- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Am I approaching my debt the right way?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Am I approaching my debt the right way?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Am I approaching my debt the right way?

Hi all,

Frequent poster and visitor of the CC forums, but only every so often here.

My situation is this: I have 7-8 CC's that are reporting TL's (util hovers between 0% and 2% max), out of TCL of about $29K - working on that; I just got my scores up to par for prime lenders. I will never have significant CC debt unless an emergency is at hand, but I do have a couple thousand in savings for that scenario. I have a beneficiary IRA handled by Merrill Lynch and a 401K at work that is 4%/4%, which of course I take advantage of.

Outside of that, I have 2 installment loans. One is my auto loan with Navy Fed for 5% (recently refi'd), which only has a balance of $5.8K. The other is a much larger student loan for my undergraduate degree, totaling about $38K. Both are totally manageable for me. When I refi'd with Navy, I took my loan from 60 months (already had paid 14 installments, was w/ GM Financial at 11.25% due to my awful scores. My only saving grace was I put $8K down on my car and had to finance half, or else I'd be at 17.99%+) to 34 months w/ NavyFed.

Here's my question, now that you know my situation: I really don't want a car loan, so I've been putting a little extra every month towards the required $192/monthly, rounding it up to $200. I also got a $200 credit for taking my loan to NFCU from another lender, applied directly to car loan today. As long as I have one installment loan -- with a mortgage to come, honestly about 2-3 years -- I can get my car paid off so I'm free and clear, right? Only one installment loan is required for an optimal FICO score? Or should I be attacking my student loans first? I figure with the freed up income, I can put half of that towards my student loans and really knock those out 7-10 years earlier. They are with the DOE, interest rate 4.15%, all consolidated, no private loans. My car is a 2013 reasonable make & model that's part hybrid with incredibly low mileage, so it'll last forever.

Thanks in advance!

What I have: NFCU | PenFed | General Electric CU | Wright Patt CU | Discover | BBVA | Apple Card (GS)

Total CL with Bank of America = $100,000 (Platinum Honors Merrill Client). I am a CERTIFIED FINANCIAL PLANNER™ practitioner, so feel free to message me if you have any planning/credit questions.

EQ 759, EX 765, TU 771 (06/10/2022)

I started with scores in the 400s in 2016. This forum is a Godsend--focus on the journey, be patient, and you'll definitely get there no matter the circumstances!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Am I approaching my debt the right way?

If I understand the scenario, you are planning to get a mortgage in 2-3 years. You want to know if it is OK to pay off your car early (or if this would hurt your credit score?)

You get points for having a variety of types of credit. You have credit cards an auto loan and student loans, so that should cover the variety of types of credit.

My best guess is that you will take a temporary hit when the auto loan is paid off despite the student loan still reporting. But, your DTI will be improved and you will be saving money (for the down payment on the house?)

So yes, if it were my money I would pay off the car first. Leave the student loans reporting although you can accelerate the payments if you don't have any other debt with a higher interest rate. Also, try to let just one credit card report with a 1 or 2% utilization reporting.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Am I approaching my debt the right way?

@Appleman wrote:If I understand the scenario, you are planning to get a mortgage in 2-3 years. You want to know if it is OK to pay off your car early (or if this would hurt your credit score?)

You get points for having a variety of types of credit. You have credit cards an auto loan and student loans, so that should cover the variety of types of credit.

My best guess is that you will take a temporary hit when the auto loan is paid off despite the student loan still reporting. But, your DTI will be improved and you will be saving money (for the down payment on the house?)

So yes, if it were my money I would pay off the car first. Leave the student loans reporting although you can accelerate the payments if you don't have any other debt with a higher interest rate. Also, try to let just one credit card report with a 1 or 2% utilization reporting.

Good question -- I didn't make that clear. It's not necessarily for my mortgage. I just want to know if my FICO score will take a dip if it's paid off early. I thought that all I needed was an installment loan? I need an auto AND student loan for ideal scoring?

ETA: I'm not talking about immediately paying it off. I mean if I pay it off about a year or so early.

What I have: NFCU | PenFed | General Electric CU | Wright Patt CU | Discover | BBVA | Apple Card (GS)

Total CL with Bank of America = $100,000 (Platinum Honors Merrill Client). I am a CERTIFIED FINANCIAL PLANNER™ practitioner, so feel free to message me if you have any planning/credit questions.

EQ 759, EX 765, TU 771 (06/10/2022)

I started with scores in the 400s in 2016. This forum is a Godsend--focus on the journey, be patient, and you'll definitely get there no matter the circumstances!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Am I approaching my debt the right way?

Bump --

Can anyone provide insight?

Thanks!

What I have: NFCU | PenFed | General Electric CU | Wright Patt CU | Discover | BBVA | Apple Card (GS)

Total CL with Bank of America = $100,000 (Platinum Honors Merrill Client). I am a CERTIFIED FINANCIAL PLANNER™ practitioner, so feel free to message me if you have any planning/credit questions.

EQ 759, EX 765, TU 771 (06/10/2022)

I started with scores in the 400s in 2016. This forum is a Godsend--focus on the journey, be patient, and you'll definitely get there no matter the circumstances!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Am I approaching my debt the right way?

I will reprint a section of the Share Secure Loan thread. It's from the "theory" section. It explains how there are two big categories that installment debt affects. One is Credit Mix (do you have an open installment loan?) and the other is Amounts Owed (how much of your open debt is paid off?).

========

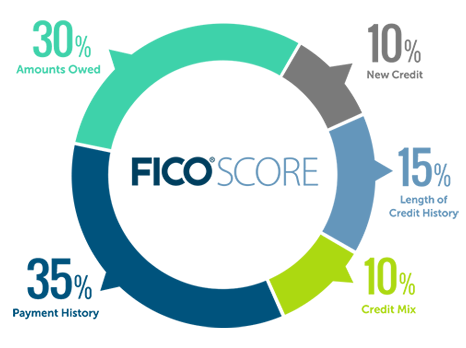

If you have no real idea how FICO scoring works, you need to first develop a big picture understanding of that. Specifically you need to understand what the five scoring groups are, and what their relative weights are. You can get that here:

http://www.myfico.com/CreditEducation/WhatsInYourScore.aspx

Be sure you have reviewed that and understand it before reading further.

Why does the SS Loan Technique work?

Let's start by remembering that, first and foremost, it helps people who have no installment loans on their reports -- not even a closed one. It also helps (though not as much) people who do have a closed installment loan, but who have no open loans.

To see the technique in action, let's assume you have no installment loans of any kind (closed or open) on your reports.

One of the five scoring groups is Credit Mix. It counts for 10% of your score. If all of your accounts are of one type (all credit cards, for example) then you get a very low number of points from this category. To get a high number of points, you want to show that you can manage a MIX of credit types. Overwhelmingly what FICO will look for first is whether you can manage both revolving credit (typically credit cards) and installment loans.

To make this really simple, almost everybody here has at least one credit card. So the bottom line is, if you want to get a lot more points from this category, you need at least one installment loan.

Furthermore, there is some evidence that, even just in the Mix category, some FICO models weigh open loans more heavily than closed loans. So the fact that the technique adds an OPEN installment loan is additional bonus.

Credit Mix (10%) is not, however, the only category that benefits. There is a factor in the much larger Amounts Owed category (30%) which also benefits. And that is something that we'll call "installment utilization" -- for a lack of a better phrase. It is a lot like credit card utilization, but it applies solely to installment debt, rather than revolving debt.

That factor measures how much of your existing open installment debt you have paid off. Here's how that factor works. You take all your current open installment loans (only the open ones -- ignoring all closed loans). You then add up all the amount you currently owe. Call that CURRENT. Then you add up the amounts that the loans were originally for. Call that ORIGINAL. Then you divide CURRENT by ORIGINAL and you get a percent. (Do you see how that is a lot like the credit card utilization calculation?) When that % is close to 100, or if you don't have any open loans at all, then you get no FICO points from this factor. But when the % is very low (say 1-9%) then you get most or all of the points from this factor.

Total installment utilization is just one factor from this big scoring category. Credit card utilization is in the category too and is more important. But still, because the category (Amounts Owed) is so much bigger than Credit Mix, installment utilization ends up giving you a lot of points, when using the SS Loan technique, in addition to the points you get from Mix. It's one reason that the technique can have a significant impact on your score -- you get help in two different areas.

In summary:

The SS Loan technique, when used by a person with no open installment loans, gives you benefit from two different scoring categories: Credit Mix and Amounts Owed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Am I approaching my debt the right way?

So if you would, read through my last post carefully. Make sure the big ideas make sense.

You will now have the tools to begin answering your own question. The student loan will meet the "credit Mix" requirement -- the auto loan is not required. (My personal opinion is that there may be a marginal Credit Mix benefit from having different sub-types of installment loans -- auto, personal, student -- but if so that is hard to prove or disprove and the advantage would be marginal anyway.)

But by paying off the auto loan it will alter your total installment utilization (TIU) -- probably causing it to go up.

So calculate your TIU as of today with all your open loans.

Then assume you payoff the car and now you have only the student loans. Calculate your TIU again using only the student loans (since the auto loan is now closed).

Circle back and tell us how much your installment utilization will have gone up, assuming you pay off the car. We may then be able to hazard a guess about possible scoring effect on FICO 8.

Finally., be aware that FICO 8 cares about installment utilization. The old mortgage models do not. Until recently, the received wisdom was that the TU and EQ morthgage models did not care at all (no difference whether your TIO was 95% or 5%). but that the EX mortgage score did care some. Since then SouthJ posted data that suggested something else. Regardless, everybody agrees that you should not expect much effect on your mortgage scores from paying down installment debt.