- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- In case any of you were wondering how i do it........

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

In case any of you were wondering how i do it......

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In case any of you were wondering how i do it......

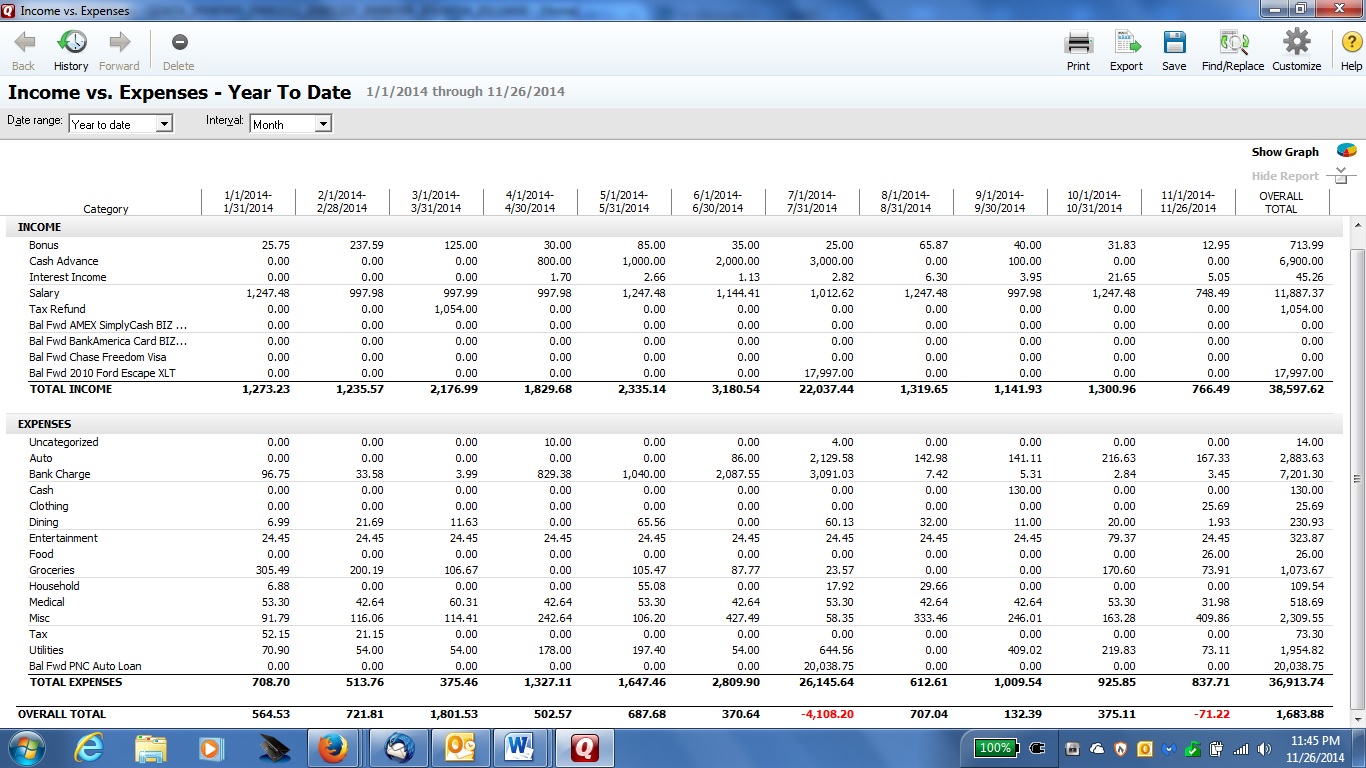

I thought I would share my spending to for you guys to see how i have been able to do everything so well with little income. Also this can be an example how to lay everything out to see where things are. I use quicken so i took this screen shot since it does an awesome job of laying everyting out.

Rebuilding Credit since 2016

Debt: Almost $80,000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: In case any of you were wondering how i do it......

I'm sorry but I can't read it.

Something is out of focus. Could be my eyes!! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: In case any of you were wondering how i do it......

It's not your eyes Marine. OP, could you maybe split it into 6 month chunks so we can see the info? Thanks

Starting Score: 515

Starting Score: 515Current Score: EQ08 711 EX08 731 TU08 735

Goal Score: 740+

Amex BCP $25k | Discover IT $15.7k | Cap 1 QS $10k | PSECU $10k | Citi DC $9300 | Citi DP $6800 | Barclay Ring $6500 | PayPal Extras MC $5045 | DCU $5000 | Chase Slate $5000 | Barclays AA $4100 | Chase Freedom $4000 | Union Plus $1000 | Target $500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: In case any of you were wondering how i do it......

Rebuilding Credit since 2016

Debt: Almost $80,000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: In case any of you were wondering how i do it......

That's pretty impressive, linux. I also have a below-average income and I don't manage anywhere near that well.

How do you do without either a mortgage or rent payments? And how do you keep utilities so low?

I don't have a mortgage, but the upgrade expenses on my fixer house get heavy some months, and between water, electric, and winter heating fuel, the costs get painful at times.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: In case any of you were wondering how i do it......

@Gunnar419 wrote:That's pretty impressive, linux. I also have a below-average income and I don't manage anywhere near that well.

How do you do without either a mortgage or rent payments? And how do you keep utilities so low?

I don't have a mortgage, but the upgrade expenses on my fixer house get heavy some months, and between water, electric, and winter heating fuel, the costs get painful at times.

living with my parents helps. ![]()

Rebuilding Credit since 2016

Debt: Almost $80,000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: In case any of you were wondering how i do it......

@linux007969 wrote:

@Gunnar419 wrote:That's pretty impressive, linux. I also have a below-average income and I don't manage anywhere near that well.

How do you do without either a mortgage or rent payments? And how do you keep utilities so low?

I don't have a mortgage, but the upgrade expenses on my fixer house get heavy some months, and between water, electric, and winter heating fuel, the costs get painful at times.

living with my parents helps.

Ohhhh, yeah, that will do it. I think I'll stick with my fixer house and higher costs, thank you. ![]() But your income and cost breakdowns are interesting anyhow.

But your income and cost breakdowns are interesting anyhow.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: In case any of you were wondering how i do it......

@Gunnar419 wrote:

@linux007969 wrote:

@Gunnar419 wrote:That's pretty impressive, linux. I also have a below-average income and I don't manage anywhere near that well.

How do you do without either a mortgage or rent payments? And how do you keep utilities so low?

I don't have a mortgage, but the upgrade expenses on my fixer house get heavy some months, and between water, electric, and winter heating fuel, the costs get painful at times.

living with my parents helps.

Ohhhh, yeah, that will do it. I think I'll stick with my fixer house and higher costs, thank you.

But your income and cost breakdowns are interesting anyhow.

I think eating out at all is what gets most people :-(

EX Fico 804 11/16/16 Fako 800 Credit.com 11/16/16

EQ SW bank enhanced 11/16/16 839 CK fako 822 11/16/16

TU Fico discover 10/19/16 814 Fako 819 Creditkarma 11/16/16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: In case any of you were wondering how i do it......

Oh and as a note when you see " Cash Advance " under income, that is taking advantage of those checks bank of america sent out and direct deposit offers too as well as i did a balance transfer from my discover card into my bank account. All at 0% interest with a 3% fee. To me a 3% fee sure beats up to 22.9% interest anyday! ![]()

Rebuilding Credit since 2016

Debt: Almost $80,000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: In case any of you were wondering how i do it......

Thanks for sharing, very interesting stuff. What did you buy in July. Or was that income. I think I'm confused. How many people are you buying groceries for, that is where the real money can be saved.

I think in my humble early freelancing days of 09-10 I lived on 500 a month. That was before I started couponing too. There is a lot to be said for the humble days, you learn a lot, grow up or you don't. These days it will give you the confidence that no matter what your income level become or layoffs happen you will be ok.

Do you have a mint account yet, its free and breaks down your expenses, lets you manage everything in one place. If I'm not working or here, I'm usually in my mint account. LOL. (now realizing your screenshot is from quicken ![]() )

)