- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Auto Insurance Advice

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Auto Insurance Advice

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Auto Insurance Advice

While not completely credit related... I hope it is still appropriate to ask. I've had Geico for a few years, and with out any changes to my driving record my rates go up every 6 months. My last increase was $40 per 6 months (was told based on claims in the area), so I increased my deductibles to bring the price back down as I had been meaning to anyway. I originally went with them because of price in comparison with Allstate. I fortunately have not had the opportunity to see the claims process with Geico (knocks on wood). Where price used to be very important to me, I'm now leaning towards piece of mind while still being frugal. While reading reviews online, there are a few bad reviews for every good review. Is there an auto insurance company that will take care of you when you need them most?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Insurance Advice

@Anonymous wrote:While not completely credit related... I hope it is still appropriate to ask. I've had Geico for a few years, and with out any changes to my driving record my rates go up every 6 months. My last increase was $40 per 6 months (was told based on claims in the area), so I increased my deductibles to bring the price back down as I had been meaning to anyway. I originally went with them because of price in comparison with Allstate. I fortunately have not had the opportunity to see the claims process with Geico (knocks on wood). Where price used to be very important to me, I'm now leaning towards piece of mind while still being frugal. While reading reviews online, there are a few bad reviews for every good review. Is there an auto insurance company that will take care of you when you need them most?

USAA, hands down. Only caveat is you have to have military sevice in your family to qualify.

850 FICO8 since 2015, Thanks MyFICO - 5+ years since last HP

850 FICO8 since 2015, Thanks MyFICO - 5+ years since last HP

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Insurance Advice

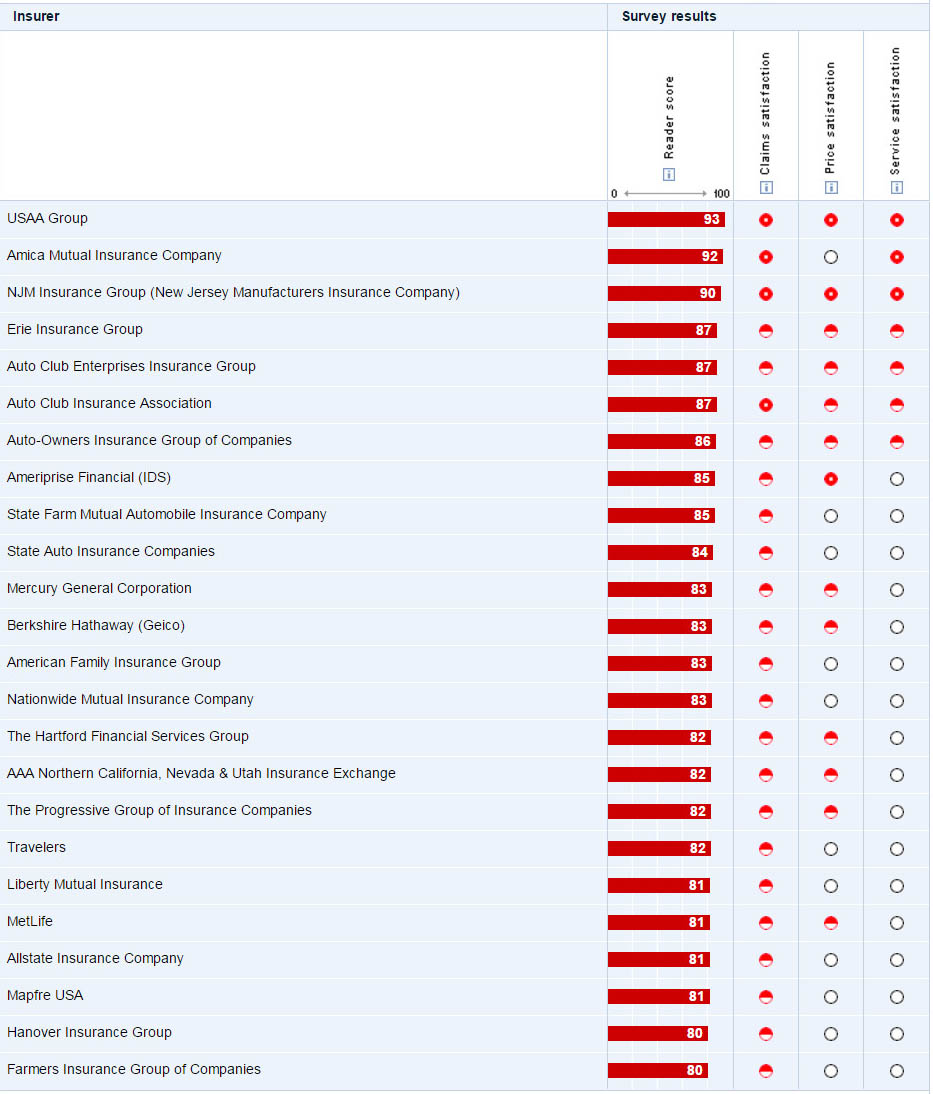

Here's some ratings from a popular consumer group. Like all national ratings, they can vary based on region. I currently have Mercury for my home and auto. I also have not needed to file a claim (10yrs), so I'm hoping they are there when I need them. I know they were half the cost of State Farm when I switched.

I do know, from personal experience, to bring your homeowners policy with you when changing auto insurers (multi-policy discount), they may require your roof to less than 7 yrs old. My roof may be older, but not leaking, hell if I'm going to buy a $12k roof to save $100 on my car insurance. LOL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Insurance Advice

@bada_bing wrote:

@Anonymous wrote:While not completely credit related... I hope it is still appropriate to ask. I've had Geico for a few years, and with out any changes to my driving record my rates go up every 6 months. My last increase was $40 per 6 months (was told based on claims in the area), so I increased my deductibles to bring the price back down as I had been meaning to anyway. I originally went with them because of price in comparison with Allstate. I fortunately have not had the opportunity to see the claims process with Geico (knocks on wood). Where price used to be very important to me, I'm now leaning towards piece of mind while still being frugal. While reading reviews online, there are a few bad reviews for every good review. Is there an auto insurance company that will take care of you when you need them most?

USAA, hands down. Only caveat is you have to have military sevice in your family to qualify.

USAA kicks ass on inurance! With the requirement being military involved they do not get credit in many insurance studies but they are awesome! I underdstand what the OP is dealing with, some years ago State Farm went up on my insurance even though I had no claims or anything but the area got Re-rated and due to the high number of people driving suspended/revoked or no license at all and the hit and run reports, they zoned my area as high risk and my rates went up. I am not permitted to have wrecks on my history and even am a driving safety abnd Emergency Driving Inctructor and they said it didn't matter....the area was rated high so everyone's insurance went up at renewal.,

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Insurance Advice

Business partner's brother owns a huge collision shop. I asked him who the best insurance company is and he said USAA... "they pay well, and pay now"

I have been a member since 06' and have had 1 claim. They paid it promptly.

Best rates last year when I bought a 2 year old SUV and shopped around. Also the benefit of logging in and seeing Banking/Credit offers. :]

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Insurance Advice

@Turbobuick wrote:Here's some ratings from a popular consumer group. Like all national ratings, they can vary based on region. I currently have Mercury for my home and auto. I also have not needed to file a claim (10yrs), so I'm hoping they are there when I need them. I know they were half the cost of State Farm when I switched.

I do know, from personal experience, to bring your homeowners policy with you when changing auto insurers (multi-policy discount), they may require your roof to less than 7 yrs old. My roof may be older, but not leaking, hell if I'm going to buy a $12k roof to save $100 on my car insurance. LOL

I remain happy with State Farm. They reward long time customers with umbrella policies. However, they do factor CBIS results rather heavily in to premiums. Not sure who they use for CBIS but, I suspect LexisNexis.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Insurance Advice

Thank you all for your help. I'm currently not eligible for USAA without some work on my end. If it were a matter of just having two generations sign up, it wouldn't be a problem at all. However the way I read it... they would need to have or had an insurance product for the next person to be a full member. Convincing two people to switch insurances (house or car) because I want them... adds complication to the mix. I started the discussion tonight and the reception went well as they are open to the idea of at least looking at rates. Fingers Crossed...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Insurance Advice

@Anonymous wrote:Thank you all for your help. I'm currently not eligible for USAA without some work on my end. If it were a matter of just having two generations sign up, it wouldn't be a problem at all. However the way I read it... they would need to have or had an insurance product for the next person to be a full member. Convincing two people to switch insurances (house or car) because I want them... adds complication to the mix. I started the discussion tonight and the reception went well as they are open to the idea of at least looking at rates. Fingers Crossed...

+1

If it helps, here's what I did...

My grandfather was in WWII, and is thus eligible for USAA. However, he's quite pleased with his arrangement with State Farm (and honestly at age 93, it would be a bit of an effort to have everything changed over at this point.)

A few years ago I got him a membership in USAA, and two years ago I helped him purchase their very least expensive jewelry policy online; if I recall correctly the price was around $35 for a year. Once that was done (I paid the one-time premium with my credit card) my father became eligible for USAA insurance. I told my grandmother to simply ignore the renewal that would come in the next year, and not to be concerned with any paperwork that might come in the mail for the policy (and I made sure to set the policy to not auto-renew on my credit card).

Note that once qualified, always qualified, so a one-time small policy is all that would be required to pass the eligibility on to the next generation. It's not necessary to disturb their current auto/home insurance arrangement if they are happy with what they have (or especially if what they already have is cheaper).

Hope this helps! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Insurance Advice

@UncleB wrote:

@Anonymous wrote:Thank you all for your help. I'm currently not eligible for USAA without some work on my end. If it were a matter of just having two generations sign up, it wouldn't be a problem at all. However the way I read it... they would need to have or had an insurance product for the next person to be a full member. Convincing two people to switch insurances (house or car) because I want them... adds complication to the mix. I started the discussion tonight and the reception went well as they are open to the idea of at least looking at rates. Fingers Crossed...

+1

If it helps, here's what I did...

My grandfather was in WWII, and is thus eligible for USAA. However, he's quite pleased with his arrangement with State Farm (and honestly at age 93, it would be a bit of an effort to have everything changed over at this point.)

A few years ago I got him a membership in USAA, and two years ago I helped him purchase their very least expensive jewelry policy online; if I recall correctly the price was around $35 for a year. Once that was done (I paid the one-time premium with my credit card) my father became eligible for USAA insurance. I told my grandmother to simply ignore the renewal that would come in the next year, and not to be concerned with any paperwork that might come in the mail for the policy (and I made sure to set the policy to not auto-renew on my credit card).

Note that once qualified, always qualified, so a one-time small policy is all that would be required to pass the eligibility on to the next generation. It's not necessary to disturb their current auto/home insurance arrangement if they are happy with what they have (or especially if what they already have is cheaper).

Hope this helps!

That helps a tremendous amount!!!!!!!!!! Thank you very much!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Insurance Advice

Started a collectibles policy as you had to have homeowners or renters to have a valuable property policy. It is through a third party.... but hopefully that is enough. We also got a quote for mobile home, (also provided by 3rd party) and they came in higher than their current rates. I'll give it a few days and then have one of my parents try to sign up.