- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Re: What do I do?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What do I do?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do I do?

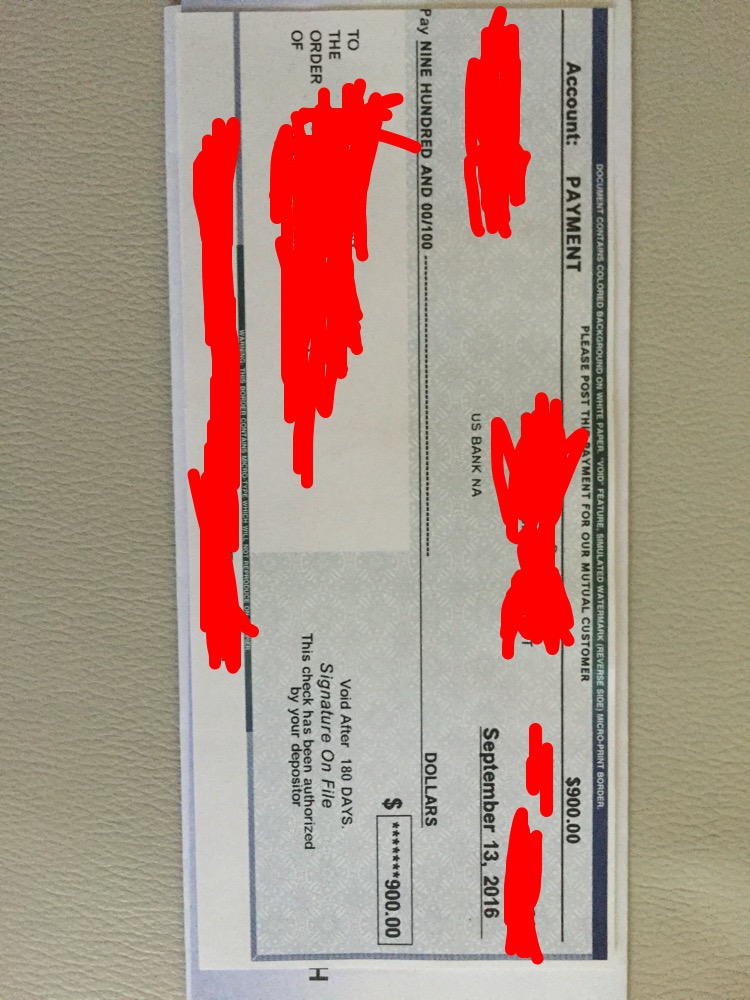

go to us bank and cash it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do I do?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do I do?

@Creditplz wrote:

They'll let me cash it??

They'll probably charge you a $5-$10 fee to cash it if you're not a customer, and they will require two forms of government-issued ID, but they should let you cash it. A number of banks allow you to cash a check drawn on their bank if you pay a fee and if you have usually two forms of government-issued ID. Hope it works out. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do I do?

That's a check generated through online bill pay. Very common (for a bank to see) and not unusual to be drawn off a different bank than the one the remitter banks at. Most banks outsource their online banking/bill pay to a few large providers who use one bank for all checks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do I do?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do I do?

Yes, bill pay checks are different depending on the bank. Typically this acts just like the user writing a personal check and the funds are not removed from the account until the the check is present back to the bank. Most banks do this so I would probably go ahead and take it to a US Bank if you have one in the area and cash it, even if there is a fee because at least that fee would likely be smaller than the Return Check fee your bank may be charging.

Chartway is one of the only banks that I know when you do a bill pay, even if they are sending a paper check, they immediately remove the funds from the account and then the "check" is drawn off of one of the bank's checks and makes their bill pay send certified funds. Best of luck with getting this taken care of.

Goal Score: Eq: 850 Tu: 850

Wallet: PenFed Power Cash 50k | AMEX Blue Cash (AU) 49.5k | Cap One QSMC 26.5k | AMEX Platinum NPSL | USAA Signature Visa 25k