- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Understanding the Loan Estimate (LE) - Part I of I...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Understanding the Loan Estimate (LE) - Part I of II

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Understanding the Loan Estimate (LE) - Part I of II

If you have applied for a mortgage on or after 10/3/15 you may have noticed you did not receive a Good Faith Estimate (GFE) or Truth-in-Lending (TIL) and instead received something called the Loan Estimate (LE). This change was put into place by the Consumer Financial Protection Bureau (CFPB) when they combined the Real Estate Settlement Procedures Act (RESPA) and Truth in Lending Act (TILA) disclosures. The primary goal of integrating them is for the consumer to have a better understanding of the loan they are applying for. While the previous GFE only told you a part of the picture, the new LE goes over the terms of the loan, the fees associated with the loan, and tells you how much money you need to bring in at closing (or are getting back). It’s pretty good and much better than what consumers were given before, although not perfect.

If you are getting close to closing, or have already gone to closing, you may have noticed a change in that process too. That is because an additional disclosure is required to be sent to you 3 days prior to consummation of the loan (signing the final loan docs in front of the notary), which is called the Closing Disclosure (CD). There is the Initial CD (the one that starts the 3 day waiting period) and then the Final CD (replaces the Final HUD-1 settlement statement). If the Initial CD’s APR varies by .125% or more from the Final CD, a prepay penalty is added, or the loan program is changed then a new Revised CD needs to be disclosed and another 3 day waiting period must elapse before the Final CD can be signed.

This will be broken into two parts, so this is Part I, otherwise it'd be too many pages of information at once. Part II, regarding the Closing Disclosure (CD), can be found at http://ficoforums.myfico.com/t5/Mortgage-Loans/Understanding-the-Closing-Disclosure-CD-Part-II-of-II....

The LE needs to be sent to you within 3 days of the loan originator receiving 6 pieces of information: full name, income, social security number to check credit, the property address, estimate of the value of the property, the mortgage amount being requested. Nothing more is needed to get a LE and the loan originator cannot ask you for anything more in order to issue you an LE (although more can be asked for if you want to actually get pre-approved or approved). You still need to meet the loan programs requirements though, so for example if you have a 499 credit score and are applying for an FHA loan then you won’t get an LE because FHA can’t do scores below 500 (or if the lender you are applying with requires a 620 score and you have a 619 score, etc.). You will get a statement of credit denial instead. Because of the limited amount of information that triggers the requirement for a consumer to have to be sent a LE, it will and already has resulted in inaccurate LE’s being disclosed to consumers. The reason being is there is only 3 days for all possible fees to be researched and disclosed to you on the LE. If time runs out before all of those fees from the actual parties who will be providing services can be obtained then you will get “generic” or “standard” fees for the area disclosed to you on the LE. It should be close, but won’t be exact. Don’t worry though, because your loan officer can still provide you a more accurate funds to close calculation, but won’t be able to provide a more accurate LE (believe it or not, when finding out the actual fees being charged by various parties to the transaction, the government says that isn’t a valid situation for the consumer to receive a new Loan Estimate – as in it’d be a violation for the lender to do it). The Initial CD will have the accurate fees though.

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding the Loan Estimate (LE) & Closing Disclosure (CD) - Part I of II

LOAN ESTIMATE

So now that you have received your LE let’s go over it, or one that the CFPB has provided as an example at http://www.consumerfinance.gov/know-before-you-owe/compare/.

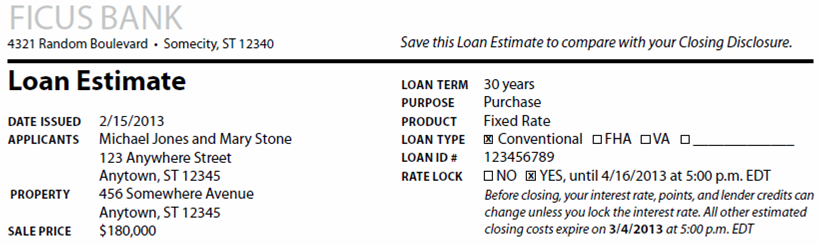

Page 1

The top left section of it looks like the below with the lender name (it can be blank if the loan is being brokered and the lender is unknown at the time the LE is disclosed), address, the date the loan estimate is issued, name, address and sales price (or estimated value if it’s a refinance). The information in the top right is more important, telling you how long the loan is for, what the loan is for (Purchase, Refinance, Construction, Home Equity, etc.), what type of loan it is (Fixed Rate, 5 Year Interest Only, 5/1 Adjustable Rate, etc.). If there is a loan number already known, and if the interest rate is locked and if it is when does it expire. There is also another date listed, 3/4/13 in the below example, where the other closing costs expire, and that needs to be at least 10 business days from the date the LE is issued.

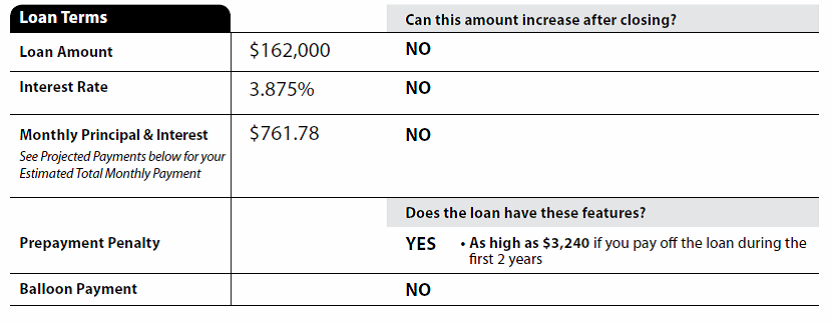

The next section below has the detailed loan terms, loan amount, interest rate, monthly P&I payment, if there is a prepay penalty or balloon payment. It also indicates if any of those can increase, such as if it was a negative amortizing loan then the loan amount could increase, or if it was an adjustable rate then the interest rate could increase (along with the monthly principal & interest). If the interest rate & monthly principal & interest payment will increase, it will also say how often it’ll adjust (e.g., every 3 years), how high it can go (12% in year 15), and will reference an additional disclosure on page 2 for more details, the same for the payment too (e.g., can go as high as $2,000 in year 15), if it’s interest only it would say “only interest and no principal” until year 6, and will also reference an additional disclosure on page 2 for more details.

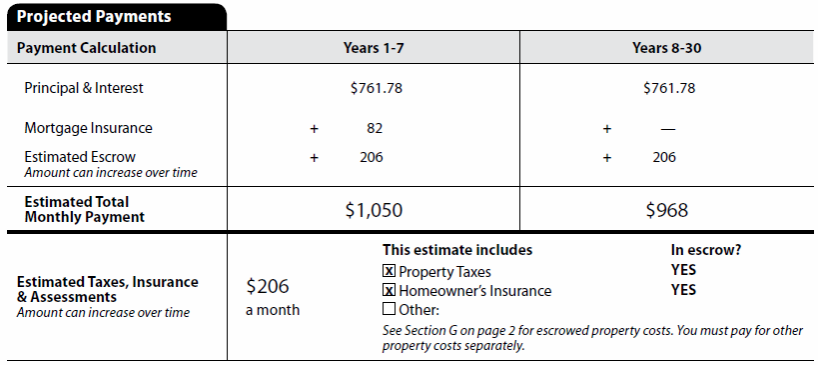

The next section will have the projected payments (should just be 1 column if it’s a 30-year fixed with no PMI), or if it’s an ARM, interest only, negative amortization, has PMI, or other features then there can be up to 4 columns (ex. Years 1-5, 6-8, 9-11, 12-30), you can see below the loan has PMI for 7 years and then it drops off. It also has an escrow account the entire time. If there was no escrow account then that spot would be blank too like the PMI is in years 8-30, but it would still list them below, and it would say “No” next to “In escrow?”. I’m actually pretty amazed at how clear this information is.

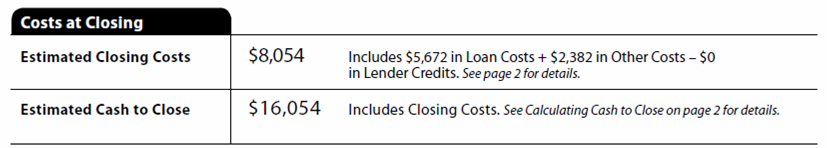

The bottom section shows how much the total closing costs and how much you need to bring in at closing (which is usually not correct, due to various positive/negative credits that appear on the CD that do not get disclosed on the LE). It’s further broken down on page 2.

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding the Loan Estimate (LE) & Closing Disclosure (CD) - Part I of II

Page 2

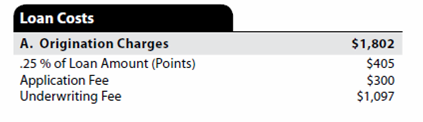

The first section A are the fees being charged by the lender for the loan. Any discount points you are paying to “buy down” the rate are listed first. Then the lender fees in alphabetical order. You’ll notice these fees are rounded up to the nearest whole dollar. Percentage amounts will be 2 or 3 decimal places. These fees shouldn’t change unless your interest rate isn’t locked. Once it’s locked you’ll be re-disclosed a new LE with the locked in terms, and then these fees should no longer change unless something else changes with the loan (value comes in different than expected, loan amount or credit score changes, etc.)

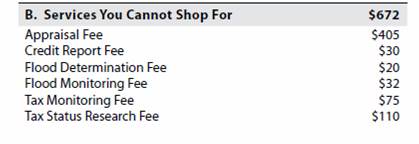

Section B are items the lender is requiring regarding your loan and you cannot shop for these services. These services will be selected for you and the costs being listed should be no less than the actual charges. If you have any sort of upfront mortgage insurance premium (such as FHA, VA, USDA and some conventional) then it would be listed in this section.

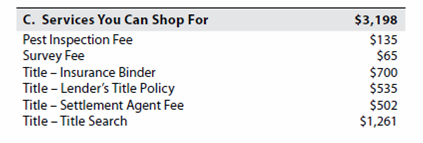

Section C are items that you can shop for, meaning you can choose the service providers. The estimates listed here will be for a service provider(s) listed on an additional “Settlement Service Provider Disclosure” which accompanies the LE. You can see a lot of them come from the title company, so if the title company being used on your transaction cannot provide those fees in time for the loan originator to disclose then the standard local fees that I previously mentioned will be used instead. Same for the survey & pest inspection (septic, water, foundation inspection, etc.). The lenders title policy fee may be higher than actual, because it should not reflect any discounts should you opt not to obtain an owners title policy. So if you opt for the owners policy then the lenders title policy fee may be less (inquire with your loan officer or title officer). Any title fees have to say “Title” front of the fee.

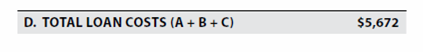

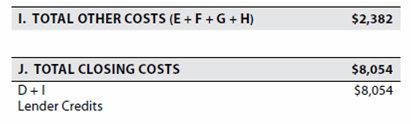

Section D totals those up, as those are the actual closing costs related to the loan.

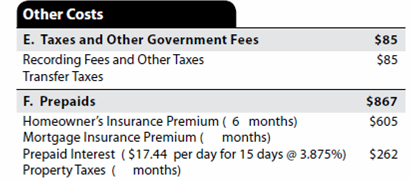

Sections E & F are for recording fees (applicable pretty much everywhere), transfer taxes (sometimes applicable), and the items you will prepay at closing – such as the 1st year of homeowners insurance, the # of days of interest leading up to when your 1st mortgage payment starts covering the interest, and property taxes such as in the situation where the next installment of property taxes will be due before your 1st payment is due.

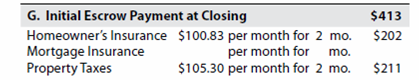

Section G is if you will have an escrow account for property taxes and/or homeowners insurance. It’ll say the monthly amount and how many months are being collected for at closing. Not to get into it too deeply, but the way it’s calculated is you take how many months are due when the taxes (or insurance) is due. Let’s do insurance since that’s always paid in 12 month installments. Then you subtract how many payments you will make until it’s due again. On a purchase it’s usually 10 or 11 (can vary depending on the lender), so you would be 1 or 2 months shy. That amount + up to a 2 month cushion (it’s always a 2 month cushion) is how many months would be deposited into the escrow account at closing. Same thing on property taxes, you just need to know when they are due, how many months it covers, and how many months of payments you’ll make before they have to be paid.

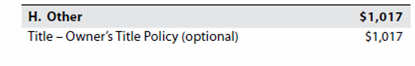

Section H is for other fees, such as the owners title policy which isn’t a requirement for the loan but something that buyers often get. It won’t be listed on refinances. Other items could be HOA transfer charges, real estate commissions, warranties, etc (anything that the loan originator is aware of at the time of preparing the LE).

Section I & J just total everything up.

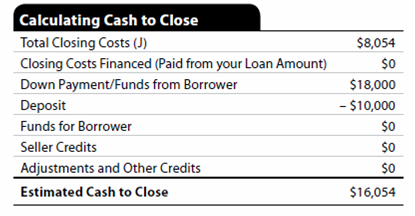

Then at the bottom right corner it shows the cash to close calculation, or sort of. This is the section where certain credits won’t likely appear, such as a seller tax credit, or a credit you have to give the seller, or the aggregate adjustment on the escrow account (the difference between the lender's desired reserves and the amount they can legally collect from you). That is why this cash to close figure won’t be accurate and your loan officer can provide you a more accurate figure. But remember this is still an estimated figured, the actual figure won’t be known until the CD is prepared. This section will show the total closing costs from the LE, the total down payment you need to come in with, any money you’ve already put in, any closing cost credit from the seller, and it has a spot for other adjustments/credits but I haven’t seen that be used yet.

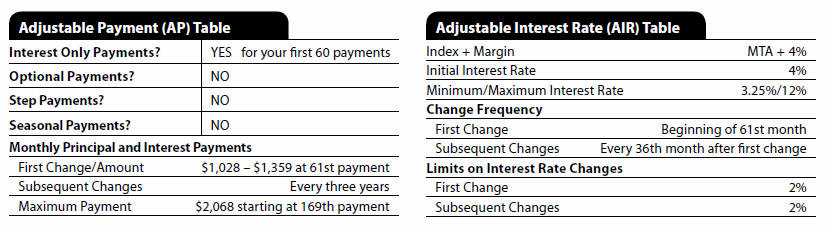

If you are getting a mortgage where the payment or interest rate will adjust then the below tables will be completed. The AP table will say if it’s interest only, optional payments, step payments, seasonal payments, when the payment changes, how often, and the max it can go to. The AIR table shows you what the current index is and your margin (index + margin = interest rate when it starts to adjust), your initial fixed interest rate, the min/max interest rate, when it will first change, how often it will change afterwards, and the limits on how much the interest rate can change when it does change.

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding the Loan Estimate (LE) & Closing Disclosure (CD) - Part I of II

Page 3

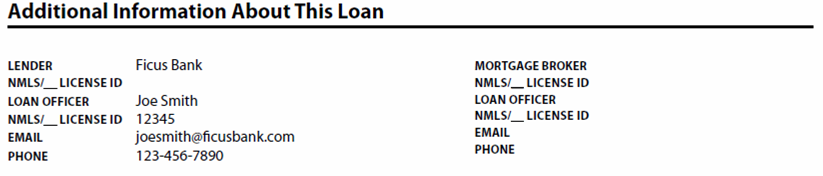

Top of page 3 will have the lenders name and loan officer as well as the mortgage broker’s information (if the loan is being brokered).

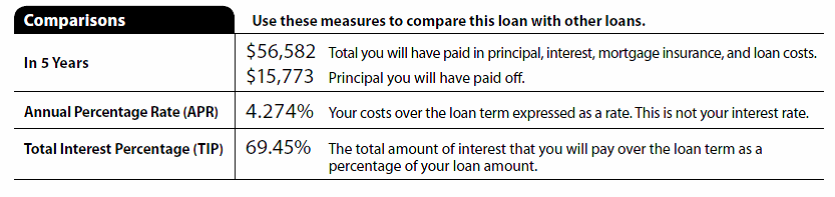

These next sections replace the old Truth-in-Lending (TIL) disclosure. The first is the comparison section which allows you to compare your loan offer vs. others you have received. It shows how much you will pay in the first 5 years and how much of that will have gone towards principal. It also shows you the APR (which is a combination of your loan terms + the fees being charged) as well as a brand new number called the Total Interest Percentage (TIP). The TIP is the total amount of interest you pay if you just make the minimum required payments due each month. So for example if your loan amount was $100k and you pay $50k of interest then the TIP would be 50%.

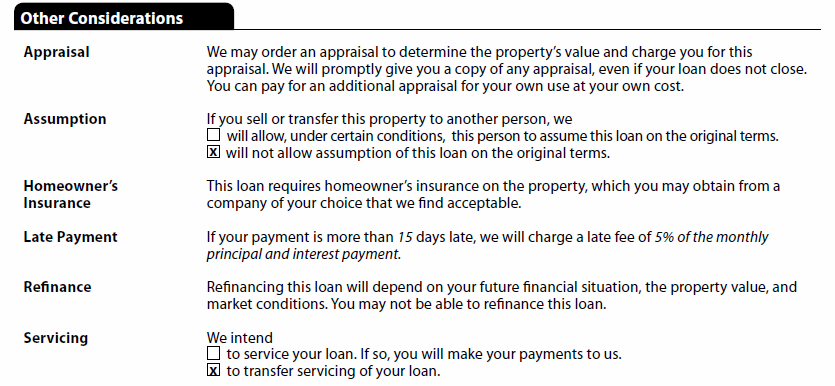

The other considerations section also discloses information about the appraisal, information about assuming the loan, informs you that homeowners insurance is required, how much the late fee will be (it should almost always say 15 days & 5%), a disclosure that you may be stuck with this loan for the rest of your life (“you may not be able to refinance this loan”), and if the lender intends or doesn’t intend to transfer the servicing of your loan to another company after closing, and other information may be listed here too (such as a notice saying you do not have to accept this loan just because you have received the LE or have signed disclosures).

The CFPB also put out an easy to follow allow explanation of the LE at http://www.consumerfinance.gov/owning-a-home/loan-estimate/.

Feel free to ask questions about the Loan Estimate here. However this should not be a thread where you post your Loan Estimate and ask “Is this a good deal for my situation?”. For those please create a new thread.

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding the Loan Estimate (LE) & Closing Disclosure (CD) - Part I of II

Thanks Shane for sharing this. I am sure someone will find it helpful...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content