- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Re: Using 401k for down payment

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Using 401k for down payment

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Using 401k for down payment

I have about $52k in my 401k and I'm 41 years old. I have the option of taking a loan or doing a hardship withdrawal.

The loan of course will need to be paid back so this will be an added bill every month whereas taking the withdrawal would just be one and done.

Any advice on whether this is a horrible idea altogether?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Using 401k for down payment

If you pay back the loan, you just have to pay back the loan (look into if you lose your job, as some employers may require the loan to be paid back within months)... but if you take a withdrawal, you pay taxes/penalties on it. Either way, you'd be missing out on the opportunity for your 401k to grow as much as it would if you kept the money there. I like the idea of using a 401(k) if you can avoid a costly mortgage, such as if it eliminates or severely reduces PMI.

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Using 401k for down payment

Thanks Shane! Glad you brought that up because my lender told me that since i don't have a 20% down payment, I will have to pay PMI and it will never end for the life of the FHA loan? I thought that was odd--why wouldn't it end once I had enought equity in the house?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Using 401k for down payment

With conventional the law says that you'll have to pay PMI until the point where your regularly scheduled payments would bring your loan-to-value down to 80% (assuming you are current on the mortgage at that time). So if you put 10% down, and then pay another 10% down on it a year later, you may still be required to pay PMI for several more years even though you've paid the balance to 80% of the value at the time you obtained the loan.

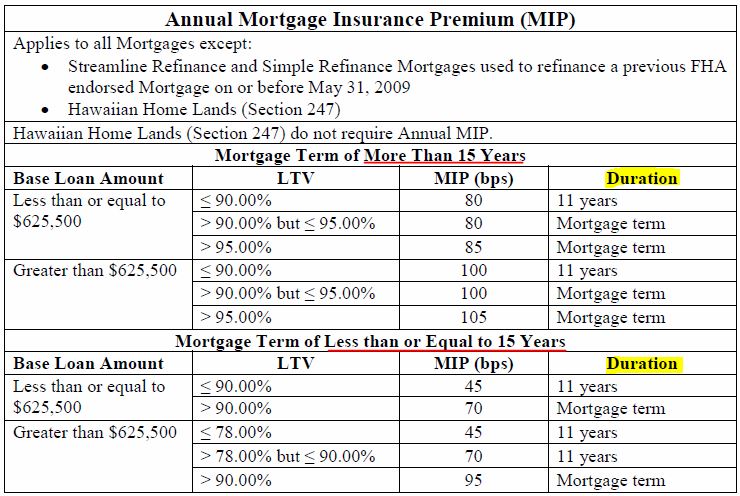

With FHA it's a bit different, depending on the term of the loan and the loan-to-value when you got the FHA loan. The chart below shows you how much the PMI will be and how long you'll have to pay it for, depending on the loan amount, the loan term (in years) and how much you are putting down. The duration is either 11 years or the life of the loan. For example if you put 10% down, it'd just be for 11 years. Less than down than that, it's for the life of the loan.

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Using 401k for down payment

So, in your opinion, would it be smarter to withdrawal half of my 401k $25k) which will allow me to pay 10% down and cover closing costs OR just borrow enough to cover 3.5% down and closing, knowing i will then pay PMI until/unless i refinance?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Using 401k for down payment

keep in mind you take that money out, you are going to have to pay the taxes on it in a year. i did that once and regretted it big time!

i have the same option as i just started the process. i cant go conv because then i would have to wait until end of year due to time period from discharge. my plan is to keep fha with the 3.5 down and refinance in a year. it'll be less than the penalty on my withdrawal, plus losing retirement funds, AND i still will get to lower my payment without MIP.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Using 401k for down payment

Oh also, I dont know that hardships can be withdrawn to use towards a DP. Buying a house doesnt categorically fit into being a hardship case.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Using 401k for down payment

It's a tough call. If you have the mortgage for longer than 11 years, then it makes sense to put 10% down on FHA. If you have it less time than that, the additional down payment will save you money (less interest & with 5% you notice a small break in the amount of mortgge insurance) but won't save you from having to pay mortgage insurance at any point of having the loan. Think about how long you will own this home for - is it a "forever" home? If so, then there may be a chance you'll have this FHA loan for a longer period of time. A couple years ago I read some information from www.realtor.com that says the average person owns their home for 6-9 years (depending on which way the market is going, holding onto it longer in down markets), I believe it was an older version of this.

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Using 401k for down payment

Thanks for all the help--it is greatly appreciated. The great thing about my company is that I can borrow for a home loan and they will allow me 240 payments to pay it back so if I take $25k, its about $104 a paycheck which would give me 10% down and enough to pay closing. That would also reduce the amount of my loan so what I'm gaining in house payment is just spent paying back my 401k BUT i would save on the PMI.

This makes my brain hurt!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content