to-obtain-the...

I don't see where 3% is too much credit card debt at all. Do you remember which post stated that?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage score debacle

It dings collections harshly also, my points were a good 50pts or more lower on mortgage vs FICO over a $34 medical. You have any of those on your bureau, regardless if it is a very small amount?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage score debacle

@StartingOver10 wrote:

@tjmolly wrote:Thanks for the input. The "stickies" stink as they say I have too much CC debt utilization at 3% they claim. Laughable.

@StartingOver10 wrote:Each of the scores uses different algoriums - they measure different attributes within your credit report. Go to the top of the mortgage section and it will tell you briefly, in the stickies, about the mortgage score or at least what we know about it (which is not much).

The mortgage scores weigh installment debt heavily. Do you have student loans or vehicle loans and are they close to their full amounts that you originally borrowed? That alone will drop your score.

Is this first post in this thread the one you read? http://ficoforums.myfico.com/t5/Mortgage-Loans/FICO-scores-used-for-mortgage-and-where-to-obtain-the...

I don't see where 3% is too much credit card debt at all. Do you remember which post stated that?

They do? EQ FICO 5 and TU FICO 4 flatly ignore it (as does EX FICO 3 not that we care about that score for mortgages) from multiple people's data.

EX FICO 2 is the only one out of the scores used for mortgage to my knowledge which has ever produced shifts for anyone on installment utilization, and I'm not entirely positive but I don't think the reason code even exists in FICO 04 models (EQ FICO 5 / TU FICO 4).

Edit: Also 3%? Did we slip a 0 off it as I do know 30% gets bandied around (though my data you want <10% aggregate on mortgage scores certainly).

Edit x2: TJ - Welcome to my world of having a tax lien. My FICO 8's were all north of 730 at the time, but my original mortgage pull was 700, 731, 722 (EQ, TU, EX respectively).

Fact is the algorithms are different and EQ apparently weights some things more heavily than others.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage score debacle

@Revelate wrote:

EX FICO 2 is the only one out of the scores used for mortgage to my knowledge which has ever produced shifts for anyone on installment utilization, and I'm not entirely positive but I don't think the reason code even exists in FICO 04 models (EQ FICO 5 / TU FICO 4).

I do see "The remaining balance on your mortgage or non-mortgage installment loans is too high." as a reason code for TU4 right now. (Not that it's making that much of a difference: >90% installment util, multiple TU HPs, and two <6 month-old new accounts and TU4 is still at 788 right now... but the reason code IS there - popped up right after opening the first of two new auto loans.)

Oddly, EX2 does NOT currently report that reason code, and is currently 11 points higher. (One point away from where myFICO "helpfully" starts hiding reason codes...)

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage score debacle

@iv wrote:

@Revelate wrote:

EX FICO 2 is the only one out of the scores used for mortgage to my knowledge which has ever produced shifts for anyone on installment utilization, and I'm not entirely positive but I don't think the reason code even exists in FICO 04 models (EQ FICO 5 / TU FICO 4).I do see "The remaining balance on your mortgage or non-mortgage installment loans is too high." as a reason code for TU4 right now. (Not that it's making that much of a difference: >90% installment util, multiple TU HPs, and two <6 month-old new accounts and TU4 is still at 788 right now... but the reason code IS there - popped up right after opening the first of two new auto loans.)

Oddly, EX2 does NOT currently report that reason code, and is currently 11 points higher. (One point away from where myFICO "helpfully" starts hiding reason codes...)

Mind sharing all the reason codes for the suite of 3B pulls presumably? Possible it wasn't in the dirty buckets unlike FICO 8/9 where it appears to function similarly for everyone. I don't have it in my now cleanish files but there's still some minor things wrong with my files keeping me from the upper eschelons of credit scoring.

I never saw a reason code on EX2, I did explicitly get a score shift every time I tested though as did jamie and others.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage score debacle

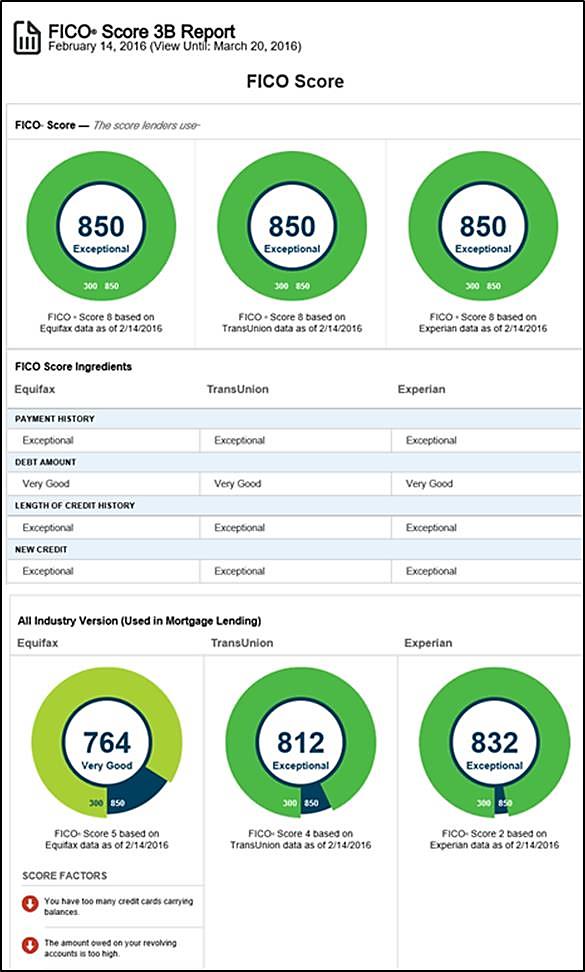

@tjmolly wrote:Riddle me this, my Equifax FICO is 741 but the mortgage FICO is 678. On the same report Experian FICO is 731 (10 less than Equifax) but the mortgage FICO is 712, 34pts higher. How in the world is that possible?

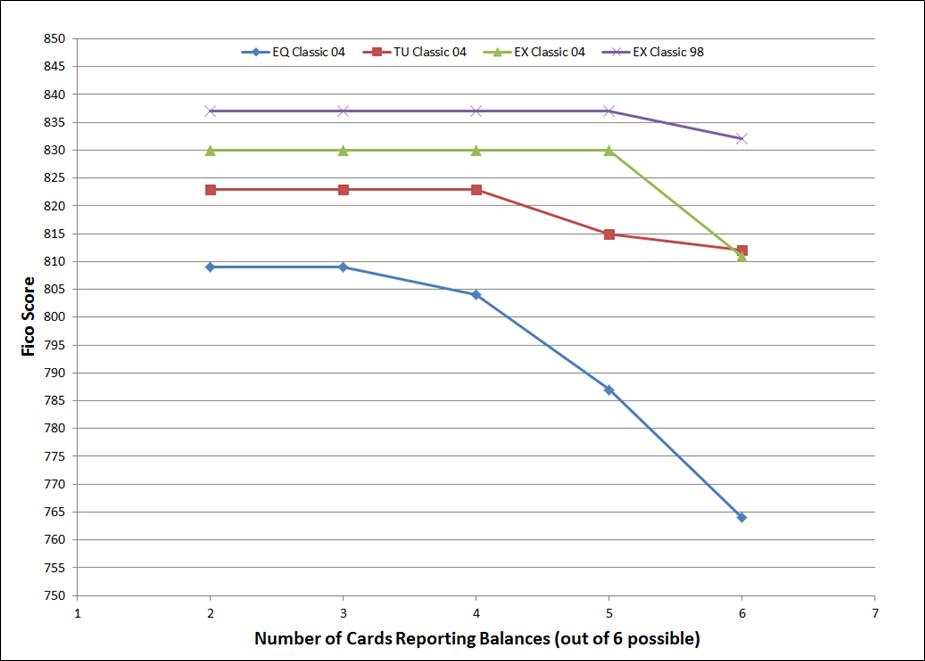

It could be the # of credit cards reporting smack down. My experience (validated by multiple tests with repeatable results) is EQ has tweaked their Fico 04 model (used for mortgages) to severly punish clean profiles that report balances on multiple credit cards (dirty profiles to a lesser but still significant extent) relative to TU and EX. The same is true for Fico 8 but, much more muted.

How many cards do you have and how many reported non zero balances for the above? Cards reporting is just one of many possibilities for the difference. However, for me, it is THE only set of circumstances where my EQ Fico 04 falls over 80 points below my EQ Fico 8. That only happens when 100% (6 of 6) of my cards report balances. Score between the EQ models wat 5 of 6 reporting was still severe (over 60 points) at 5 of 6 reporting (850 vs 788).

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage score debacle

@Revelate wrote:Mind sharing all the reason codes for the suite of 3B pulls presumably?

Sure.

As of this weekend, with EQ5:772, TU4:788, EX2:799 (and in the same pull, FICO8s at 844/845/850):

"You opened a new credit account relatively recently." - EQ5/TU4

(Yup, two very new auto loans!)

"You've recently opened too many new credit accounts." - EQ5/EX2

(Ditto...)

"You have too many credit accounts with balances." - EQ5/TU4/EX2

(Yup, 7/9 cards (including AUs) with balances reporting - PIF but not before statement cut. As TT mentions, #/% of cards reporting a balance does have an outsized effect on EQ5.)

"You have too many credit cards and/or open-ended accounts carrying balances." - EQ5

(Ditto...)

"The remaining balance on your mortgage or non-mortgage installment loans is too high." - TU4

(Yup, one current mortgage at 94.88%, auto loan at 89.58%, auto loan at 94.59%, overall at 94.42%)

"You've recently been looking for credit." - TU4/EX2

(EQ:1, TU:4, EX:1 - with the four on TU probably de-duped to 2.)

Reason codes for most of the other models are being "helpfully" hidden by myFICO (get within 50 points of nominal max on a model, and you just get "Because your score is high, negative score factors present with your score are less relevant and therefore not provided.").

The Auto versions of EQ5/TU4/EX2 at 781/815/824 do show reason codes, with Auto-TU4 also including the same "The remaining balance on your mortgage or non-mortgage installment loans is too high." reason code. (Also, to my great amusement, "You have a short credit history." - AoOA is 21y2m... true, AAoA is only 7y9m with the new loans, but still!)

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06