- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Re: Sebonic Financial for Mortgage loan?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Sebonic Financial for Mortgage loan?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sebonic Financial for Mortgage loan?

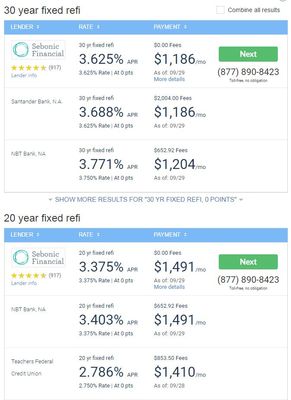

Any ever heard of or dealt with this company?

The online reviews (if legit) are very good and looking at their fees seem

quite lower than alot of other ppl (comparing w. Bankrate.com)

btw what are teachers federal CU never talked about on here?

It seems their rates beat everyone unless I'm reading this wrong

Im about to close on a 30 year SONYMA loan and thinking about

refi down the road. I noticed NFCU loans have no PMI but Sebonic rates are always

low and .. not sure why they never list fees.. hmmm

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sebonic Financial for Mortgage loan?

@Anonymous wrote:Any ever heard of or dealt with this company?

The online reviews (if legit) are very good and looking at their fees seem

quite lower than alot of other ppl (comparing w. Bankrate.com)

btw what are teachers federal CU never talked about on here?

It seems their rates beat everyone unless I'm reading this wrong

Im about to close on a 30 year SONYMA loan and thinking about

refi down the road. I noticed NFCU loans have no PMI but Sebonic rates are always

low and .. not sure why they never list fees.. hmmm

A bit late to your post but I have been trying to buy with them for over a year now. I keep getting outbid on the local level..... Anyway I just had to reapp with them again today. Down sides so far is that they aren't open on the weekend... Well my old MLO gave me his phone number and ran Pre-Approvals anytime I needed them (recently left the company). Now I'm starting over again (time since last pre-approval is too great). My cousin on the other hand refinanced with them last summer and has had no problems with them so far.

Sorry my response is so late... They do have the most reviews and some of the lowest % rates...

Updated Feb 2023:

Citi Double Cash: $26,300

Citi Costco: $33,800

PenFed Power Cash: $50,000

Chase Freedom Unlimited: $33,400

NFCU Cash Rewards: $29,000

BoA Unlimited Cash: $99,900

Wells Fargo Active Cash: $50,000

Citi AAdvantage Executive: $30,500

Wells Fargo Mortgage 30yr fixed 3.625%

Business Cards:

BoA Business Advantage Unlimited Cash: $8,000

Chase Ink Business Unlimited: $75,000

Chase Ink Business Unlimited: $75,000

RIP: EECU PLOC | BBVA PLOC | Chase SP | Chase Amazon | Chase Freedom | WF Propel | Cap1 QS | AMEX Gold | BoA Custom Cash | Lowes | Barclays Aviator Red

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sebonic Financial for Mortgage loan?

I went through an aborted refinance with them: have nothing remotely bad to say about them, at all (which is saying something given how many dumb things can go wrong even in a refinance) about their handling of my application or processing it to the point where I walked away and went the HELOC route instead.

I will certainly be considering them if I do another conventional loan when I move.