- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- 30 day delinquency?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

30 day delinquency?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

30 day delinquency?

Members,

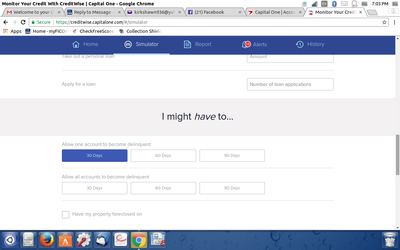

So out of pure boredom i was just playing around with the credit simulator that Cap One gives me with my checking account.. I have no baddies on EX, EQ or TU anymore. So to continue to learn i had it simulate 1 30 day delinquency to see how big of a impact they really have.

Well when i simulated this it showed my score would actually go up by 45pts.. I know Cap One gives TU FAKO scores but as im still to new to be on the FICO radar FAKO is all i have to go by at this time.

So can anybody tell me the lodgic behind them saying if i let an account go 30 days delinquent it would raise my score? I dont understand that lodgic at all.. None whatsoever.

~ Shawn

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 30 day delinquency?

There is no logic to FAKO scores. NONE.

My reports all posted $0 on all CCs this month waiting for statement to cut on my one card that posted $50. During the zeros, my FICO8s dropped up to 20 points but FAKO Vantage Score stayed the same.

After the $50 posted, my FICO8s went up 20 points, FAKO stayed the same.

Just stop applying logic to Vantage Scores. They are truly without purpose no matter how often someone looks at one and thinks they see correlation.

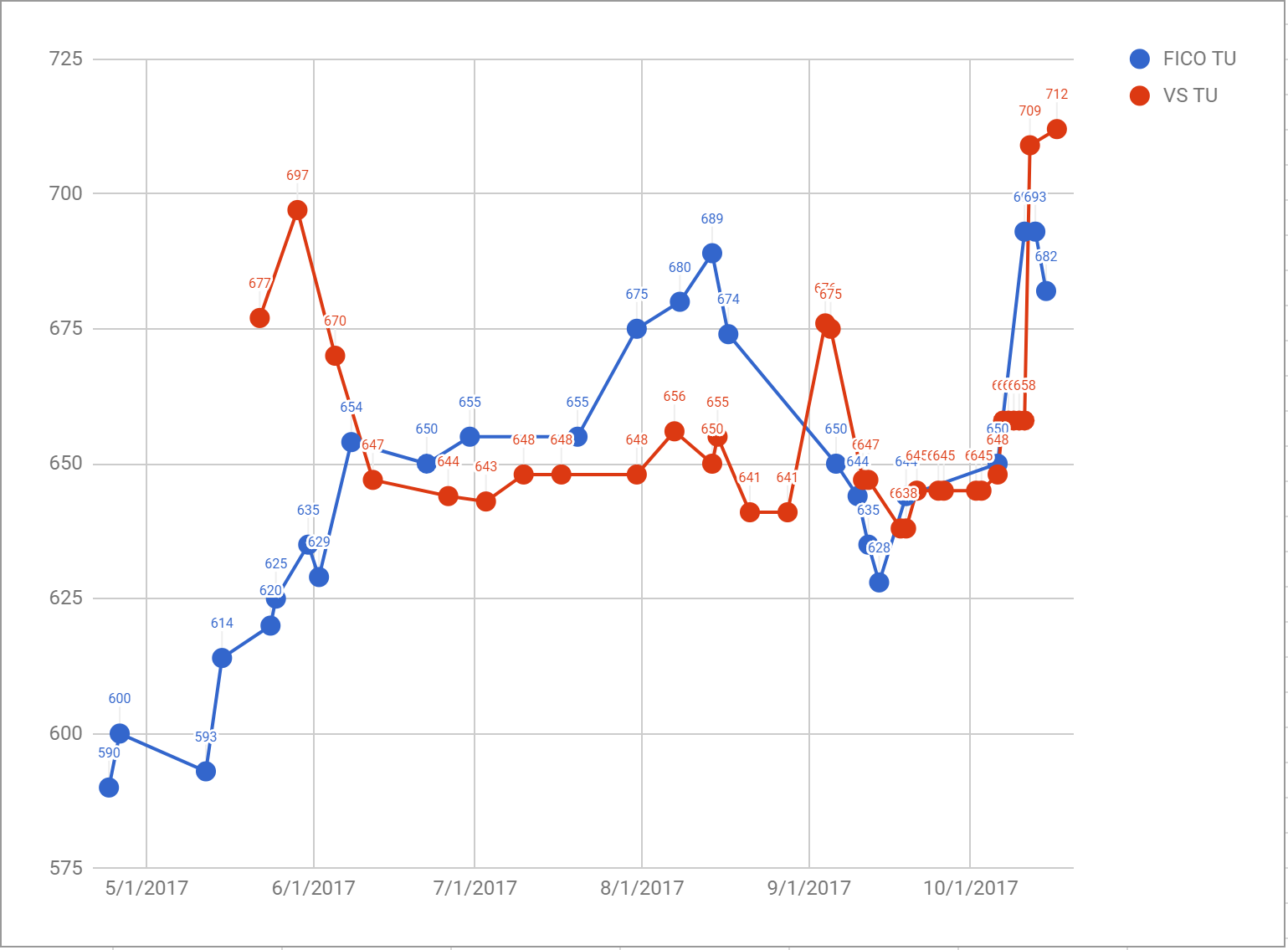

Here's a graph of my TU scores compared over time. While you may think you see correlation, the differences are so vast that it's obvious looking at particular date regions how useless VS is.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 30 day delinquency?

could be that you are close to an AAoA milestone. The 30d both ages your account. Is there an "age my account" simulator? does it also give you a point hike?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 30 day delinquency?

@Kree wrote:could be that you are close to an AAoA milestone. The 30d both ages your account. Is there an "age my account" simulator? does it also give you a point hike?

Kree,

I dont see 1, I will search around to see if i can find that simulator somewhere on the net.. I can see my AAOA reaching 30 days giving me a little bost but just dont see how having a 30 day delinquency would bost my score. I would think it would make my score drop..

IDK but i worked to hard to get all 3 of my reports clean so im not going to let any one of my accounts go 30 days delinquent to find out & make more work for myself.. LOL

However i did not know about the point hike for an acount reaching the AAOA of 30 days.

~ Shawn

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 30 day delinquency?

The simulation likely was an evaluation of your expected score a few months from now, which includes both the impact of an added 30-late AND aging of your accounts by x-number of months. It thus includes both possible negative and positive score impacts.

Score simulators try to avoid being able to isolate a single scoring factor, and determine its instant impact today on your scoring.

That would permit, after spending a little time on various scoring simulations, the ability to reverse-engineer the algorithm.

Scoring algorithms are protected as trade secrets rather than obtaining a patent. Patenting requires a full disclosure of how to make and use the algorithm, and expire after 20'ish years from application date, so they have a limited protecting period.

What, exactly, was the stated scenario in your simulation that showed the score increase?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 30 day delinquency?

@RobertEG wrote:The simulation likely was an evaluation of your expected score a few months from now, which includes both the impact of an added 30-late AND aging of your accounts by x-number of months. It thus includes both possible negative and positive score impacts.

Score simulators try to avoid being able to isolate a single scoring factor, and determine its instant impact today on your scoring.

That would permit, after spending a little time on various scoring simulations, the ability to reverse-engineer the algorithm.

Scoring algorithms are protected as trade secrets rather than obtaining a patent. Patenting requires a full disclosure of how to make and use the algorithm, and expire after 20'ish years from application date, so they have a limited protecting period.

What, exactly, was the stated scenario in your simulation that showed the score increase?

RobertEG,

The scenario of my simulation was to see how big of a hit my score would take if i let just 1 of my accounts hit the 30 day delinquent mark.. Wondering how much my score would drop for my own educational info.. NO other filters just the let 1 of my accounts hit the 30 day delinquent..

When i hit simulate well it did not show my score going down, It showed my score going up & i know that cant be right at all as a delinquency would show as a DEROG..

Its no biggie as i dont plan on letting any of my accounts go delinquent because that would just make the rebuilding pointless.

I was just trying to find the lodgic in them saying a 30 day delinquency would raise my score and not drop it - OR - if there was some sort of lodgic behind it i just dont know about.

~ Shawn

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 30 day delinquency?

Beyond the FICO score drop, a reported late on your CR could triiger AA on other accounts, I know several CCCs or regularly peek at your CR. If you really want to have a wakeup call, get your yearly CR for the CRAs and you woudl be amazed at who looks and how often people do that to your CR.