- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Re: Question about Roth IRA

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Question about Roth IRA

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Roth IRA

Hello everyone!

Yesterday i opened a Roth IRA with 1,000 in my local bank branch for 3 years at 1.00%. I know there is a maximum contribution of 5,000 per year but I would like to know how I do those contributions because I tried to do money transfer from my checking account to the Roth IRA and i was unable to.

Maybe I'm a little bit confused on this and I need some light on how is the best way to work it out...

Thanks in advance!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Roth IRA

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Roth IRA

I will go to the local branch tomorrow.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Roth IRA

In theory the purpose of a Roth IRA is to contribute a maximum of 5k a year which I'm clear if not mistaken but what really get me confuse is how can I contribute to the Roth IRA if I cannot make transfer within the same account on the same bank or if there is another mechanism to contribute or if could be possible to NOT contribute doing transfers.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Roth IRA

Well is sounds like you investing in a CD through your Roth IRA. Which, is not the smartest move financially speaking being that you are in your 20's. You cant just add more money to a CD. The CD rate is based on the amount and is locked for a period of time and money cant be withdrawn before maturity without penalty. At your age, in my opinion, invest in the Roth, however, invest in a good index fund with a low fee. Over the course of your lifetime, your ending balance will not grow much at all when investing in CD's - at least not while interest rates are ~1%.

You can still max out your Roth every year, but you would need to either open another CD or attach a brokerage account to your Roth. If you do the latter, then you can do ACH transfers and invest the money as you see fit. I would suggest you do research on investing strategies based on your risk tolerance, however, if you dont want to do that right now, a good bet is the index funds or a target date fund.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Roth IRA

I also just realized that you are not the same poster as the one asking for Roth IRA advice, so I dont know how old you are. That being said, unless you are near retirement, a CD still isnt the best investment option.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Roth IRA

I don't know if this will make a difference to you, but the current maximum contribution is $5,500 per year, not $5k.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Roth IRA

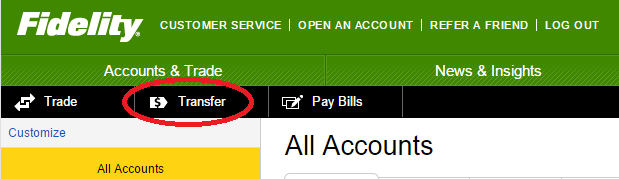

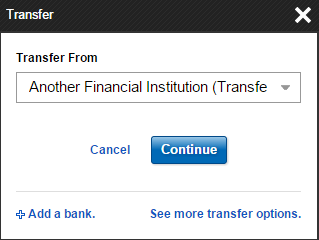

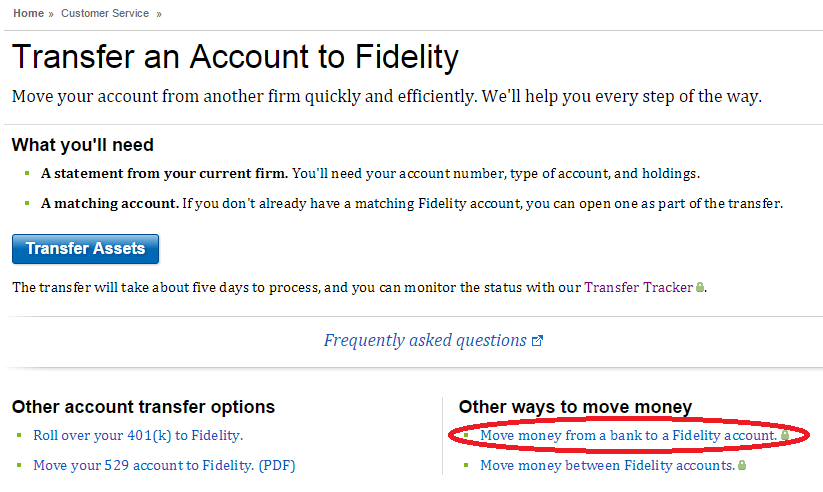

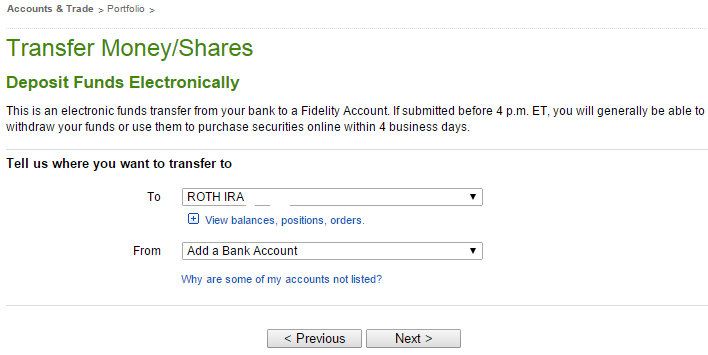

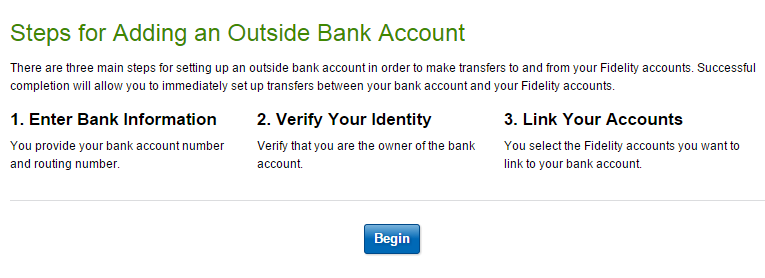

You should set up transfer from the brokerage firm's website. Here's how I do it with my Fidelity Roth IRA:

Then fill the information in. Once done, you can then initiate a transfer from the bank to the Roth IRA (from the second picture above - select the bank account from the drop-down list).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Roth IRA

+1

Lyythine is right, you cannot add money to a CD (typically). When you take out a CD it is for a set amount, with a set rate, over a set period of time. 3 years for 1% is also really low. Here in Chicago you can get 1% for around 16-20 months. That being said unless you are close to retirement I would not be looking at a CD as an investment vehicle. I would open an IRA with a discount online broker like Sharebuilder, Fidelity, TD, etc and put your money in a diverse ETF - preferrably one that tracks an index until you have more to invest. I would also look at how much the penalty is to break this CD (probably 6-12 months interest which is under $10) and transfer these funds to that new IRA.