- myFICO® Forums

- Types of Credit

- Mortgage Loans

- USDA Guaranteed Loan Without Spouse

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

USDA Guaranteed Loan Without Spouse

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USDA Guaranteed Loan Without Spouse

Hello! Looking at houses in the USDA area and I have a question about qulifying without spouse.

I need to qualify using my own credit history. I have solid scores ~740. Income 75k. Monthly debts $300. Also, have a car loan that will have less than 8 payments by closing so I assume that wont be included in the debt calculations.

When we include my spouse's income, we still meet the income qualifications for USDA. My wife's student loans in deferment and her car payment kill our combined DTI ratio and this is why I would need to qualify alone. This is where my question comes in...Is it true that since we are in TX (a community property state), USDA will still count my wife's debts even if I apply alone??

If USDA is not an option, I may need to look at Navy Federal 100% financing w/ no PMI. If I wait until next spring, I could have enough saved to go 5% down conventional. New build home prices are rising so fast in Houston, it's looking very attractive to go 100% financing today rather than wait to do a conventional. Plus I won't have to go through the hassle of saving nearly $20k. All the communities I have been looking at have all had price increases in the least 2 months averaging $12-15k. YIKES!!

Any help is greatly appreciated!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USDA Guaranteed Loan Without Spouse

If the car loan's payment is less than $100/mo, then with 8 payments or less, it should be excluded from the debt ratio. If it's $100/mo or more then it's underwriter's discretion if it'll be excluded or not.

You are correct that in a community property state, with USDA financing, your wife's credit will be checked, and her debts will be included in what you can qualify for by yourself. Can you not add your wife to the loan? What is her credit like?

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USDA Guaranteed Loan Without Spouse

Thanks for the info Shane. Adding my wife is problematic because her income is only ~25k, but she has a large balance of student loans in deferment. As well as other debts that severely reduce the amount of home we would qualify for. We qualify for much more house (which is a need due to kids) when I qualify alone. (Assuming they don't count my car payment that's winding down)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USDA Guaranteed Loan Without Spouse

Her income may outweigh her monthly payments. Have you run the numbers both ways?

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USDA Guaranteed Loan Without Spouse

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USDA Guaranteed Loan Without Spouse

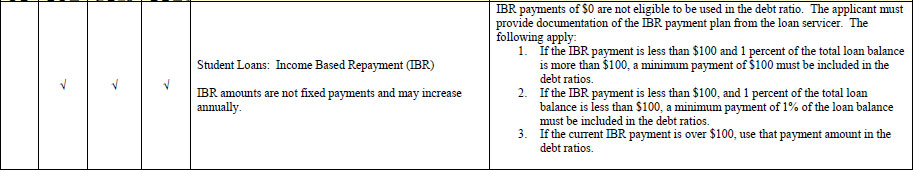

If you can get a letter stating they'll be on IBR then $100/mo is what should be used.

USDA guidelines on IBR student loans are:

Located in Southern California and lending in all 50 states