- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- NFCU CLOC DATAPOINTS

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

NFCU CLOC DATAPOINTS

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NFCU CLOC DATAPOINTS

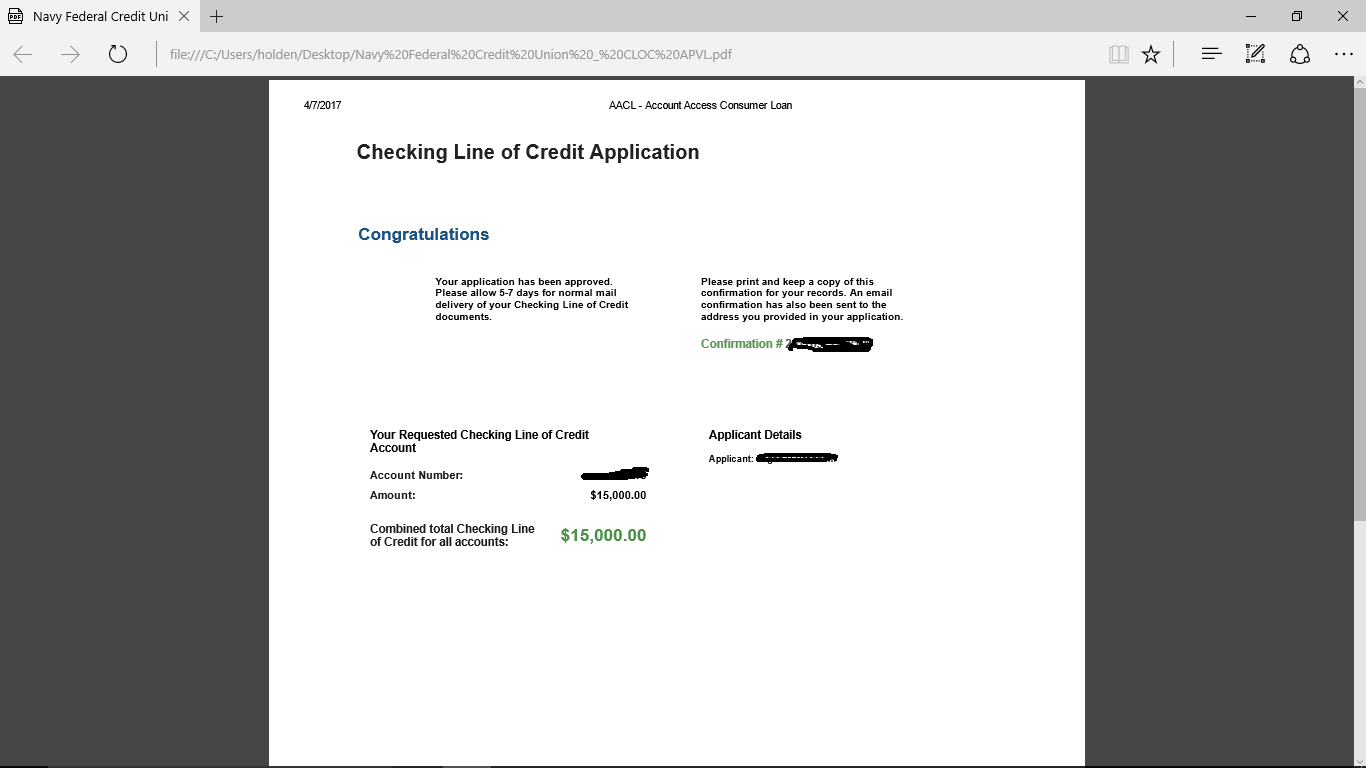

well, i decided to try for the CLOC and Auto loan with NFCU the other day. and im proud and shocked to say, IM APPROVED!

I didnt expect it, but im not complaining. still waiting on the auto refinance.

i know this will be moved, but ive been making headway in this section, so i wanted to post in here for the data points.

Thank you to everyone who is involved in these forums!

data points:

TU- 652/ 24%UTI/ 5 derog(judgements) / AAoA 2yr 1 mo/ 35inq

EQ- 640/ 32%UTI/ 4 derog(judgements) / AAoA 2yr 1mo/ 22inq

EX- 645

They are FICO8 scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU CLOC DATAPOINTS

wanted to add, i also have the Gorewards card with them. 1300sl.

ran quite a bit of money through this card in the 1.5 mo ive had it.

multiple payments monthly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU CLOC DATAPOINTS

Congratulations!

I wish I could understand why NFCU takes huge risks approving a profile like the OP's. Please don't take offense OP, but I really am interested the reasoning.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU CLOC DATAPOINTS

Congrats and thank you for the data points. It gives me hope for eventual success with them. Gotta love NFCU!

EQ-554 TU-567 EX-542 ~ Day of Filing (2/2017)

EQ-559 TU-496 EX-510 ~ Day of Discharge (6/2017)

EQ-696 TU-677 EX-679 ~ Current (4/18)

Credit One, Merrick, Paypal, Overstock, Pottery Barn, NFCU Secured & CapOne

Live, learn, and overcome

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU CLOC DATAPOINTS

I have worked my ace off getting where i am, and im EXTREMELY proud of my accomplishments, including the "risk" that NFCU handed me. If you want to look at things that way, you have more credit than i do, you're far more of a "risk" than I am.

No seriously though, i see where you're coming from, and honestly, i was shocked. But, like my others, i will use responsibility and continue going up!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU CLOC DATAPOINTS

@Anonymous wrote:

Well that wasn't very nice. Thanks for the positivity and self worth boost there, Donny!

I have worked my ace off getting where i am, and im EXTREMELY proud of my accomplishments, including the "risk" that NFCU handed me. If you want to look at things that way, you have more credit than i do, you're far more of a "risk" than I am.

No seriously though, i see where you're coming from, and honestly, i was shocked. But, like my others, i will use responsibility and continue going up!

OP trust me, i was as bad as you can become with every possible derogatory and delinquency you can think of.

You should be proud that you are growing! Congrats!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU CLOC DATAPOINTS

I'm very proud. Just goes to show, sometimes....people get the chance they needed to improve their life, make that change, etc.

You never know if you don't try.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU CLOC DATAPOINTS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU CLOC DATAPOINTS

My scores (not stats) are lower than the OP's and I got approved for 16,000. That is a far cry from the CL increase I requested and got from Capital One from $500 to $1,500.00

I can understand why a Mlitary Credit Union or bank would take bigger risks if most of their clientele are military members. Because if you don't pay, they are going to get their money one way or another. Whether it's taking money out of your pay or writing a letter to your commanding officer. Or both. I've seen it done many times.

I'm with the Original Poster though. Very, very grateful for the opportunity now that I'm "grown up" too. Will use this credit extremely wisely (gas/restaurants only) and watch as my scores grow to Morgage approval levels!

Thanks for sharing.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU CLOC DATAPOINTS

I completely understand where Mil credit unions come from being a bit more ... tolerant and generous.... Sometimes they are alloting credit to folks who may not have learned how to deal with credit initially and feel they should give them a chance... It can be a problem with newer military folk since living and budgeting as an enlisted folk is not quite the same as having a job.. and a lot easier to get into a crunch...... plus they are experts at setback...... Have experience dealing with a DOD/Govt FCU and they sometimes have products that arent avalible at your typical bank for situations (a bridge loan when govt employees were required to work but were not being paid is one example).. and want to actually help try to improve the financial education and situation of the member... Some are still quite conservative but even so, theres more options than in major banks to grow..) Im surprised with how much NavyFed puts up with sometimes with their members (old and new)... (Im coming from watching the shenanigans of a friend and his accounts with Navy... I would have terminated his membership for some of what he has done)

-J