- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Re: Pre-Approved!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Pre-Approved!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pre-Approved!

Found a local lender and after a bit of back and forth regarding the FHA Back to Work Program I have a pre-approval: "We have you approved for an FHA loan with a sales price of $160,000. If you find a USDA eligible house we will try that program and see if we can get you approved. The pre-approval is contingent on underwriting and FHA approval, but our underwriting machine did approve your loan."

- $160,000

- Rate: 4.37% but no rate lock until I sign a purchase contract. She says the rates have been changing between 4.25% and 4.375% so fingers crossed it doesn't jump in the next 2 months!

- I was told it is very common here for the seller to pay closing costs and also the prepaids at closing. I'm waiting on the fee sheet.

They also want to see I have the downpayment funds, I think by the time I put in the purchase contract - trying to get clarification. I assume this is usual? Problem is, right now I have about $2k. I was going to add $1k in September and $2500 by October 15th so I'd have it by closing, assuming a 60-90 day time-line, but not necessarily by the time I put in a purchase contract. Of course, I don't actually want to spend $160k! That's at the very top of my comfort level. Moot I suppose if I go USDA. "Gift" funds do not need to season, correct? And it's better to get a check than a bank transfer for these? Just in case I need to . . . .

I hope it is smooth sailing from here on out.

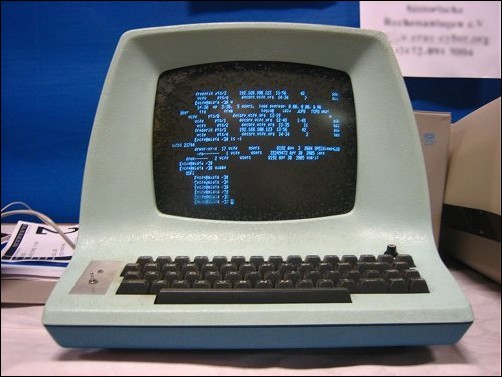

I imagine their underwriting machine looks something like this and that it speaks with the voice of Hal.

Starting Score: 2/2013 EQ 535

Starting Score: 2/2013 EQ 535Current Score My Fico: 5/23 EQ 808| EX 812 | TU 800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-Approved!

@songsofexperience wrote:Found a local lender and after a bit of back and forth regarding the FHA Back to Work Program I have a pre-approval: "We have you approved for an FHA loan with a sales price of $160,000. If you find a USDA eligible house we will try that program and see if we can get you approved. The pre-approval is contingent on underwriting and FHA approval, but our underwriting machine did approve your loan."

- $160,000

- Rate: 4.37% but no rate lock until I sign a purchase contract. She says the rates have been changing between 4.25% and 4.375% so fingers crossed it doesn't jump in the next 2 months!

- I was told it is very common here for the seller to pay closing costs and also the prepaids at closing. I'm waiting on the fee sheet.

They also want to see I have the downpayment funds, I think by the time I put in the purchase contract - trying to get clarification. I assume this is usual? i approve people all of the time 'subject to' cash to close. so this is normal. Problem is, right now I have about $2k. I was going to add $1k in September and $2500 by October 15th as long as those funds are 'acceptable' then you are fine saving up so I'd have it by closing, assuming a 60-90 day time-line, but not necessarily by the time I put in a purchase contract. Of course, I don't actually want to spend $160k! That's at the very top of my comfort level. Moot I suppose if I go USDA. "Gift" funds do not need to season, correct? And it's better to get a check than a bank transfer for these? Just in case I need to . . . .

I hope it is smooth sailing from here on out.

I imagine their underwriting machine looks something like this and that it speaks with the voice of Hal.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-Approved!

MyFICO: TU 780, EQ 785 EX 776 Discover TU FICO 780. Rebuilt from 500's....closed on home May 2015!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-Approved!

Thanks Dallas - yes, she said it the approval would be on condition of funds to close and I would need to have proof of this before it goes to underwriting so I actually wouldn't necessarily have all the time I need to save up.

It's been a while since I've done this so I'm trying to get the steps straight in my mind.

1. I have my pre-approval

2. I find a house, make an offer, its accepted. I do an inspection somewhere in here!

3. I inform the lender and provide them with the sales contract - is this the stage at which I need to have proof of funds to close?

4. An appaisal is ordered

5. Application for that home goes to UW - or is THIS the stage at which I need to have proof of funds?

are 4 and 5 reversed?

6. Loan approved - CTC

7. Close!

Starting Score: 2/2013 EQ 535

Starting Score: 2/2013 EQ 535Current Score My Fico: 5/23 EQ 808| EX 812 | TU 800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-Approved!

@peepers wrote:

I have nothing to offer advice wise, however I want to say the picture of the "underwriting machine" accompanied by the voice of Hal is epic! I literally spit diet dr. pepper on my screen. Good luck in the home buying journey!

My job here is done. Goodnight everyone ![]()

Starting Score: 2/2013 EQ 535

Starting Score: 2/2013 EQ 535Current Score My Fico: 5/23 EQ 808| EX 812 | TU 800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-Approved!

You are not pre-approved yet (or at least not properly pre-approved). You got an automated underwriting approval because your foreclosure doesn't report on your credit report as you said in previous posts. If a foreclosure occurred within 3 years, it's automatically downgraded to a manual underwrite. Since you are also applying for Back to Work, the underwriter will need a significant amount of documentation before they can approve you. So before you make an offer you should absolutely insist that the underwriter does a full review on all of your documentation to confirm you are definitely approved under the Back to Work guidelines. Any loan officer who issues a pre-approval for Back to Work without the underwriter reviewing the loan should be flicked in the forehead.

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-Approved!

@ShanetheMortgageMan wrote:. Any loan officer who issues a pre-approval for Back to Work without the underwriter reviewing the loan should be flicked in the forehead.

i agree 100%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-Approved!

@ShanetheMortgageMan wrote:You are not pre-approved yet (or at least not properly pre-approved). You got an automated underwriting approval because your foreclosure doesn't report on your credit report as you said in previous posts. If a foreclosure occurred within 3 years, it's automatically downgraded to a manual underwrite. Since you are also applying for Back to Work, the underwriter will need a significant amount of documentation before they can approve you. So before you make an offer you should absolutely insist that the underwriter does a full review on all of your documentation to confirm you are definitely approved under the Back to Work guidelines. Any loan officer who issues a pre-approval for Back to Work without the underwriter reviewing the loan should be flicked in the forehead.

Thanks Shane. Excellent point as always.

I gave them tax returns and W2s from the years I was affected by unemployment as well the last couple of years to show recovery. They also got my counseling certificate and all the usual documentation (bank statements, pay stubs etc). They asked for an LOE for the FC and paid collections as well as an LOE regarding why I have not been paying rent for the last 2.5 years. They do all UW and funding in house so she said the underwriter looked at everything, verified the loss of income, looked at the LOEs, and so on. She did make it clear that although their underwriter had "approved" and their "machine" had approved, it would still be subject to final UW and FHA approval.

I think what she's saying is that they will fund the loan if FHA approves.

I know I'm a long way from home (no pun intended), but very grateful for the support and advice of the community here!

Starting Score: 2/2013 EQ 535

Starting Score: 2/2013 EQ 535Current Score My Fico: 5/23 EQ 808| EX 812 | TU 800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-Approved!

Did you provide your job severance/income reduction paperwork too?

Only time FHA (it's actually HUD) would review is if you need to get a CAIVRS removal for a prior FHA foreclosure. So you may want to get clarification on what FHA (HUD) would actually be approving.

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-Approved!

@ShanetheMortgageMan wrote:Did you provide your job severance/income reduction paperwork too?

Only time FHA (it's actually HUD) would review is if you need to get a CAIVRS removal for a prior FHA foreclosure. So you may want to get clarification on what FHA (HUD) would actually be approving.

Yes, and I provided my unemployment benefits info and 1099Gs for 2009 and 2010.

My FC was on a conventional mortgage so no CAIVRS.

Starting Score: 2/2013 EQ 535

Starting Score: 2/2013 EQ 535Current Score My Fico: 5/23 EQ 808| EX 812 | TU 800