- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Streamline FHA Refinance questions (Oceanside Mort...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Streamline FHA Refinance questions (Oceanside Mortgage, NJ)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Streamline FHA Refinance questions (Oceanside Mortgage, NJ)

Hey all, I got an FHA loan in December of 2014 right before the MI reduction, so last year, I got all kinds of notes from people saying they could lower my mortgage payment.

Last week, I swore if I got another "loan reduction" letter AFTER the fed rate hike announcement I'd look into it.

I got a letter from a company called Oceanside Mortgage, NJ. They have an nmls# and an A+ rating on BBB, and seemed very friendly on the phone.

They told me they could cut my 3.75 APR to 3.25 and my MI from 1.3 to .8, saving me $209 a month. They would pay closing costs, and there would be a total of 4800 in other fees, of which, I would recieve an FHA MI credit of around 2600 leaving me with a $2200 (Due at closing) deficit. That $2200 could be either tacked on to the loan (Currently278K) or I could pay it in cash. There was no penalty to the APR for adding the 2200 into the loan. This effectively means lowering my payment by $200+ a month and paying nothing out of pocket.....

Is this too good to be true? I haven't heard of Oceanside but the light research I did, did not reveal anything nefarious.

Does anyone have any insight into this, or have any idea if there's something sketchy I should look for?

Also, I was planning to APP for Amex Platinum and BCP after Christmas, is it still ok to go ahead and app for those if I'm going to refi my house, or should I refi first?

Thanks for all the help!

CK EQ: 730 / CK TU: 735 / EXP FICO: 721 / EX Vantage: 793 / Total Exposure: 112K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Streamline FHA Refinance questions (Oceanside Mortgage, NJ)

@mccallb wrote:Hey all, I got an FHA loan in December of 2014 right before the MI reduction, so last year, I got all kinds of notes from people saying they could lower my mortgage payment.

Last week, I swore if I got another "loan reduction" letter AFTER the fed rate hike announcement I'd look into it.

I got a letter from a company called Oceanside Mortgage, NJ. They have an nmls# and an A+ rating on BBB, and seemed very friendly on the phone.

They told me they could cut my 3.75 APR to 3.25 and my MI from 1.3 to .8, saving me $209 a month. They would pay closing costs, and there would be a total of 4800 in other fees, of which, I would recieve an FHA MI credit of around 2600 leaving me with a $2200 (Due at closing) deficit. That $2200 could be either tacked on to the loan (Currently278K) or I could pay it in cash. There was no penalty to the APR for adding the 2200 into the loan. This effectively means lowering my payment by $200+ a month and paying nothing out of pocket.....

Is this too good to be true? I haven't heard of Oceanside but the light research I did, did not reveal anything nefarious.

Does anyone have any insight into this, or have any idea if there's something sketchy I should look for?

Also, I was planning to APP for Amex Platinum and BCP after Christmas, is it still ok to go ahead and app for those if I'm going to refi my house, or should I refi first?

Thanks for all the help!

Not necessarily. I am in the process of doing a streamline refi with my current lender and going from 4.25% to 3.75% and and reduced MI for a saving about $200/month. My Jan mortgage payment [less than $2k] will be applied to cost and my first post-refi payment is in February. Have you tried contacting your current mortgagor about a refi? I don't have to produce any documentation other than one month's bank statement.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Streamline FHA Refinance questions (Oceanside Mortgage, NJ)

My current lender is Wells Fargo, and like 2 or 3 months ago when I started getting the refi letters in the mail heavily, I called. They couldn't really offer me a much better rate, and I was going to be out of pocket several thousand dollars.

So to get out of this loan with a lower rate, lower monthly payment and less than 1000$ out of pocket sounds amazing.

Can I trust the BBB if they say they are legit?

Also, I've seen not to open new "debt" before applying for a house, but Im starting to travel in January and really wanted to get my AMEX Platinum by then.

CK EQ: 730 / CK TU: 735 / EXP FICO: 721 / EX Vantage: 793 / Total Exposure: 112K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Streamline FHA Refinance questions (Oceanside Mortgage, NJ)

When you spoke to Wells Fargo, did you speciricall request a streamline refi? also, things change constantly so I'd call them again and let them know that you have an offer for a refi and will likely refi the loan but you'd prefer to stay with Wf f they'd match your offer.

Personally, I don't believe in BBB ratings...or any other ratings. research the company [how long they've been in business? Are the in good standing with the licensing authority nationally? Can you find borrower complaints on the internet? What do they do with the loans they make?]

Good luck with your refi.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Streamline FHA Refinance questions (Oceanside Mortgage, NJ)

I did ask WF for a streamline refi, and she ran the numbers and it would have saved me like 100$ but cost me like 4,000.

I think the primary difference there was that Oceanside (new possible comp) would pay closing costs, except the FHA portion, and I can apply my first month payment to the closing costs.

I have heard something weird about Oceanside, someone said they messed with their escrow account. My escrow account is pretty empty, it just paid my property taxes and I think I have an overage of like 350$.

Perhaps I could call wf with a specific quote that I got from Oceanside and see if they'll match?

CK EQ: 730 / CK TU: 735 / EXP FICO: 721 / EX Vantage: 793 / Total Exposure: 112K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Streamline FHA Refinance questions (Oceanside Mortgage, NJ)

So update, I just called WF and they said there was no way they could match the 3.25% apr (i have 3.75) now. The CSR was like, but keep in mind, you get online banking with us, which is really good, and you don't know if the new company will have online banking.

I'm like, no online banking is worth 210$ a month lol.

CK EQ: 730 / CK TU: 735 / EXP FICO: 721 / EX Vantage: 793 / Total Exposure: 112K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Streamline FHA Refinance questions (Oceanside Mortgage, NJ)

That 3.25% seems awefully low so some of that $4k may be buying down the rate. Did you receive a disclosure form showing the fees and how they are being applied? WF's response cracks me up. What dolts!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Streamline FHA Refinance questions (Oceanside Mortgage, NJ)

I havent recieved a fee sheet showing me yet what was doing what, but i will definitely ask for it.

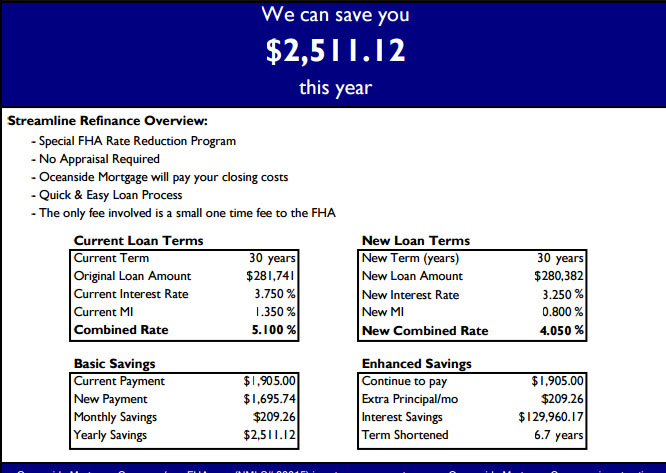

What I got was a breakdown of the original loan terms and the savings. it was given to me in a pdf, customized to my plan but we haven't gotten to the pull credit or fee breakdown yet.

But i'm definitely interested in knowing WHAT questions I should be asking, because I definitely don't want to get taken advantage of

Here's a copy of what I got.

CK EQ: 730 / CK TU: 735 / EXP FICO: 721 / EX Vantage: 793 / Total Exposure: 112K