- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Paying for home inspections, attorney, etc...with ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Paying for home inspections, attorney, etc...with cash

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paying for home inspections, attorney, etc...with cash

I'm in the process of buying a foreclosure, so along with an attorney and a regular home inspector I also need a company to come in and de-winterize the property so that it can be inspected (turn water back on, verify that plumbing is not leaking, etc...) and a septic inspector to do a hydraulic load test on the septic system to determine whether or not it is functioning/will function for much longer. The funds to close in our accounts are tight so we're watching every penny, but I do have some cash from a side business (buying, repairing, and selling outdoor power equipment) that I keep off the books that I want to use to pay the inspectors, attorney, and winterization company. In my GFE there is a line item for attorney fees, survey, title insurance, etc...but nothing for inspections. When we purchased our last home I didn't write the check to the attorney until about a week after we closed because that was when he sent me the invoice.

Basically, if I pay all of these professionals in cash, is that going to cause issues for me at the closing table? We are going FHA-not sure if that factors in or not. I realize that FHA does allow a certain amount of "mattress money" for closing, but I'd rather not make the process more complicated than it already is.

Lowes $17K - Capital One Quicksilver Rewards $10K

TU - 704 / EQ - 716

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying for home inspections, attorney, etc...with cash

You can pay for those outside costs from outside funds.

I don't think FHA allows for any mattress money. All the funds you use for down payment and closing have to be sourced or seasoned.

The inspections are outside of the loan process so they are not subject to the same scrutiny.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying for home inspections, attorney, etc...with cash

Thanks-what then is considered an actual "closing cost?" Obviously down payment, upfront MIP, prepaids, etc...but could I pay the title company/appraiser with "outside funds?"

Lowes $17K - Capital One Quicksilver Rewards $10K

TU - 704 / EQ - 716

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying for home inspections, attorney, etc...with cash

I am in a similar situation in that I have $5k in cash at home as "ransom" money. I know I can't deposit it in the bank but I am using it to pay for things that will not be listed as a closing cost. Inspection is one of them as well as all my food, gas, etc. I am using the rule of thumb that if it isn't listed as part of the "cash needed for closing", it shouldn't matter. I'm closing at the end of July and intend to make my car payment on July 20th in cash. I think they just need a bank statement, etc that shows verified funds in the amount equal to "cash needed to close".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying for home inspections, attorney, etc...with cash

Usually an inspection doesn't show on the closing statement since it's POC (paid outside of closing)...THe GFE is totally a different piece of work...That's just the lenders estimate of cost you may incur alongside the loan itself and for you to do a comparison on other loan products you may have considered.

Paying them in cash usually isn't an issue but it's definitely a question for your lender/loan officer or Realtor.

For our closing we paid for everything with our debit card which was attached to the same bank account the lender asked for statements for. I'm a Realtor and during the inspection at the end depending on the inspector, they usually ask for payment. I have a few that I've worked with here in MO that may do POC at times they usually ask my clients that upfront though. Remember too everything on your GFE is an estimate it's a Good Faith Estimate and sometimes estimated on the high side....In your contract did you ask for any closing cost from the seller/bank since it's a foreclosure?

On the de-winterizing, usually the bank has a company that does it, your realtor should be setting that up with the bank and it can sometimes take weeks depending on the pending contracts and amount of foreclosures in your area.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying for home inspections, attorney, etc...with cash

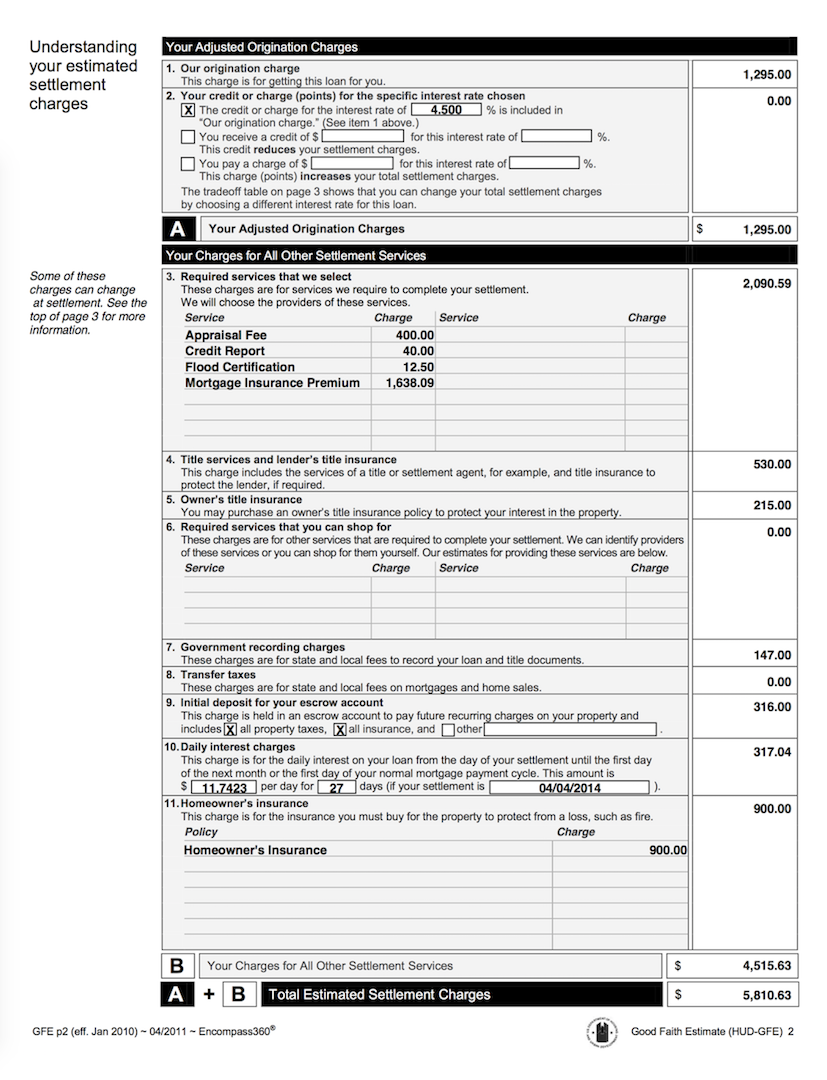

Oh and the GFE usually is lender fees...this is what ours was...in the end...since it was FHA...the MIP was rolled into the loan. The appraisal was only $275...the inspection which doesn't show here because it was a optional cost (you aren't required to get an inspection but you should) was like $300. The credit report was $25. There was no flood cert charge the lender ate it. Our seller paid 6% of our closing cost which took out the cost of the title insurance and the lender policy. Out of the total settlement charge we didn't pay anything because of the lender credits and sellers assist. We only ended up paying the required downpayment and ended up getting a check for $400 back from the lender because we paid upfront for it but it ended up on our closing sheet (pre-TRID)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying for home inspections, attorney, etc...with cash

The actual closing costs are listed on your Loan Estimate, which that document now replaces the GFE.

The items that do not appear on your Loan Estimate are typically:

1) Inspections

2) Your attorney cost (not referring to title insurance here)

The items that have to come from your bank account (per the lender) are:

1) Your down payment - and you will want to make sure the down payment comes from the account you supply to the lender. This should be the same account you paid the EMD from too and the same account should be used to pay for the closing costs due at closing. The reason for this consistency is to make sure that you have the funds sourced and/or seasoned and you don't have any hicups at the end.

2) If the seller isn't paying any portion of your closing costs and pre-paids, make sure your insurance is also paid from the same account.

As pointed out from the poster above that also is a Realtor, you can use your cash for living expenses and those closing costs not included on your Loan Estimate. this way your account will be building up funds during your loan approval because you are spending money outside of that account for your living expenses.