- myFICO® Forums

- Types of Credit

- Mortgage Loans

- NFCU 0 down, no PMI closing cost sticker shock

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

NFCU 0 down, no PMI closing cost sticker shock

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NFCU 0 down, no PMI closing cost sticker shock

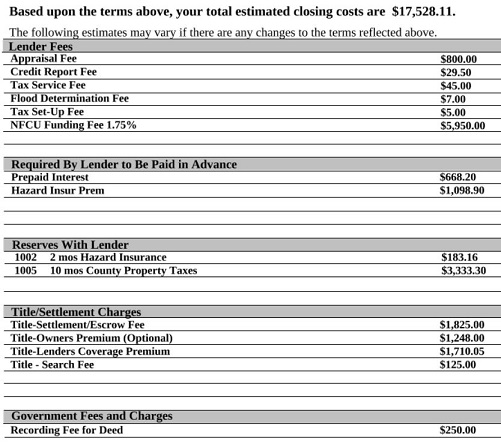

So today I finally received the Pre approval from NFCU. $340K and I was feeling pretty good since we were looking at a couple properties on Saturday. That is until I started reading the documents online and there on the estimated closing costs....... $18,000 and the rate was darn near 6%. Needless to say, I was dumbfounded. Am I wrong to think that $18K is way too much?

12/27/16 - Eq683 TU666 Ex681 04/05/17 Eq742 TU763 Ex757

12/27/16 - Eq683 TU666 Ex681 04/05/17 Eq742 TU763 Ex757

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU 0 down, no PMI closing cost sticker shock

@oldman425 wrote:So today I finally received the Pre approval from NFCU. $340K and I was feeling pretty good since we were looking at a couple properties on Saturday. That is until I started reading the documents online and there on the estimated closing costs....... $18,000 and the rate was darn near 6%. Needless to say, I was dumbfounded. Am I wrong to think that $18K is way too much?

To me 340k home mortgage is in itself sticker shock...here that would buy a mansion with 3 pools, and enough left over to pay the butler. It is insane how high houses are in some areas of the Country. Glad I live in South Carolina where 125k will buy a nice house in a good neighborhood.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU 0 down, no PMI closing cost sticker shock

The rates are higher for 0 down and no PMI loans so that part isn't too surprising. I read a post a couple of weeks ago about the NFCU good faith estimates for closing being extremely conservative and the acutal costs being quite a bit less than the estimate. Not sure that really helps because you need to have the 19k to close anyway, can't take a chance on it being correct. Better they estimate high then low though so your not short when you go to close.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU 0 down, no PMI closing cost sticker shock

@oldman425 wrote:So today I finally received the Pre approval from NFCU. $340K and I was feeling pretty good since we were looking at a couple properties on Saturday. That is until I started reading the documents online and there on the estimated closing costs....... $18,000 and the rate was darn near 6%. Needless to say, I was dumbfounded. Am I wrong to think that $18K is way too much?

If you post the breakdown of the $18k we can see what looks out of line. As to the rate, they get a higher rate because that's how no down payment and no PMI translate to the buyer. In essessence you are paying PMI - but it is rolled up into the rate and not separated out and labeled as "PMI". The good thing is that interest is deductable. The bad thing is you can't drop your rate down without a refi. If you have PMI you can drop it when the LTV gets to 80% or less. Not possible with this type of mortgage. If you are going to be there for the long term you might want to reconsider your options.

Same thing with "no down payment" = higher risk loan = higher interest rate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU 0 down, no PMI closing cost sticker shock

WOW this is crazy. i too am looking to buy and researching for a 100% financing loan. Yiou have good scrores too from what I can see little better thabn mines should I even try???

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU 0 down, no PMI closing cost sticker shock

Let me ask, whats your annual income, since I see what you're approved amount is and i can comopare to mines. I dont trust online calculators

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU 0 down, no PMI closing cost sticker shock

@Anonymous wrote:Let me ask, whats your annual income, since I see what you're approved amount is and i can comopare to mines. I dont trust online calculators

113K a year between my wife and I. We live North of Seattle and the housing market is crazt hot right now, one house we saw today had at least 50 agent business cards on the kitchen counter.

12/27/16 - Eq683 TU666 Ex681 04/05/17 Eq742 TU763 Ex757

12/27/16 - Eq683 TU666 Ex681 04/05/17 Eq742 TU763 Ex757

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU 0 down, no PMI closing cost sticker shock

@StartingOver10 wrote:

@oldman425 wrote:So today I finally received the Pre approval from NFCU. $340K and I was feeling pretty good since we were looking at a couple properties on Saturday. That is until I started reading the documents online and there on the estimated closing costs....... $18,000 and the rate was darn near 6%. Needless to say, I was dumbfounded. Am I wrong to think that $18K is way too much?

If you post the breakdown of the $18k we can see what looks out of line. As to the rate, they get a higher rate because that's how no down payment and no PMI translate to the buyer. In essessence you are paying PMI - but it is rolled up into the rate and not separated out and labeled as "PMI". The good thing is that interest is deductable. The bad thing is you can't drop your rate down without a refi. If you have PMI you can drop it when the LTV gets to 80% or less. Not possible with this type of mortgage. If you are going to be there for the long term you might want to reconsider your options.

Same thing with "no down payment" = higher risk loan = higher interest rate.

12/27/16 - Eq683 TU666 Ex681 04/05/17 Eq742 TU763 Ex757

12/27/16 - Eq683 TU666 Ex681 04/05/17 Eq742 TU763 Ex757

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU 0 down, no PMI closing cost sticker shock

Well 6000 dollars of that is basicly points to reduce the APR by 1.75%, so your real interest rate is 7.75%. Edit..a google search revealed that the 1.75% fee is actually up front mortgage insurance premium....not points. That 5950 dollars is apparently what allowed the 100% financing. The following is copy and paste from someone else being answered on the net.

The UFMIP is 1.75%. Its the same for everyone and should be listed under closing costs. It can be financed into the loan or paid up front.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU 0 down, no PMI closing cost sticker shock

Ouch.

12/27/16 - Eq683 TU666 Ex681 04/05/17 Eq742 TU763 Ex757

12/27/16 - Eq683 TU666 Ex681 04/05/17 Eq742 TU763 Ex757